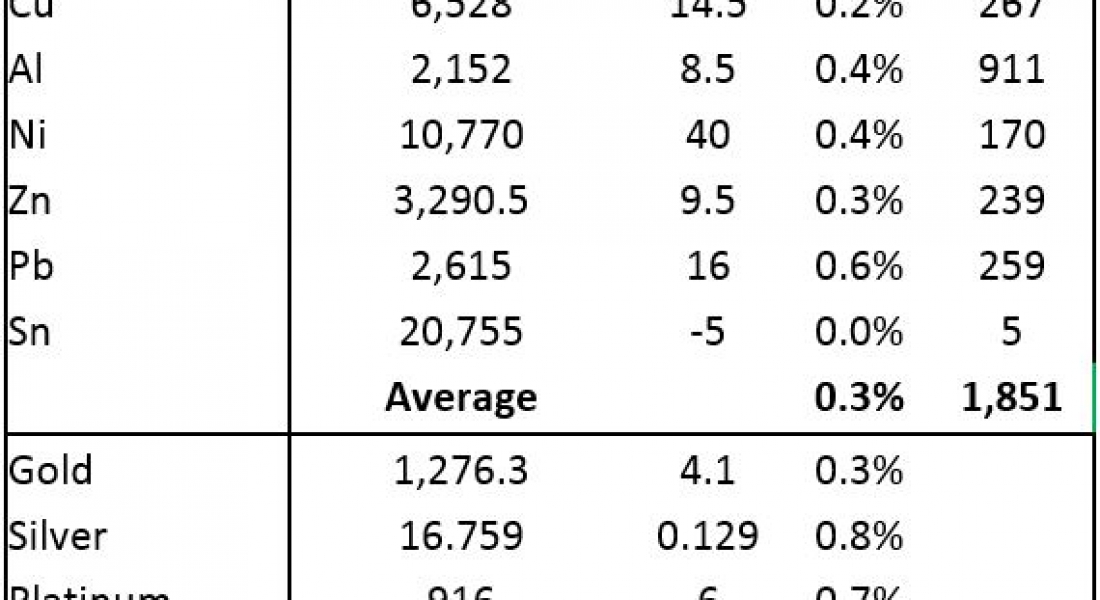

Base metals prices, with the exception of tin, on the London Metal Exchange are up by an average of 0.4% this morning, Wednesday October 4, with gains ranged between 0.2% for copper ($6,528 per tonne) and 0.6% for lead ($2,615 per tonne), while tin prices are little changed at $20,755 per tonne. With China on holiday all week, volume has been light with 1,851 lots traded as of 07:03 BST.

Tuesday was also a strong day for metals prices with gains averaging 1.5%, led by a 2.9% rally in lead prices and a 2.6% rise in nickel prices. The other metals also ended the day higher with aluminium and zinc prices up by 1.9% and 1.2%, respectively, while tin prices were up by 0.4% and copper rose by 0.3%.

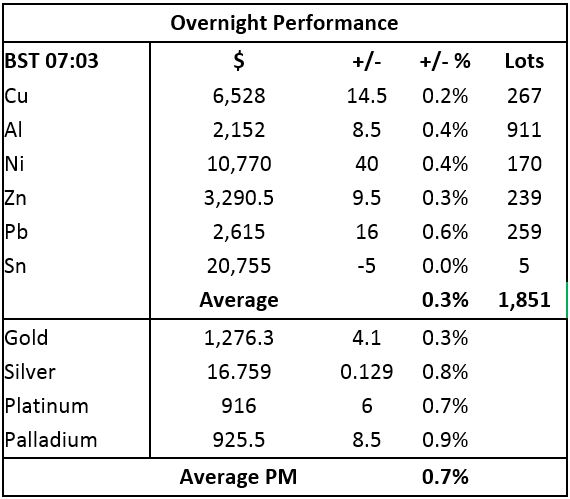

Precious metals prices are up by an average of 0.7% this morning; spot gold is the laggard with a 0.3% rise to $1,276.30 per oz, while the rest are up by between 0.7% and 0.9% – a weaker dollar no doubt helping the complex. This follows a 0.8% rally in palladium prices on Tuesday, while gold, silver and platinum prices were little changed. Palladium prices appear to have reacted to positive US auto sales figures, which rocketed to an annualised rate of 18.6 million units in September from 16.1 million units in August – with post-hurricane demand boosting sales.

In international markets, spot Brent crude oil prices are little changed at $55.70 per barrel, the yield on US ten-year treasuries has eased to 2.31% and the German ten-year bund yield is little changed at 0.45%.

Most Asian equities have reopened today and apart from the ASX 200 that is down by 0.9%, the rest are firmer with the Nikkei up by 0.1%, the Hang Seng up by 0.7% and the Kospi up by 0.9%. This follows a firmer session on Tuesday, where in the USA, the Dow closed up by 0.37% at 22,641.67 – it set a fresh intraday record high at 22,646.32; and in Europe, where the Euro Stoxx 50 closed up by 0.08% at 3,605.73.

The dollar index edged up to 93.92 on Tuesday, but at 93.37 this morning is slipping, which means it has yet to confirm that it has broken out of its 2017 downward trend. It does look as though it is turning a corner, but we feel it would need to move above the August rebound peak of 94.15 to confirm that. As the dollar index has dipped, other currencies have firmed with the euro at 1.1773, sterling at 1.3275, the yen at 112.50 and the Australian dollar at 0.7865. Emerging market currencies are also firmer on the back of the dollar’s hesitation.

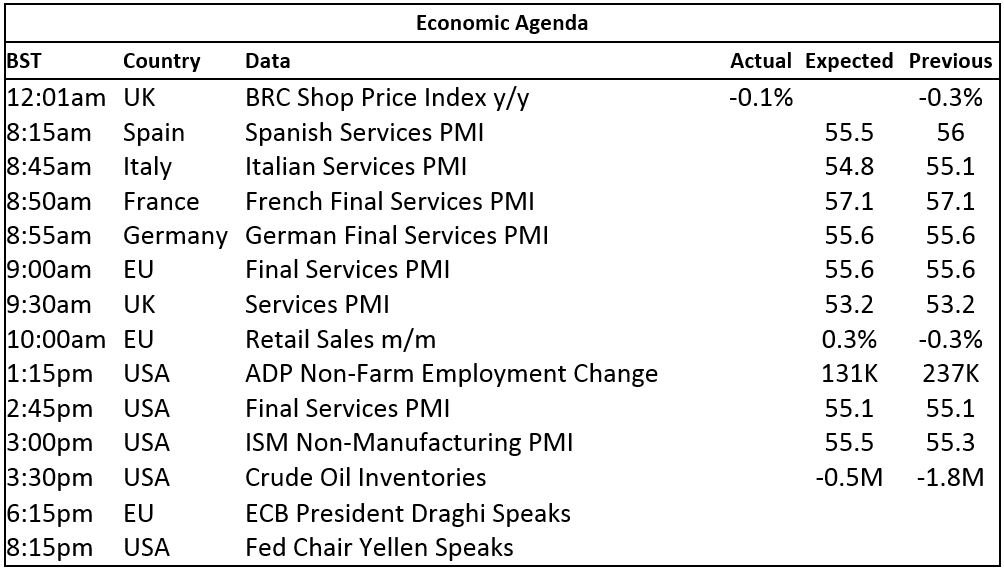

The economic agenda is busy today and is focused on services purchasing managers’ index (PMI) data out across Europe and the USA as well as data on EU retail sales, US ADP non-farm employment change and crude oil inventories. In addition, European Central Bank president Mario Draghi and US Federal Reserve chair Janet Yellen are also speaking.

Zinc and lead prices are setting new highs for the year and aluminium and nickel prices are following, although have yet to push into new high ground for the year while nickel is rallying off a lower base than aluminium is. Tin prices remain stuck below resistance, but upward momentum in most of the other metals may see prices push higher. Meanwhile, copper is the one metal still consolidating. A move above $6,585 per tonne would signal a stronger tone is returning. All in all, lead and zinc suggest the September corrections are over, and having regained energy the uptrends are alive again. We are now moving further into the post-summer period when manufacturing activity should pick up, which should be good for demand.

The weakness in precious metals prices has halted for now, the pullback in the dollar seems to be behind the move, with strong US auto sales no doubt helping the platinum group metals. With equity markets pushing higher the opportunity cost of holding gold is high, so in the absence of a pick-up in geopolitical tension, gold prices may struggle to rebound too far. That said, we do not think it will be too long before tensions rise again and as such the next rally in gold, off this lower base, may not be too far away.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Slide in gold prices halts as dollar eases appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News