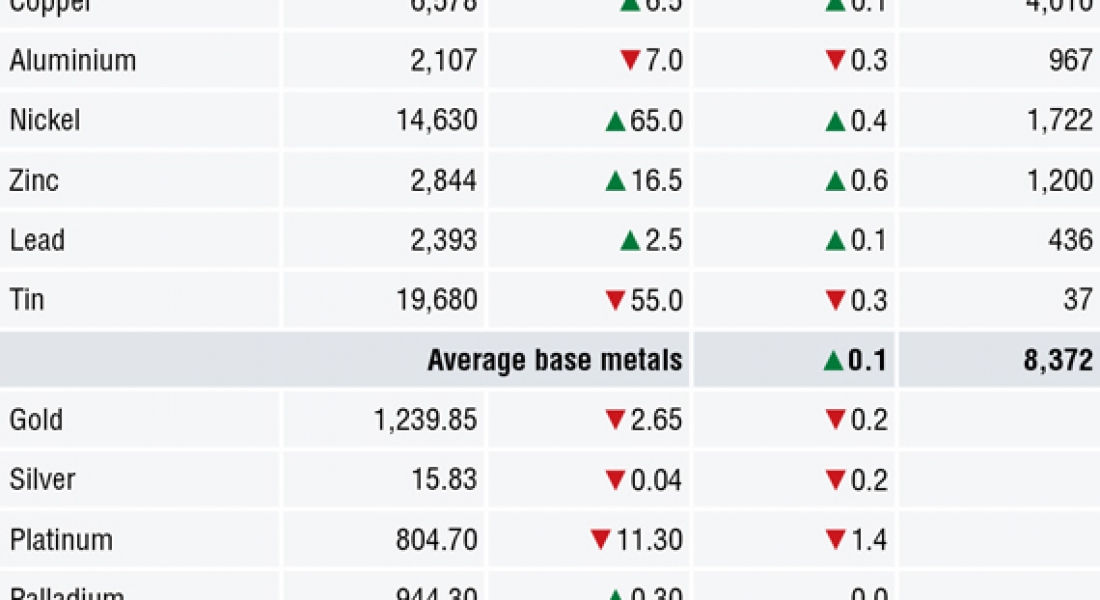

Three-month base metals prices on the London Metal Exchange were split into two camps on the morning of Tuesday July 3, with aluminium and tin prices both off by 0.3%, while the rest of the complex was up by between 0.1% and 0.6%. Zinc led the rebound, while copper was the laggard at $6,578 per tonne.

Volume has been above average with 8,372 lots traded as at 7:13am London time.

Precious metals were for the most part weaker this morning, led by a 1.4% drop in platinum prices to $804.70 per oz, while spot gold prices were off by 0.2% at $1,239.85 per oz.

In China, base metals prices on the Shanghai Futures Exchange were also mixed. The September nickel contract led on the downside with a 0.9% drop, the August lead and aluminium contracts were off by 0.4% and 0.3% respectively, while the August copper contract was up by 0.3% at 51,470 yuan ($7,731) per tonne, the September tin contract was up by 0.2% and the August zinc contract was up by 0.1%.

In other metals in China, the September iron ore contract on the Dalian Commodity Exchange was unchanged at 465 yuan per tonne. Meanwhile on the SHFE, the October steel rebar contract was down by 1.1%, the December gold contract was up by 0.1% and the December silver contract was down by 0.3%.

Spot copper prices in Changjiang were down by 0.3% at 51,020-51,120 yuan per tonne and the LME/Shanghai copper arbitrage ratio was at 7.83.

In wider markets, spot Brent crude oil prices were up by 0.51% at $77.83 per barrel this morning. The yield on US 10-year treasuries was at 2.8693% and the German 10-year bund yield was at 0.3135%.

Asian equity markets were mixed on Tuesday: Nikkei (-0.12%), Hang Seng (-1.82%), CSI 300 (-0.09%), the Kospi (+0.07%) and the ASX200 (+0.52%). This follows a similarly mixed performance in western markets on Monday, where in the United States the Dow Jones closed up by 0.15% at 24,307.18, and in Europe where the Euro Stoxx 50 closed down by 0.69% at 3,372.21.

The dollar index at 94.81 is consolidating just off a double high at 95.54 (June 21 and 28), the euro is consolidating in low ground at 1.1642, as is sterling at 1.3145, while the yen is weakening (111.05) and the Australian dollar (0.7373) is rebounding from low ground.

The recent tensions over trade with the United States has sent the yuan lower – it was recently quoted at 6.6963 and most of the emerging currencies we follow are trending lower too, the exception being the peso which has rebounded in recent weeks.

Today’s economic agenda has data on Japan’s monetary base, the French government budget balance, Spanish unemployment change, UK construction purchasing managers’ index (PMI), UK Financial Policy Committee minutes, EU producer price index (PPI) and retail sales, as well as US data that includes factory orders, total vehicle sales and economic optimism.

The base metals are looking quite diverse this morning with aluminium and tin still looking weak, while the rest are attempting a rebound, which in the case of copper is after a 17-day sell-off that has seen prices fall to $6,519 per tonne from the multi-year high of $7,348 per tonne. Whether the rebound has legs remains to be seen. The dominant trends are to the downside for all the base metals with the exception of nickel.

Our medium-term view is not bearish; we still feel this year’s weakness is the market adjusting to the strength seen in 2016 and 2017, but further tightness in supply lies ahead. Needless to say the US’ stance on trade is undermining confidence and until those tensions die down, buyers may feel in no need to restock.

The precious metals have been hit hard on the downside and the fact they have not featured as a haven bid during the US trade negotiations suggests they are out of favor with investors now that other havens are paying a higher yield. Platinum prices are looking particularly weak with the recent low at $797 per oz, the lowest they have been since December 2008.

The post METALS MORNING VIEW 03/07: Some base metals prices attempting a rebound, but continue to look fragile appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News