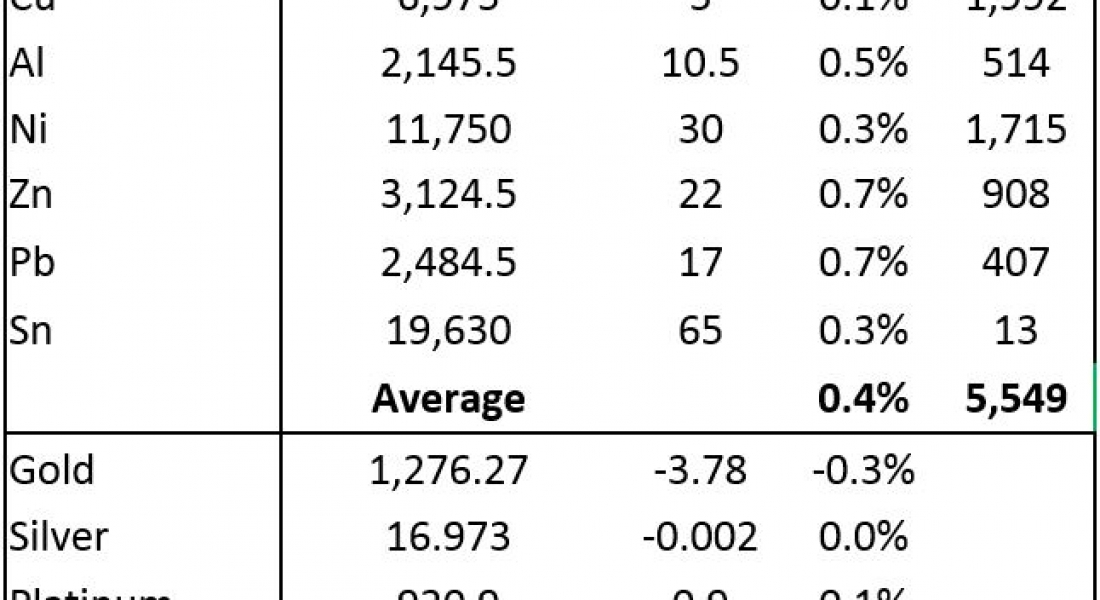

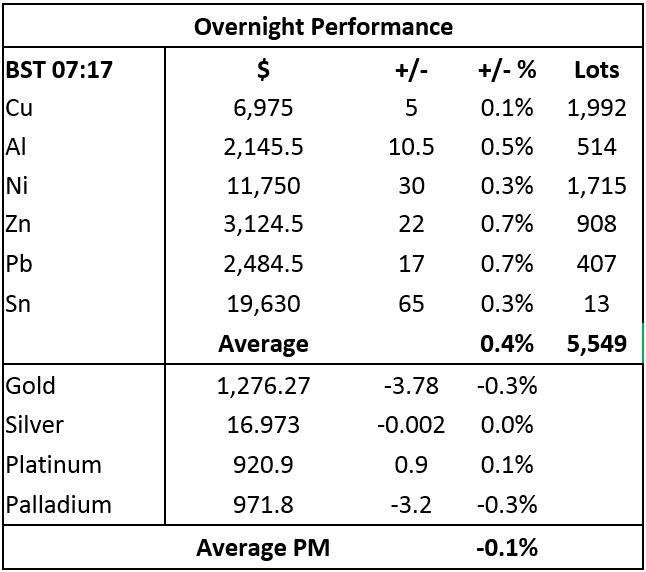

Base metals prices on the London Metal Exchange are firmer by an average of 0.4% this morning, Monday October 23. Zinc and lead prices lead the way with a 0.7% gain, while copper prices are the laggards with a 0.1% gain to $6,975 per tonne. Volume has been average of 5,549 lots as of 07:17 BST.

This follows a day of price weakness on Friday, when the complex closed down by an average of 0.7% after what had been a strong start to the day with prices up approximately 1.1% around the time European markets opened.

Precious metals prices are for the most part weaker this morning, with gold and palladium prices both down by 0.3%, while silver prices are off slightly and platinum prices are up by 0.1%. Spot gold was recently quoted at $1,276.27 per oz. Friday’s trading showed weakness in gold, silver and platinum prices with bullion prices off by an average of 1.2%, and platinum prices off by 0.2%, while palladium prices bucked the trend with a rise of 1.6% to $975 per oz.

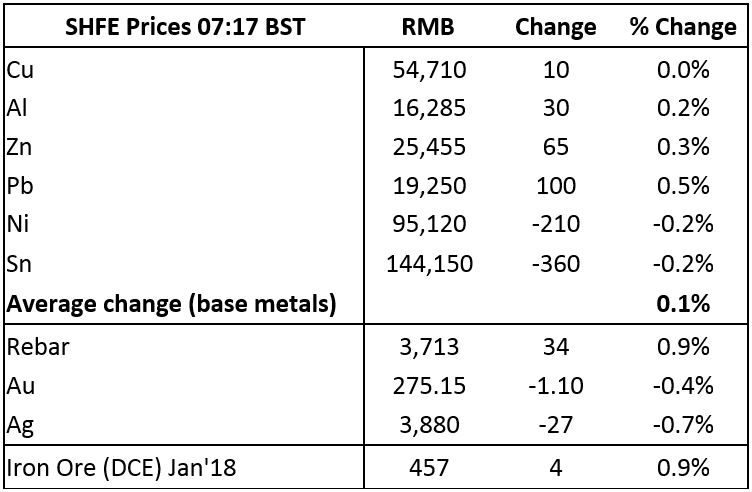

Base metals on the Shanghai Futures Exchange (SHFE) are mixed; copper prices are little changed at 54,710 yuan ($8,255) per tonne, gains are being seen in aluminium (0.2%), zinc (0.3%) and lead (0.5%), while nickel and tin prices are both down by 0.2%. Spot copper prices in Changjiang are down by 0.5% at 54,930-55,150 yuan per tonne while the London/Shanghai copper arbitrage ratio has firmed to 7.84.

The steel-orientated metals in China are firmer this morning with iron ore prices climbing by 0.9% to 457 yuan per tonne on the Dalian Commodity Exchange, while steel rebar prices on the SHFE are also up by 0.9%. Gold and silver prices on the SHFE are down by 0.4% and 0.7%, respectively.

In international markets, spot Brent crude oil prices are off by 0.07% at $57.83 per barrel. The yield on US ten-year treasuries has firmed to 2.38% and the German ten-year bund yield has also firmed to 0.43%.

Equities in Asia are mixed: Japanese Prime Minister Shinzo Abe’s re-election victory has boosted the Nikkei that is up by 1.11%; the CSI 300 and Kospi are both little changed with gains of less than 0.1%; the ASX 200 is off by 0.2% and the Hang Seng is off by 0.6%. Western markets were stronger on Friday, where in the USA, the Dow closed up by 0.71% at 23,328.63 and in Europe where the Euro Stoxx 50 closed up by 0.08% at 3,605.09.

The dollar index at 93.77 is edging higher again within its recent 92.75 to 94.27 range – the jury remains out as to whether this is a pause in the downward trend that has been in effect all year, or whether it is the start of a turning point for a move higher – the latter looks likely. The euro at 1.1765 is also consolidating, but is looking possibly toppy, while sterling is firmer at 1.3202, the Australian dollar at 0.7824 is consolidating, while the yen has weakened on the back of Abe’s victory, which suggests ongoing stimulus.

The Chinese yuan remains weak, it was recently quoted at 6.6324, while the other emerging currencies we follow are flat to weaker.

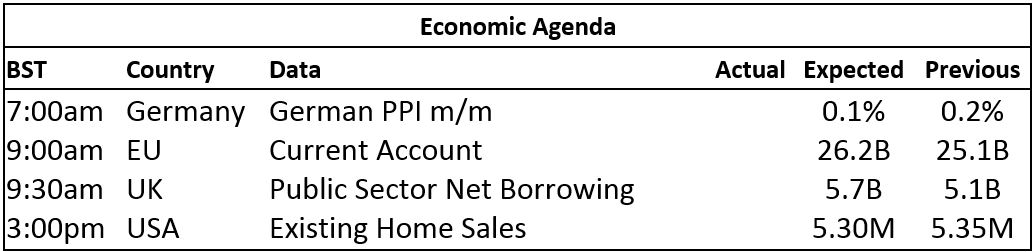

Today’s economic data includes a German Bundesbank monthly report, UK CBI industrial order expectations and EU consumer confidence.

On Friday morning it looked like the pullback in the metals prices had run its course with most of the LME metals putting in some strong gains, however, that was reversed by the close and this morning prices are back in consolidation mode. Tin has been the weakest performer of late, but that has probably been caused by the low liquidity in the metal. We are now, once again, on the lookout for signs about how strong underlying bullish sentiment is. Our view of late has been to remain quietly bullish, but expect trading to become choppier as prices are generally in high ground so we should expect more bouts of scale-up selling along the way. A firmer dollar is also likely to be a headwind for prices.

Gold prices have gapped lower today, which is a sign of weakness that is affecting silver and platinum prices too, while palladium prices are consolidating below recent highs. The stronger dollar and calm over North Korean, are weighing on gold prices. We would expect the precious metals to remain supported, but with the dollar looking well placed to push higher, the precious metals may face a headwind.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices under pressure as dollar firms appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News