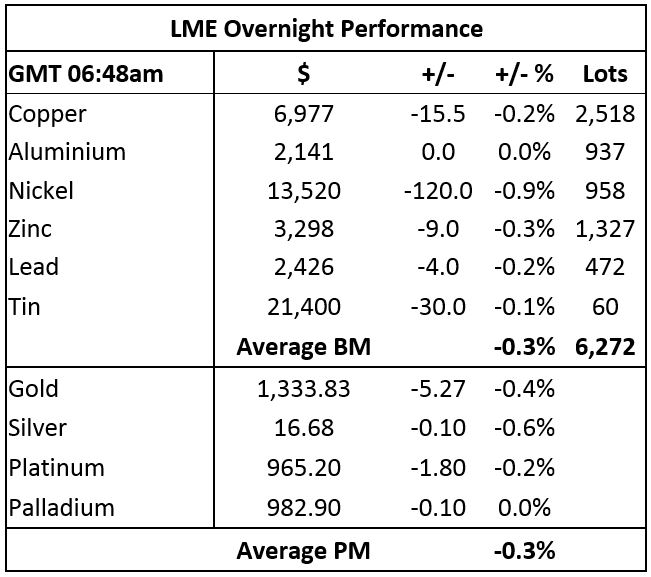

Precious metals prices are also weaker with gold prices off by 0.4% ($1,333.83 per oz), silver off by 0.6% ($16.68/oz), platinum by off 0.2% ($965.20 per oz) and palladium off slightly at $982.90 per oz. This follows a general day of strength on Tuesday that saw the complex close up by an average of 1.1%, led by a 2.3% rise in platinum prices.

Gold prices are holding up well and the uncertainty mentioned above is likely to prompt a pick-up in haven interest, while the other more industrial precious metals may well suffer in line with the base metals.

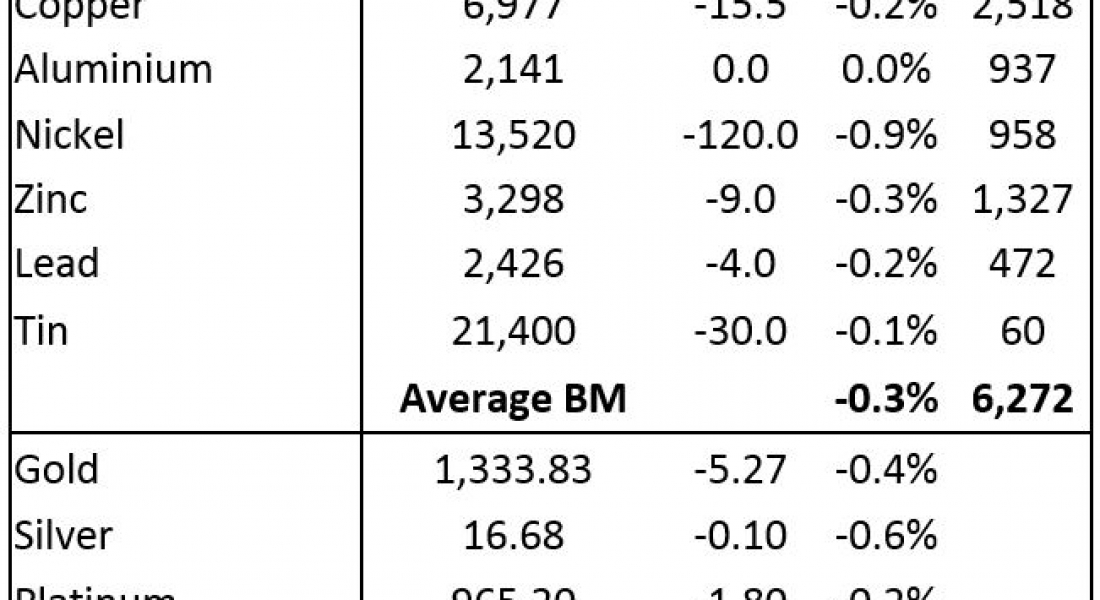

Base metals traded on the London Metal Exchange are down across the board by an average of 0.3% this morning, Wednesday March 7. Nickel leads the decline with a 0.9% drop to $13,520 per tonne, while the rest are off between less than 0.1% and 0.3%, with three-month copper prices at $6,977 per tonne.

Volume has been average with 6,272 lots traded as of 06.48am London time.

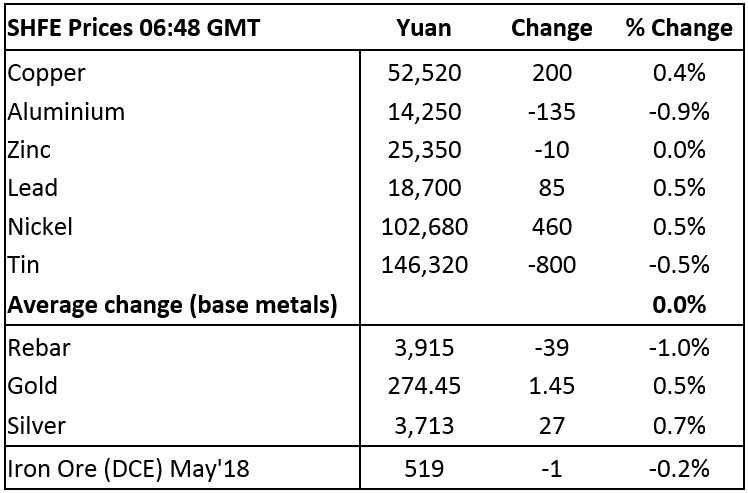

On the Shanghai Futures Exchange this morning, metals prices are mixed – aluminium and tin prices are down by 0.9% and 0.5% respectively, zinc prices are little changed, lead and nickel prices are up by 0.5% and copper prices are up 0.4% at 52,520 yuan ($8,296) per tonne. Spot copper prices in Changjiang are up by 0.3% at 51,900-52,070 yuan per tonne and the LME/Shanghai copper arbitrage ratio has eased to 7.53, from 7.58 on Tuesday.

In other metals in China, iron ore prices are down by 0.2% at 519 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices are down by 1%, while gold prices and silver prices are up 0.5% and 0.7% respectively.

In wider markets, spot Brent crude oil prices are off by 0.41% at $65.21 per barrel, while the yield on US 10-year treasuries has fallen to 2.86%, while the German 10-year bund yield has edged up to 0.66%.

Equity markets in Asia are weaker this morning on the back of a pick-up in concerns over a trade war, which has escalated with the European Union proposing tariffs on some US goods, and on the resignation of US President Donald Trump’s top economic adviser Gary Cohn: Nikkei (-0.77%), Hang Seng (-1.06%), CSI 300 (-0.77%), ASX 200 (-1.01%) and the Kospi (-0.40%). This follows volatility in western markets on Tuesday, where in the United States the Dow Jones closed up by 0.04% at 24,884.12, and in Europe where the Euro Stoxx 50 closed down by 0.08% at 3,357.86 – but since the closes, pre-market indications suggest the Dow is down by 1.4%.

The dollar index has fallen back to 89.53 as the potential for trade wars and Cohn’s resignation weigh on sentiment. The euro (1.2418), yen (105.62) and Australian dollar (0.7803) are firmer on the back of the weaker dollar, while sterling is flat (1.3886). The yuan is also stronger at 6.3228, while the other emerging market currencies we follow remain mixed.

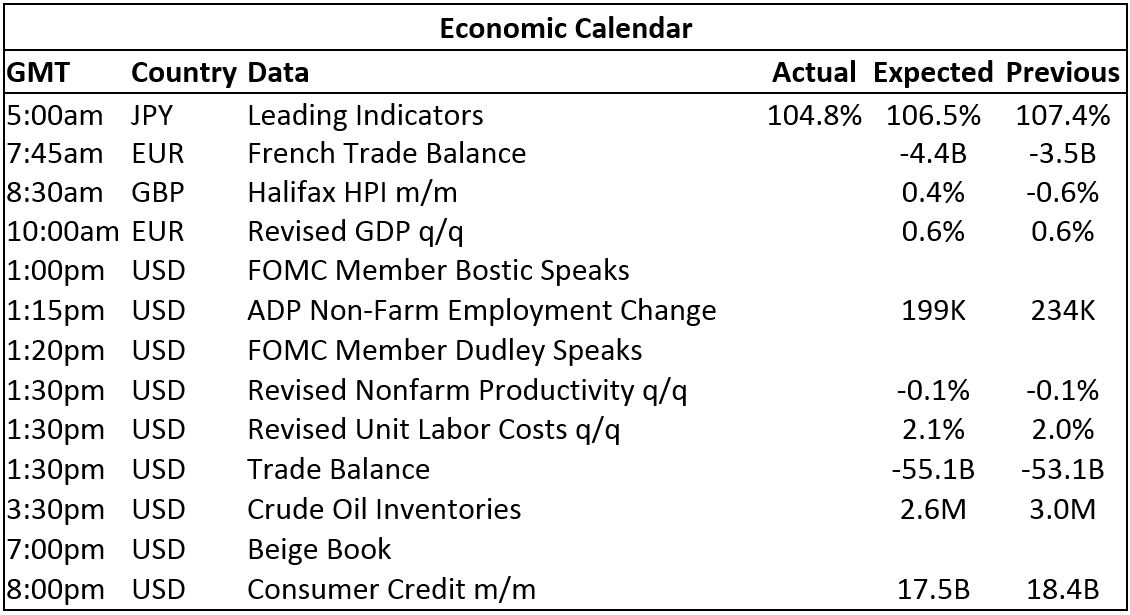

Economic data out today includes Japan’s leading indicators that came in at 104.8%, which was down from the prior reading of 107.4%. Data out later includes France’s trade balance, UK house price index (HPI), EU revised gross domestic product (GDP), along with US releases including ADP non-farm employment change, revised non-farm productivity and unit labor costs, trade balance, crude oil inventories, the beige book and consumer credit. In addition, US Federal Open Market Committee members William Dudley and Raphael Bostic are speaking.

Most of the base metals remain on a back footing this morning and that seems to be a result of the increased uncertainty over the combination of whether a trade war is about to kick-off, a more hawkish US Federal Reserve, nervous equity markets and some disappointing manufacturing purchasing managers’ index (PMI) data for February. We expect these headwinds will pass and the underlying concerted global growth to underpin commodity prices, but sentiment may be weak for a while as these uncertainties prevail. As such, we would let any weakness run its course but be on the lookout for buying opportunities once the winds start to change direction.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Metals morning view: Gold prices weaker following a day of strength on Tuesday appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News