The reopening of Chinese markets this morning, Monday October 9, after last week’s holiday has led to a fairly strong start to the week for the base metals, the exception being lead, which is the sole metal in negative territory.

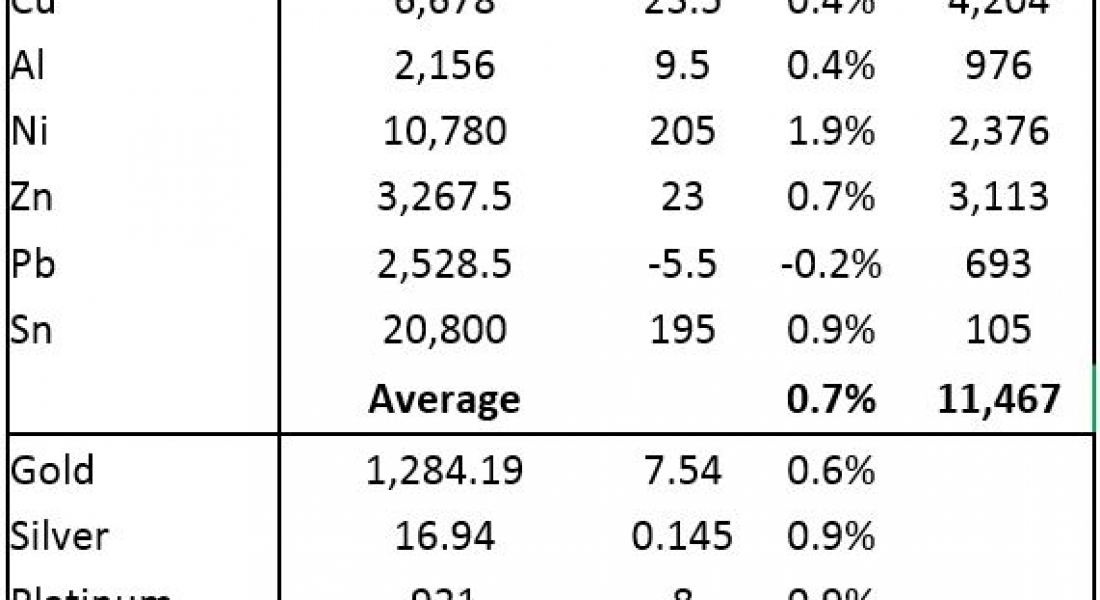

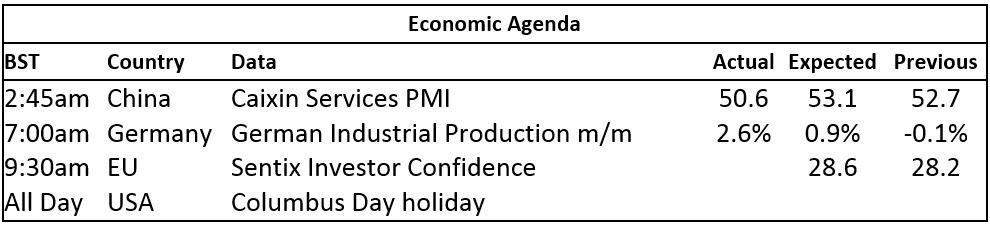

Nickel prices lead on the upside with 1.9% gain to $10,780 per tonne, followed by a 0.9% rise in tin prices; zinc prices are up by 0.7%; copper and aluminium prices are firmer by 0.4%, with the former at $6,678 per tonne; while lead prices are down by 0.2%.

Volume has jumped higher to 11,467 lots traded as of 07:01 BST, this after an average trading volume of around 1,500 lots at this time of day last week. This follows a day of consolidation on Friday, when prices dropped an average of 1.2%, which came after a show of strength mid-week.

Gold prices are continuing their rebound this morning with prices up by 0.6% at $1,284.19 per oz, silver prices are up by 0.9% and the platinum group metals (PGMs) are up by 1%. It seems gold prices are on the climb again following a Russian report suggesting North Korea is preparing to test a missile that could potentially reach the USA. This follows the yellow metal’s solid rebound on Friday from a low of $1,260.70 per oz to close at the day’s high of $1,276.90 per oz.

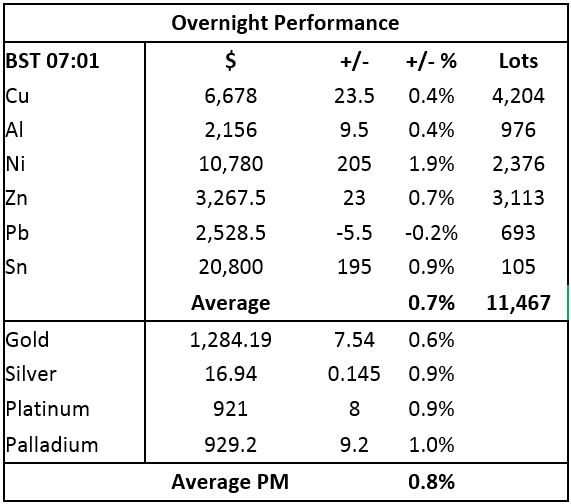

In Shanghai, the base metals on the Shanghai Futures Exchange (SHFE) are up across the board with average gains of 1.6%, led by a 2.5% rally in zinc prices. Copper prices are up by 1.4% at 51,980 yuan ($7,839) per tonne. Spot copper prices in Changjiang are up by 1.8% at 52,300-52,500 yuan per tonne and the London/Shanghai copper arb ratio is slightly easier at 7.78.

In other metals in China, iron ore prices continue to weaken – they are down by 2.5% at 440.50 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices are up by 2.4%, silver prices are up by 0.7%, but gold prices are down by 0.5%.

In international markets, spot Brent crude oil prices are up by 0.47% at $55.66 per barrel, the yield on US ten-year treasuries has edged higher to 2.36% and the German ten-year bund yield is firmer at 0.46%.

China’s CSI 300 has reopened with a 1.7% gain, the ASX 200 is up by 1.2%, but the Hang Seng is off by 0.4%, and the Nikkei and Kospi are closed for holidays. This follows a slightly weaker performance on Friday, where in the USA, the Dow closed little changed at 22,773.67; and in Europe, where the Euro Stoxx 50 closed down by 0.28% at 3,603.32.

The dollar index is weaker this morning at 93.78. This comes after the index set a fresh high of 94.27 on Friday – breaching the August rebound peak of 94.15, which was a bullish development. A pick-up in geopolitical tensions seems to have weighed on the dollar this morning, but we wait to see if the market can shake-off those concerns and build on Friday’s gains. The euro at 1.1730 is consolidating, sterling at 1.3122 is consolidating/rebounding after political weakness last week pulled the currency lower, the yen is firmer at 112.60, while the Australian dollar at 0.7764 is consolidating after last week’s weakness.

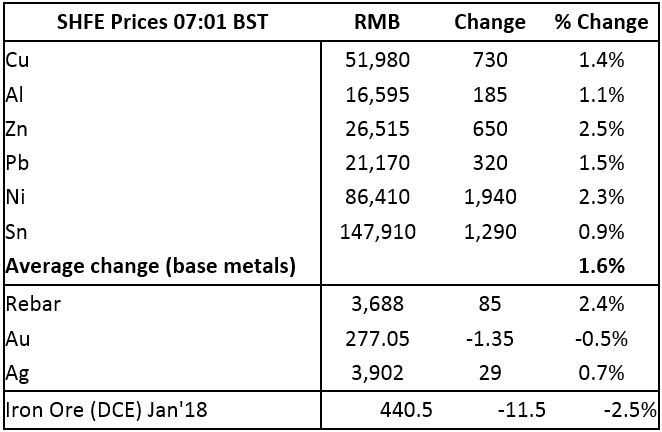

The economic agenda is light today, with data already out showing China’s Caixin services purchasing managers’ index (PMI) dropping to 50.6 from 52.7 and German industrial production climbing 2.6% after a 0.1% fall previously. Later there is data on EU Sentix investor confidence.

The base metals seem well place to work higher again. Rallies got going last week, they consolidated on Friday, but with China coming back in buying mode, the outlook is positive. That said, a lot of the metals’ prices are already in high ground so trading is likely to become more volatile as we started to see at the end of last week.

Gold prices are rebounding again – we thought the lull in geopolitical tensions over North Korea would not last long. However, with the dollar breaching resistance on Friday, it may well work higher and that may prevent a strong rebound in gold prices. Silver prices are following gold’s lead, while the PGM prices are consolidating.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices rebound on pick-up in geopolitical tensions appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News