Each quarter FastMarkets and Sucden Financial produce an analysis and forecast report on the precious and base metals – the latest are Sucden Financial Metals Reports for July 2016.

Below are the platinum and palladium reports. To download a PDF copy of the full report, please click here.

Subscribers have exclusive access to these reports before they are published through the research tab in FastMarkets Professional.

PGMs – Set to shine further in Q3

Summary

Platinum and palladium rose 4.9 percent and 6.3 percent respectively in the second quarter amid a rally across precious metals. We expect them to continue higher in the third quarter, with platinum ranging between $950 and $1,170 and palladium between $530 and $670, driven by a rebound in speculative and investor demand and reinforced by possibly tighter mine output.

Overall trend – The platinum group metals strengthened in the second quarter – platinum is up 15.1 percent and palladium 6.5 percent so far this year. This is slightly weaker than gold, which we attribute mainly to a lack of investor interest. PGMs enjoyed decent upward pressure, supported by positive sentiment overall in precious metals, in the second quarter. Stronger autocatalyst demand, accounting for 75 percent of palladium demand and 40 percent of platinum demand, offset weaker speculative and investor sentiment. Palladium outperformed platinum because risk aversion, albeit elevated, slowed. Moving into the third quarter, we expect PGMs to surprise further on the upside, with palladium to outperform platinum slightly. While autocatalyst demand should remain healthy, we expect global risk sentiment to improve, partly due to a more cautious Fed, which should trigger a rebound in investment and speculative demand. Since palladium tends to perform better than platinum in a risk-on environment and its speculative positioning is clearly overstretched on the short side, we expect the former to play catch-up. Despite the presence of large above-ground inventories, output from South Africa, which accounts for 80 percent and 45 percent of platinum and palladium production, could fall more than expected this year if volatile wage negotiations lead to strikes.

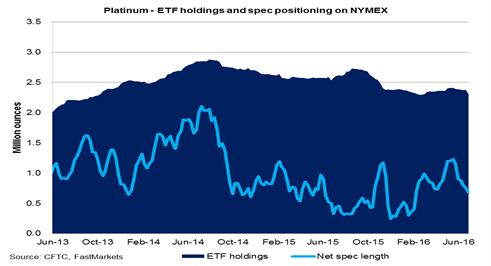

ETF investors sold 43,000 ounces of platinum in the second quarter after 25,847 ounces in the first. Money managers trading on Nymex sold 60,000 ounces in the second quarter after buying 291,000 ounces in the first three months of the year. We foresee renewed ETF inflows combined with spec buying in the current quarter.

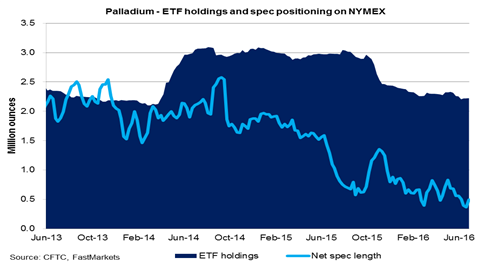

ETF investors sold 68,000 ounces of palladium in the second quarter after 94,000 ounces in the first. Money managers trading on Nymex slashed the net long position by 245,000 ounces in the second quarter after 122,000 ounces in the first three months. We expect increased ETF inflows and spec buying in this quarter; this seems to have started already.

The post Platinum and Palladium forecast and analysis for Q3 2016 appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News