Each quarter FastMarkets and Sucden Financial produce an analysis and forecast report on the precious and base metals – The Sucden Financial Metals Reports, July 2016.

Below is the summary and economic overview from the report, to download a PDF copy of the full report covering all the metals in pdf form click here.

Subscribers have access to these reports before they are published through the research tab in FastMarkets Professional.

Summary

Chinese activity appears to be stabilising. Latest growth figures are encouraging, with further reports of increased infrastructure spending. US growth is stuttering a little and interest rate movements are on hold pending the outcome of the global effects of Brexit, although the dollar remains firm. EU uncertainties, UK uncertainties and Japanese Yen strength are all contributing to a mixed macro outlook, but sentiment is improving and metals prices are stabilising having built bases.

Gold – Brexit inspired safe haven buying is starting to dissipate although the possibility of US interest rate increases is fading in the short term. Gold likely to remain steady in the range $1,210 and $1,425 for the quarter.

Silver – Currently outperforming and looking overbought. Underpinned by a lack of Fed interest rate decisions but likely to run into selling on any spike up to $22. Likely range of $17 – $24 for the quarter.

PGMs – Driven by fresh speculation, investor buying and production issues, with prices likely to push higher within the ranges of $950 – $1,170 for platinum and $530 – $670 for palladium.

Market Overview

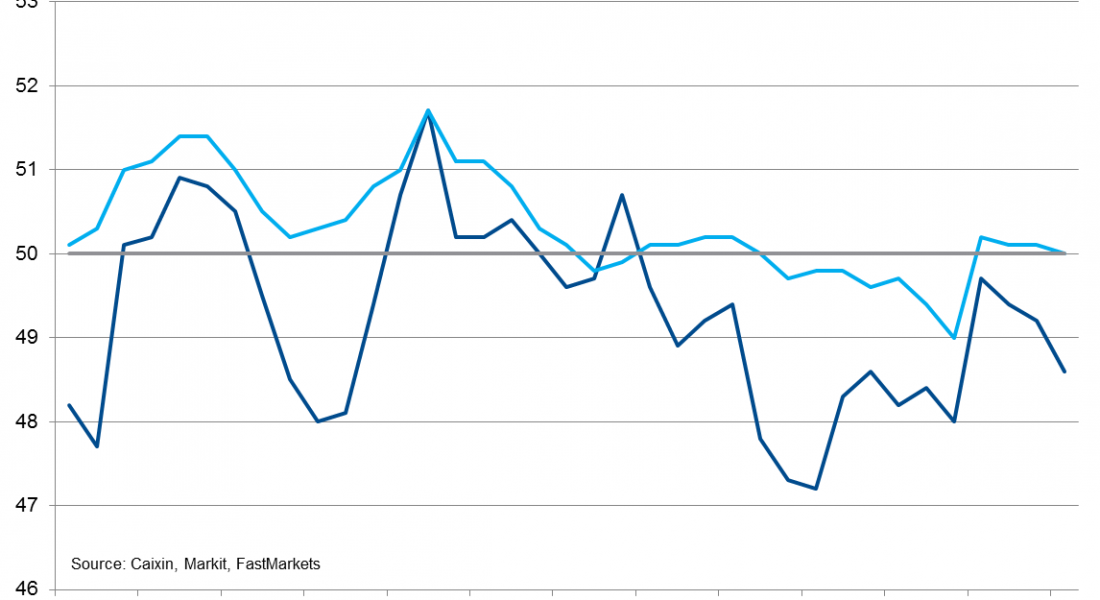

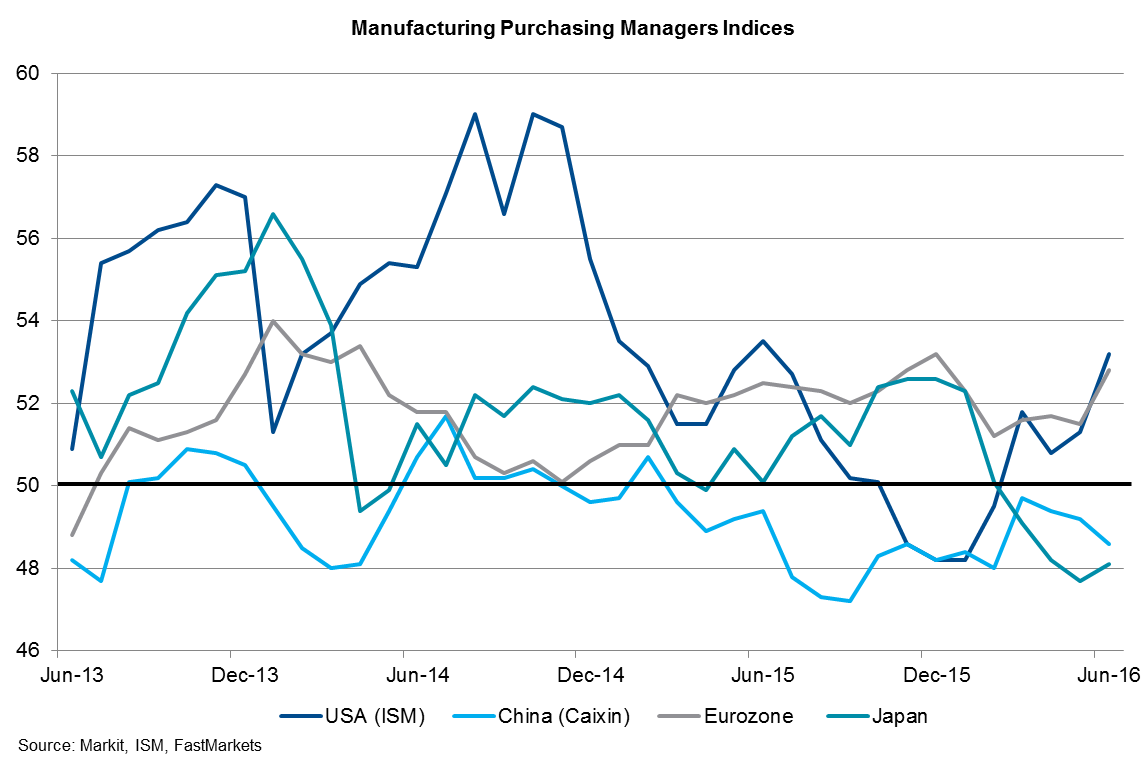

Outlook – Improved Chinese manufacturing PMI data for March (see first chart below) released in early April led to a false sense of optimism that China’s recovery was gaining upward momentum, which prompted another rally across most of the metals that lasted until early May. The release of the next Chinese manufacturing PMI in early May, along with poor Japanese and EU data (see second chart below) disappointed the market; corrections subsequently unfolded.

We view these price sell-offs as corrections to the surprisingly strong rallies in January to May; having corrected, it seems the base metals are for the most part looking to resume the earlier rallies despite the curveball thrown at the markets from the outcome of the Brexit vote and against a background of generally weak economic data, especially out of China.

The base metals seem to be ignoring for now much of the poor data – zinc, nickel and tin have already set fresh highs for the year in June/July and aluminium and lead are near to doing so. Copper is the one metal holding back the most.

Iron ore and steel prices in China have been surprisingly strong and although there is an element of speculation in their strength, reports suggest that stockpiles of steel rebar are the lowest they have been since March 2010 despite the higher production that has been encouraged by higher prices. This suggests demand may be stronger than economic data suggests.

If China’s economy proves stronger than the market currently thinks, the commodity markets could get a significant boost from restocking. Pessimism about demand has been one of the main factors keeping sentiment neutral-to-bearish; any pick-up could catch the market wrong-footed.

There are many crosscurrents flowing through the markets so the metals have their own fundamentals to consider as well as wider geopolitical issues. These include the uncertainty about China’s economy, what fallout there will be from Brexit, what central banks will try next if negative interest rates do not provide the required boost and how markets will react as US presidential elections play out.

Overall, there is much uncertainty around on the economic and geopolitical fronts but the metals are choosing to ignore a great deal of it. With equities at or near record levels – the S&P set a fresh record high on July 11 – and US treasuries at highs too, perhaps there is a certain amount of portfolio diversification taking place where investors view commodities as offering value. Having sold off over recent years, they are now starting to rebound, helped by the supply responses last year and early this year and a generally destocked supply chain (see LME Index chart).

The physical metals markets are quiet and traders generally report good availability, with physical premiums under pressure. This raises some warning flags about the strength of the base metals; perhaps copper is more reflective of the global economic situation than the other metals are. Still, some of the metals (zinc and tin) are rising thanks to their fundamentals and others (nickel) because of possible changes to their fundamentals.

It would also be foolhardy to ignore the rebound in metal prices. Perhaps changes are under way in China that some macro fund observers are seeing before they show up in the economic data. The Chinese authorities seem to be managing the transition of the economy from industrial-based and export-led to a more consumer- and services-oriented economy. Even if the economy is growing at a slower pace, it is still a massive economy so even a growth rate of five or six percent would still mean a lot more demand.

Overcapacity and destocking following the slowdown in recent years seem to have weighed on apparent demand in China but, with capacity curtailments and with steps being taken to rein in obsolete capacity, restructuring is in progress and this time it appears that Beijing has a firmer hand on supply. This may be because its anti-corruption drive has been running for a few years and because local governments are relying more on central government to back the loans they need to push forward with infrastructure projects.

In a way, power has returned more to the centre so there is more control on how to push the economy forward in an economic way i.e. scarce resources are put to work where they will bring about the best for the country. The transition was never going to be easy but President Xi Jinping has now been in office for three-and-a-half years, so it may well be that his policies will start to bear fruit.

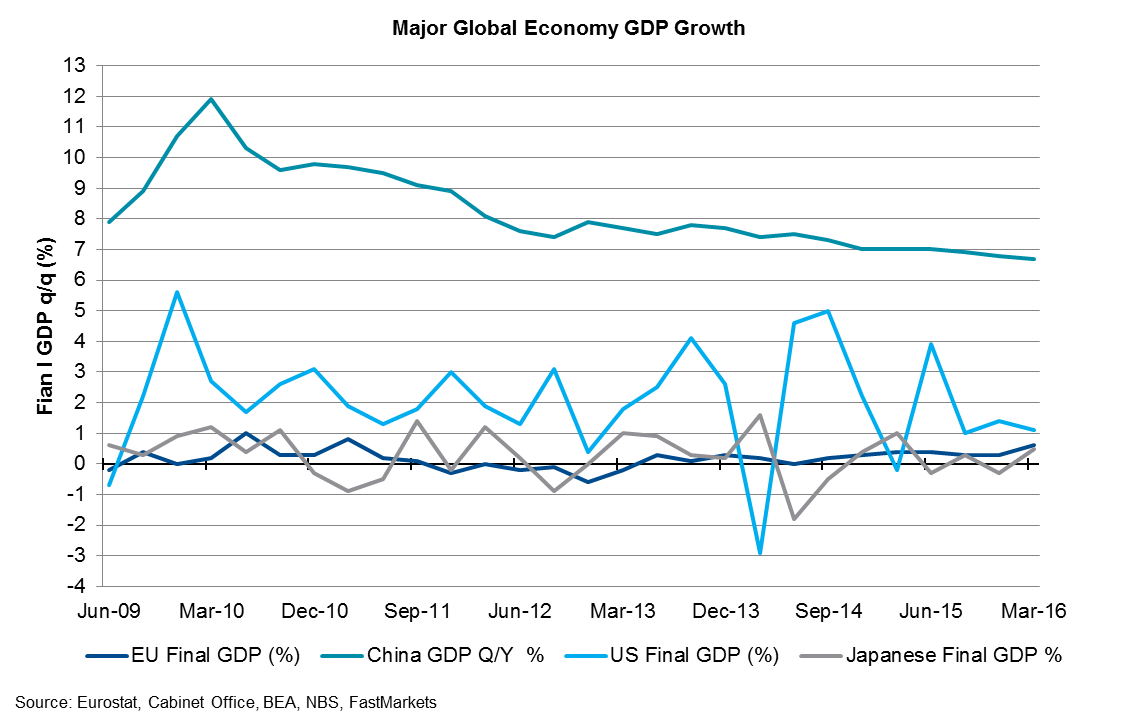

Outside China, Japan continues to struggle and the rapid rise in the yen will be hurting its economic activity. At the start of the year, the currency was around 120 against the dollar but it has since fallen to 99 and was last around 104. As the chart below shows, GDP continues to oscillate either side of zero and its manufacturing PMI was last at 48, having averaged 50.5 in the first quarter.

With the yen as strong as it is, driven by safe-haven issues, there is a high chance that the government intervenes to weaken the currency. This could help revive the economy but because the yen – like gold – has been such a safe haven, some of the shine may come off the yen if it falls because of intervention. This should be good for gold – the metal could be seen as the main non-fiat safe-haven product.

Europe’s recovery is gaining momentum: GDP growth was 0.6 percent in the first quarter and its manufacturing PMI climbed to 52.8 from an average of 51.7 in the first quarter. Since the Brexit vote, the euro has dropped to either side of 1.1000 from highs of around 1.1500 in May; a weaker euro should help boost demand for Europe’s exports. The question, however, is how the Brexit will hit economic confidence and growth.

For now we are in the eye of the Brexit storm; the UK has not invoked article 50, which is the process by which it informs the EU that it is leaving the EU, so for now trade is operating in a ‘business as usual’ way. Although confidence may have been hit, it may still take several years before the full impact of Brexit is felt. Judging by the DAX, German equities are well on their way to regaining all the lost ground following the Brexit vote, so perhaps any contagion will take a long time to emerge.

For now, data suggests economic activity is improving. EU auto registrations show confidence, with May the 33rd consecutive month of stronger sales – car registrations rose 16 percent that month and are nearly back to levels before the 2009 financial crisis. In the first five months of the year, registrations were up 9.9 percent on the same period in 2015.

In the US, first-quarter GDP grew 1.1 percent, which was the slowest pace in a year. This has raised concerns that the economy may be slowing in its eighth year of expansion. Business investment is at a six-year low and consumer spending growth is at a two-year low.

But the ISM manufacturing PMI has shown steady growth in the second quarter, rising to 53.2 in June from 51.3 in May and 50.8 in April after an average of 49.8 in the first quarter; second-quarter GDP growth may well provide a confidence boost. The fact the S&P 500 recently hit a record high already shows a degree of confidence.

With the Fed likely to remain on hold until more is known about the Brexit impact, the US economy might run hot for a while, which could well feed through to a more bullish outlook for metals. Still, it may not be too long before the US economy starts to focus on the US presidential election, which could lead to some nervousness, giving the Fed another excuse to remain on hold.

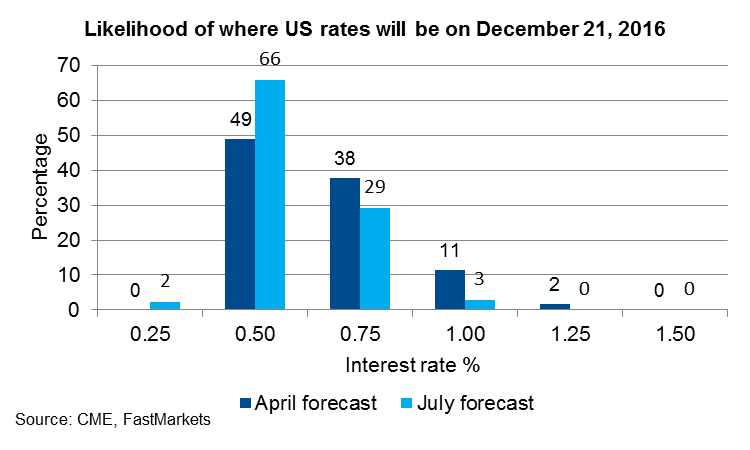

The Fed fund futures puts the chance of interest rates being left unchanged at 0.5 percent at the central bank’s December meeting at 66 percent, up from 49 percent in April. The market suggests rates will stay unchanged out to June 2017 although we would not be surprised if it turns more hawkish as the second half of 2016 unfolds. A low-interest-rate environment should be bullish for gold, especially with negative interest rates in Japan and Europe, but low US interest rates should also mean the financing of base metals remains profitable, which should see the large stock overhangs remain off the market.

Outlook – As the LME Index chart shows, metals prices have started to rally and, having fallen a long way in recent years, there may well be considerable room for them to recover. Falling metal prices tend to lead to destocking throughout the supply chain, with excess inventory locked up in financing deals.

Now that there have been price-driven supply responses and there are some politically driven ones too, notably Indonesian tin and possibly Philippine nickel in the months ahead, the downside may be limited while the upside has considerable potential. Fund short-covering seems to acknowledge less room on the downside, but not all fund managers are bullish yet. There has been strong fund buying in zinc and nickel, but less in the other base metals.

The physical market is quiet and premiums are weak, which suggests there has not been much restocking yet. Indeed, given the economic data, consumers probably feel there is little need to restock. But if prices are being driven higher, consumers may well restock – or hedge – to protect themselves against further price rises.

For now the path of least resistance in the metals seems to be to the upside. There are numerous headwinds that could turn prices lower again but, while more metals break higher above their March/April/May highs, CTA-type buying may well carry prices higher.

On balance, in the absence of any economic shocks, we expect the base metals to brush off mildly bearish Chinese economic data. But a marked deterioration would be a different matter. Conversely, if Chinese data starts to improve, we would expect that to add fuel to the rallies.

For the precious metals, we are generally bullish for gold because of all the geopolitical uncertainty and the opportunity cost for holding gold is so low now that most European and Japanese government bonds have a negative yield. Gold should remain a favoured non-fiat safe-haven; it may well gain market share from the yen if the Bank of Japan intervenes to weaken the currency and/or the dollar if markets gets nervous about the US election. We expect silver to map gold’s moves.

With the Fed likely to remain on hold for the rest of the year, we are not overly bullish on the dollar but neither are we bearish. The chart suggests the dollar has consolidated in the first five months of the year after running ahead of itself in 2014/2015. Having corrected, it now seems to be trending higher again.

With the US economy looking the strongest, with the yen likely to weaken and the euro vulnerable to suffering from the Brexit, the dollar is likely to remain a safe-haven buy. But it could suffer if US equities correct or if the market gets nervous about the US election.

We feel the PGMs had become oversold; a strong global auto market should provide support, as should stronger gold prices. In the near term, the possibility of strikes in South Africa has picked up as wage negotiations are under way in the platinum industry again. If strikes are called, the PGMs may well get quite bullish again.

The post Summary and economic overview of the metals markets – Q3 2016 appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News