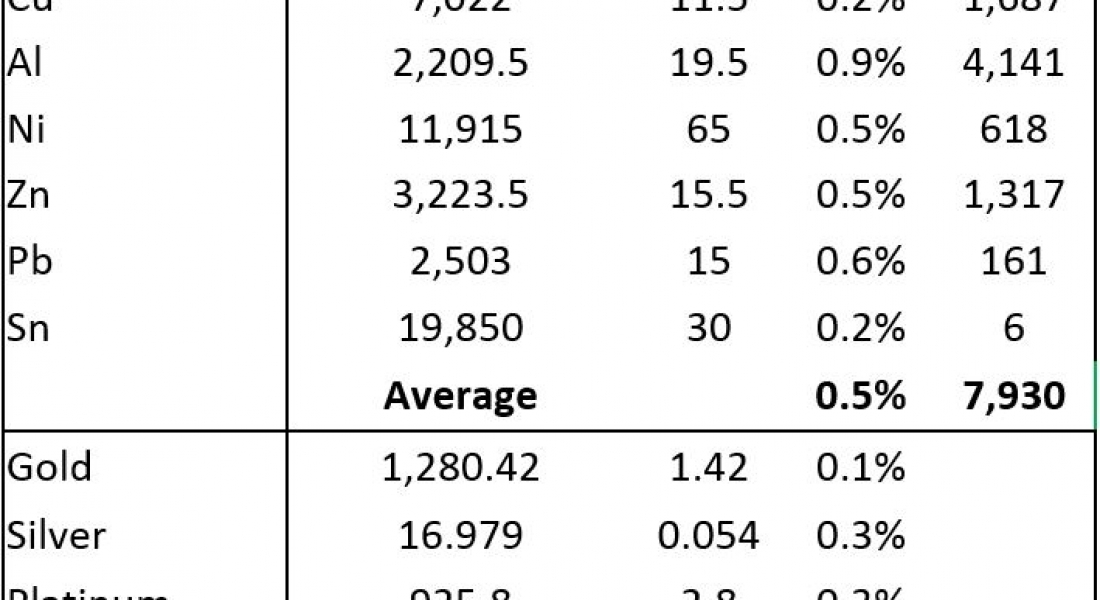

The base metals on the London Metal Exchange are up across the board by an average of 0.5% this morning, Thursday October 26. Aluminium leads the way with a 0.9% rally to $2,209.50 per tonne – the high so far has been $2,215, which means prices have surpassed the October 2012 peak of $2,212. Copper prices ($7,022 per tonne) and tin prices are up 0.2%, while the rest are up between 0.5% and 0.6%.

Volume has been slightly above average this morning with 7,930 lots traded as of 06:18 BST, with 4,141 lots of aluminium traded.

This follows a mixed performance on Wednesday that saw copper and nickel prices decline, while the rest closed up. Nickel prices are under pressure as reports out of the Philippines suggest a possible weakening on the government’s stance on open-pit mining.

Precious metals prices are up across the board this morning with gains ranging from a 0.1% gain in spot gold prices, recently at $1,280.42 per oz, to a 0.6% rise in palladium prices to $968 per oz. Silver and platinum prices are both up by 0.3%. On Wednesday, gold and platinum prices were up by 0.2%, silver prices were little changed and palladium prices were off by 0.2%.

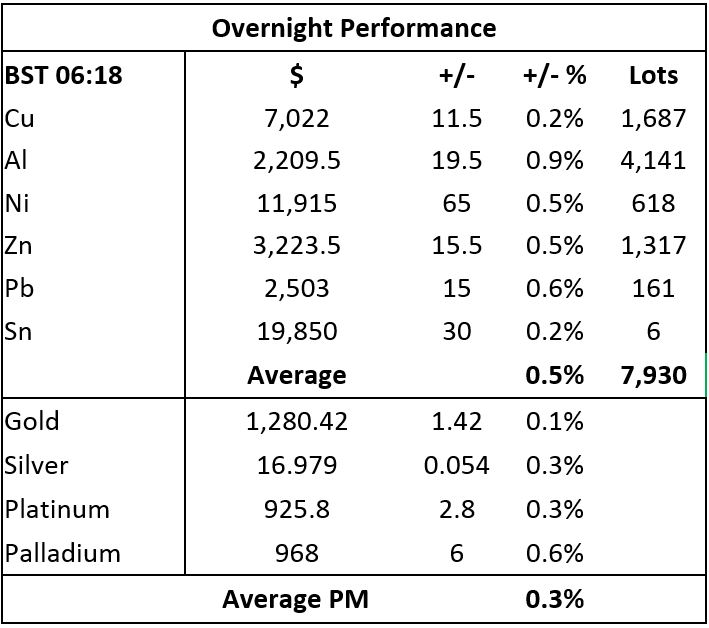

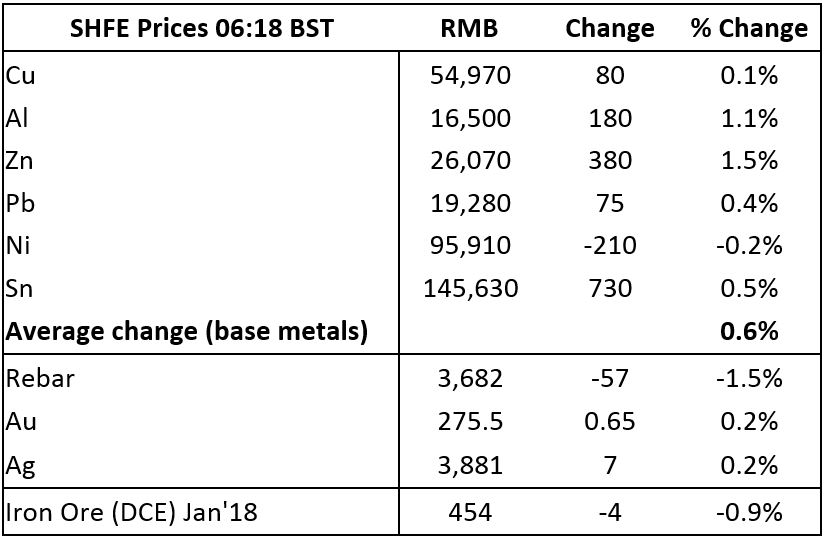

Base metals prices on the Shanghai Futures Exchange (SHFE) are for the most part firmer today, led by a 1.5% gain in zinc prices and a 1.1% rise in aluminium prices. Tin prices are up by 0.5%, lead prices are up by 0.4% and copper prices are 0.1% firmer at 54,970 yuan ($8,276) per tonne, while nickel prices are bucking the trend with a 0.2% fall. Spot copper prices in Changjiang are down by 0.6% at 55,100-55,300 yuan per tonne and the London/Shanghai copper arbitrage ratio is weaker at 7.83, compared with 7.91 on Wednesday. The disparity in the spot and future’s copper prices, suggests copper prices have rallied since the physical prices was set earlier this morning.

The steel-orientated metals in China are weaker again this morning with iron ore prices dropping by 0.9% to 454 yuan per tonne on the Dalian Commodity Exchange, while steel rebar prices on the SHFE are off by 1.5%. Gold and silver prices on the SHFE are both up by 0.2%.

In international markets, spot Brent crude oil prices are slightly firmer, up by 0.06% at $58.38 per barrel. The yield on US ten-year treasuries is little changed at 2.41% and the German ten-year bund yield is slightly firmer at 0.48%.

Equities in Asia are generally positive with gains in the CSI 300 (0.5%), the ASX 200 (0.2%), the Nikkei (0.1%), but the Hang Seng and Kospi off by 0.4% and 0.3%, respectively. Western markets were weaker on Wednesday: in the USA, the Dow closed down by 0.48% at 23,329.46, while in Europe, the Euro Stoxx 50 closed down by 0.53% at 3,591.46.

The dollar index at 93.52 has once again turned back from pressing ahead with its rebound, so is back in consolidation mode, meaning the jury is still out as to whether this is a pause in the downward trend that has been in effect all year, or whether it is the start of a turning point for a move higher. We are still awaiting US president Donald Trump’s decision on who will be the next US Federal Reserve chair, so the dollar could see some short-lived volatility. The euro at 1.1830 is firmer within its consolidation pattern and as such is looking less toppy, but with the European Central Bank (ECB) rate decision and press conference today, it could move either way. Sterling is stronger this morning at 1.3267, the Australian dollar at 0.7709 is consolidating after four days of weakness and the yen is firmer at 113.46.

The Chinese yuan is consolidating after recent weakness, it was recently quoted at 6.6320; the South African rand is weaker at 14.1017, the rupee is firmer at 64.76, while the rest of the emerging currencies we follow are consolidating.

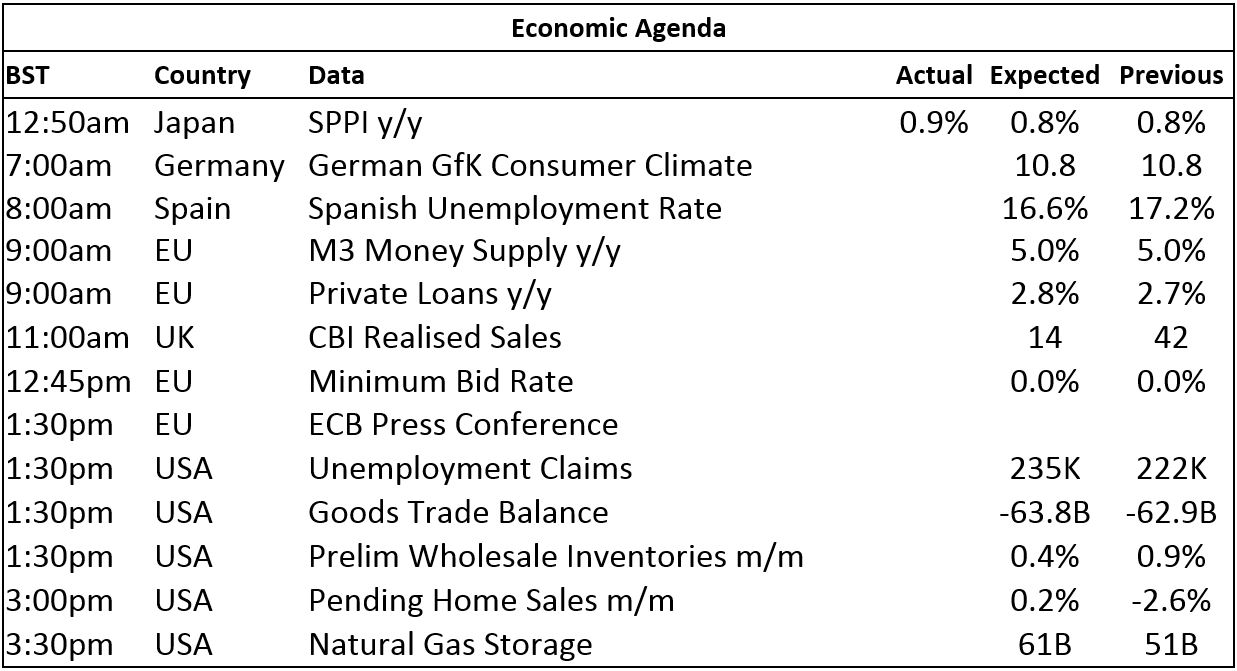

Today’s economic data includes Japan’s service producer price index (SPPI), which climbed 0.9% in September after a 0.8% gain in August and German GfK consumer climate which dipped to 10.7 this month, from 10.8 in September. Data out later includes Spanish unemployment, EU M3 money supply, EU private loans , UK CBI realised sales, the ECB interest rate decision and the ECB press conference. US data includes data on the goods trade balance, wholesale inventories, pending home sales and natural gas storage.

Copper prices are oscillating sideways either side of $7,000 per tonne and the rally seems to be pausing. Nickel prices are in the same boat, while lead, zinc and tin prices continue their rebounds off recent support levels and aluminium prices have pushed up to levels not seen for five years. Our view of late has been to remain quietly bullish, but expect trading to become choppier as prices are generally in high ground, so we should expect more bouts of scale-up selling along the way – this seems to be playing out, but with aluminium prices breaking higher, underlying sentiment still seems to be bullish.

Gold prices have found underlying support, as have the other precious metals. We expect the precious metals to continue to be well supported, but for now, in the absence of any pick-up in geopolitical tensions, we do not see too much to be bullish about. That said, the euro may get more directional after the market hears what the ECB press conference has to say and that could influence gold prices.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices consolidate having found support; eyes on ECB press conference appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News