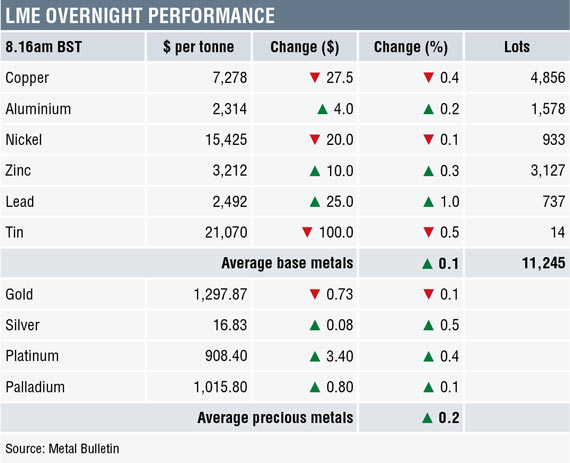

Three-month base metals prices on the London Metal Exchange were split into two camps on the morning of Monday June 11, with lead, zinc and aluminium prices moving higher, while the rest weakened.

Lead outperformed this morning with a 1% gain to $2,492 per tonne, with zinc and aluminium registering increases of 0.3% and 0.2% respectively. Tin led on the downside with a decline of 0.5%, while copper was off by 0.4% at $7,278 per tonne and nickel dipped by 0.1%.

Acrimonious G7 talks with the United States souring relationships with the other members have dulled sentiment in the metals, especially in copper, where prices had been buoyant on a combination of potential supply disruptions at Escondida and strong Chinese economic data that saw the country’s producer price index (PPI) rise 4.1% in May from 3.4% previously.

Trading volume has been above average with 11,245 lots traded as at 8.29am London time.

In the precious metals, gold prices continued to meander sideways either side of $1,300 per oz and were recently quoted at $1,297.87 per oz. Platinum prices were following gold’s lead, while palladium and silver prices have been following the industrial metals higher.

Base metals prices on the Shanghai Futures Exchange, as on the LME, were split this morning. The most-traded August copper contract price increased 2.4% to 54,130 yuan (8,452) per tonne, while the July lead and August zinc contract prices were both up by 0.2%. The September nickel contract price fell 0.8%, the September tin contract price declined by 0.5% and the August aluminium contract price dipped 0.4%.

In other metals in China, the most-traded September iron ore contract on the Dalian Commodity Exchange edged 0.6% higher to 470 yuan per tonne. Meanwhile on the SHFE, October steel rebar prices rose by 0.2%, while the December silver and gold prices were both up by 0.2%. Spot copper prices in Changjiang were up by 0.5% at 53,750-53,880 yuan per tonne.

Equity markets in Asia were mainly positive on Monday: Nikkei (+0.48%), Hang Seng (+0.56%), CSI 300 (+0.01%), Kospi (+0.76%) but the ASX 200 was down by 0.2%. This follows the firmer performance in western markets on Friday, where in the US the Dow Jones closed up by 0.30% at 25,316.53.

The dollar index has been under downside pressure since it reached a 2018 peak of 95.03 on May 29 – it was recently quoted at 93.40. Trade frictions between the US and its key trade allies continue to undermine the index. Meanwhile, the other major currencies we follow were consolidating: euro (1.1813), the Australian dollar (0.7610), sterling (1.3432) and the yen (109.98).

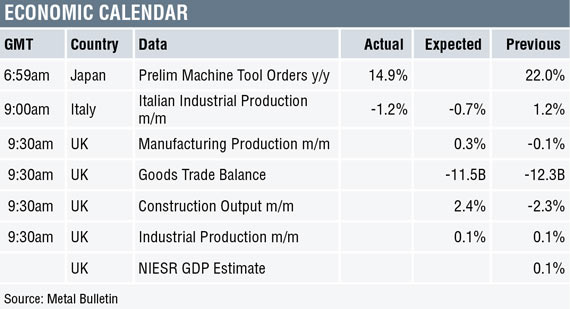

On the economic front, there is data on Italian industrial production, along with UK releases including manufacturing and industrial production, construction output and goods trade balance.

Most of the base metals prices have been moving higher again in recent days, albeit in a choppy fashion – the main exception has been aluminium that is stuck sideways. Key now will be whether there is follow-through buying. Last year, the second quarter was generally subdued with prices only starting to pick up in mid-June, so we may be in for a repeat performance. Economic data continues to be mixed, but there are some brighter spots as seen by the May purchasing managers’ index (PMI) data. We remain quietly bullish, but needless to say the rally in copper will be semi-dependent on the outcome of labor contract negotiations at Escondida, where the company, BHP, will respond to a counter-proposal by the workers’ union today.

Gold and platinum prices are stuck in sideways trading ranges, with even the pullback in the dollar index not providing much drive, but silver and palladium prices do seem to be benefiting from the stronger tone in the other industrial metals. We expect more of the same.

The post METALS MORNING VIEW 11/06: Metals consolidate recent gains, await further developments appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News