Three-month base metals prices on the London Metal Exchange consolidated on the morning of Friday June 8 amid concerns that the latest trade figures from China could stoke further trade tensions.

This as world leaders gather in Canada for the 44th G7 Summit, where likely topics for discussion include global economic issues such as trade relations and tariffs.

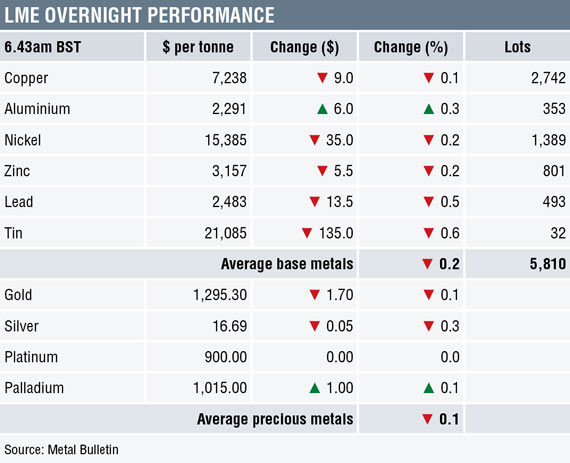

The three-month aluminium price on the LME was up by a modest 0.3% at $2,291 per tonne, while the rest of the complex was in negative territory. Copper dipped by 0.1%, nickel and zinc were both down by 0.4%, while tin was the weakest performer so far this morning with a decline of 0.6%.

Volume has been relatively light with 5,810 lots traded as at 6.43am London time. This comes after copper saw 33,248 lots traded on Select on Thursday, the largest intra-day volume since early February.

In the precious metals sphere gold and silver are in a softer tone so far, down 0.1% and 0.3% respectively. Platinum and palladium are in positive ground, both up by around 0.1%.

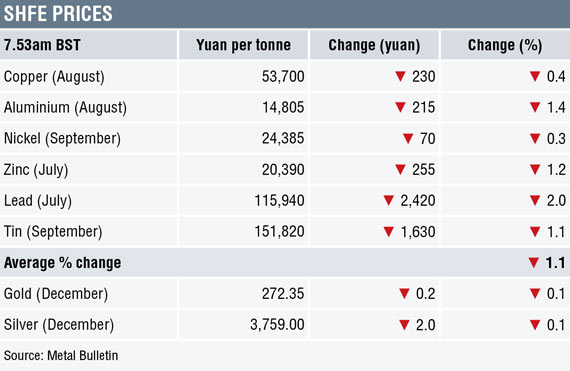

In China, base metals prices on the Shanghai Futures Exchange were under pressure with the complex down by 1.1% on average. In other metals, the September iron ore contract price on the Dalian Commodity Exchange was up by 0.9% at 472.5 yuan per tonne. The October rebar contract price on the SHFE was up by 0.5%, while the December gold and silver contract prices were down by 0.1%.

In wider markets, spot Brent crude oil prices were down 0.4% at $77.05 per barrel, but remain underpinned by supply uncertainties.

Equities in Asia were in a softer tone on Friday after trade concerns weighed on investor sentiment, with the Hang Seng down by 1.4% and similar weakness in the CSI 300 (-1.5%), Nikkei 225(-0.5%) and ASX 200 (-0.2%).

This followed a mixed finish to westerns markets on Thursday after concerns of a trade war picked up. In the US, the Dow Jones closed up 95 points or 0.4% at 25,241.41, while in the Europe, the Euro Stoxx 50 closed down by 0.03% at 3,459.77

In the currencies the dollar index stands currently at 93.49 after dipping to a three-week low of 93.21 on Thursday. The dollar will likely remain supported ahead of next week’s US Federal Open Market Committee (FOMC) meeting, but markets are expecting the European Central Bank to announce it will end it quantitative easing program by the end of this year.

Data released earlier this morning showed China recorded a trade surplus of $24.92 billion in May compared with $28.78 billion in the prior month. Exports increased by 12.6% year on year, while imports rose at the fastest pace since January, climbing 26% year on year.

But China’s surplus with the United States widened to $24.58 billion last month, from $22.15 billion in April.

Aside from China’s trade data figures, other releases showed Japan’s economy contracted at an annualized 0.6% in the first quarter, unchanged from the preliminary reading; bank lending increased 2.0% year on year in May, while the economy watchers survey weakened to 47.1 from 49.0 in April. Meanwhile, data from Europe so far has underwhelmed; industrial production in Germany dropped by 1% in May compared with the 0.4% rise forecast.

Canada’s labor market will be in focus later today. Net employment is forecast to rise by 20,000 in May, after the small 1,100 decline in April. Housing starts are expected to show a rise of 219,000 last month.

Inflation consumer and producer price readings are scheduled from China over the weekend. The consumer price index (CPI) is seen rising by 1.9% year on year in May; a further pick-up in the producer price index (CPI) to 3.9% is also forecast from the 3.4% rise in April.

Trade will likely be a hot topic today, and could overshadow price sentiment if tensions rise at the G7 meetings. For the base metals this is likely to lead to an element of profit-taking following recent price gains. But fundamental drivers are likely to limit downside risks, and for copper in particular, price risks are still to the upside amid the wage negotiations at the giant Escondida mine in Chile.

In precious metals, the softer dollar has helped support prices recently. The dollar has stabilized so far today and could create pressure if it strengthens ahead of next week’s FOMC meeting. Within the precious metals, silver has again stalled above its 200 daily moving average, although elevated speculative short exposure suggests the metal has room to rally. Platinum by contrast remains vulnerable after failing to vault overhanging trendline resistance which has dominated since the start of this year.

The post METALS MORNING VIEW 08/06: Trade jitters overshadow price sentiment appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News