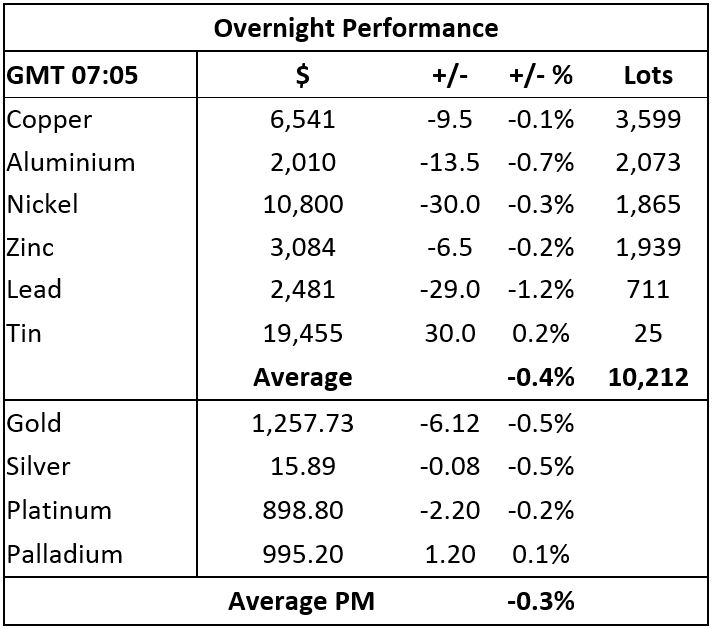

Precious metals are generally weaker this morning with gold and silver prices off by 0.5%, with gold prices at $1,257.73 per oz, while platinum prices were off by 0.2% and palladium prices are up by 0.1%. This follows a mixed performance on Wednesday that saw losses in platinum (-1.4%), silver (-0.9%), gold (-0.2%), while palladium rebounded 0.9%.

Precious metals are suffering with gold breaking below support at $1,260 per oz to follow silver and platinum prices lower, but for now palladium prices are holding up relatively well. With most of the metals prices in retreat, with the dollar firmer and geopolitical tensions low, the path of least resistance remains to the downside. That said, with the US Federal Open Market Committee meeting next week and with the market expecting an interest rate rise, the weakness we are seeing in gold may well be the market anticipating the rate rise.

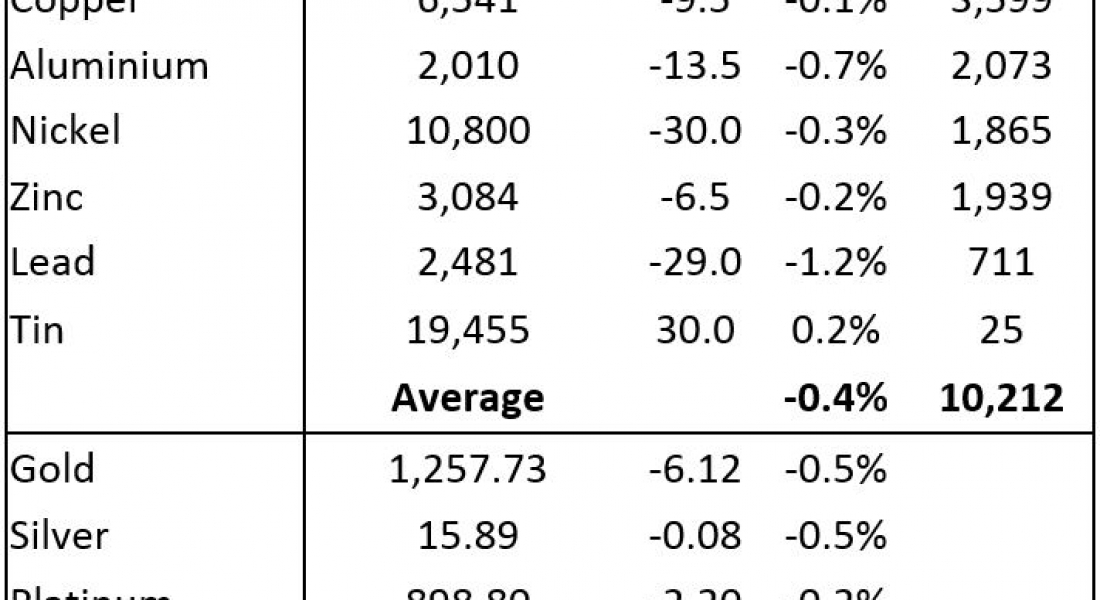

Base metals prices on the London Metal Exchange are for the most part weaker again this morning, Thursday December 7, although tin prices are bucking the trend with a 0.2% gain. The rest are down by an average of 0.5%, ranged between copper that is off by 0.1% at $6,541 per tonne and lead prices that are down by 1.2%.

Volume has been above average with 10,212 lots traded as of 07.05am London time.

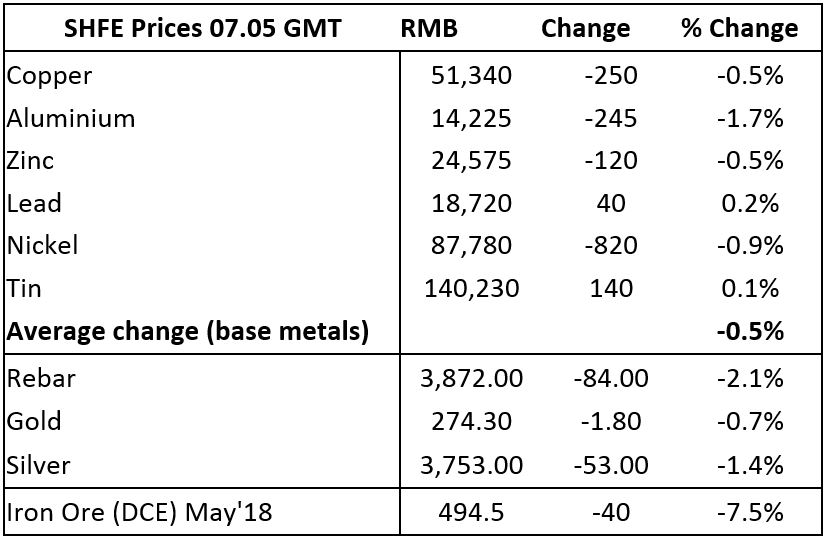

On the Shanghai Futures Exchange today, the base metals prices are divergent with aluminium leading on the downside with a 1.7% fall, nickel prices are off by 0.9%, copper and zinc prices are both down by 0.5%, while lead and tin prices are up by 0.2% and 0.1% respectively. February copper prices are at 51,340 yuan ($7,759) per tonne, while spot copper prices in Changjiang are down by 0.1% at 51,300-51,500 yuan per tonne and the LME vs Shanghai copper arbitrage ratio has strengthened to 7.85, from 7.81 on Wednesday.

The steel market is also weaker with iron ore prices in China falling by 7.5% to 494.50 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices are off by 2.1%, with gold and silver prices down by 0.7% and 1.4% respectively.

In international markets, spot Brent crude oil prices are up by 0.7% at $61.23 per barrel, this after the weakness seen on Wednesday. The yield on US 10-year treasuries is unchanged at 2.34% and the German 10-year bund yield has firmed to 0.31%.

Equities in Asia this morning are mixed: some of the markets have rebounded after Wednesday’s weakness, with gains seen in the Nikkei (1.45%), the Hang Seng (0.33%) and the ASX200 (0.54%), while the Kospi (-0.50%) and the CSI 300 (-1.11%) are weaker. This follows weakness in western markets on Wednesday where in the United States the Dow Jones closed down by 0.16% at 24,140.91 and in Europe where the Euro Stoxx 50 closed down by 0.25% at 3,561.57.

The dollar index, at 93.65 is getting some lift with the index back above the 20 day moving average. The euro at 1.1793 is weaker, as are sterling at 1.3373, the yen at 112.58 and the Australian dollar at 0.7535.

The yuan remains flat at 6.6148, while the other emerging currencies we follow are giving back some of their recent gains.

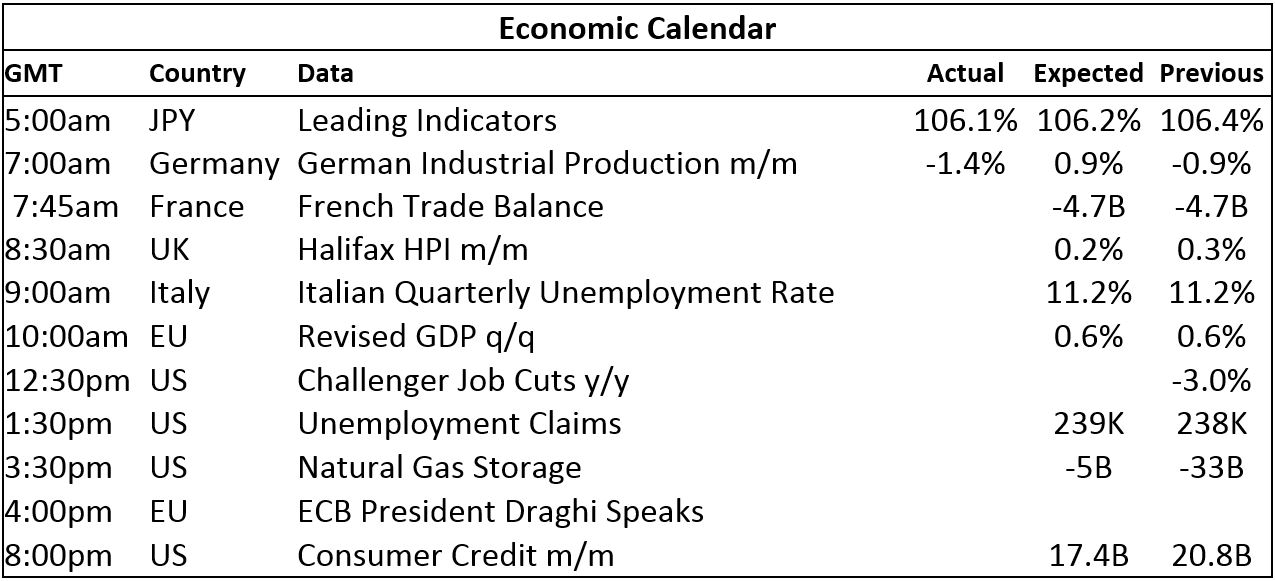

Today’s economic agenda shows Japan’s leading indicators were slightly weaker at 106.1%, down from 106.4% and German industrial production has fallen by 1.4% after a 0.9% fall previously. Data out later includes the French trade balance, UK house prices, Italian unemployment rates, EU revised gross domestic product (GDP), with US data including challenger job cuts, initial jobless claims, natural gas storage and consumer credit. In addition, European Central Bank president Mario Draghi is speaking.

Most of the base metals prices are correcting, led by aluminium and nickel, while tin and lead prices are holding up and copper and zinc prices have broken lower – but for now are seeing some support. The market therefore remains vulnerable. We do see this more as a technical/profit-taking correction rather than one that is warning of a meaningful economic slowdown. The market, however, seems concerned about slower growth in China and while that view is held then prices may well fall further, but we would view this as leading to a better buying opportunity.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Precious metals suffering with gold breaking below support appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News