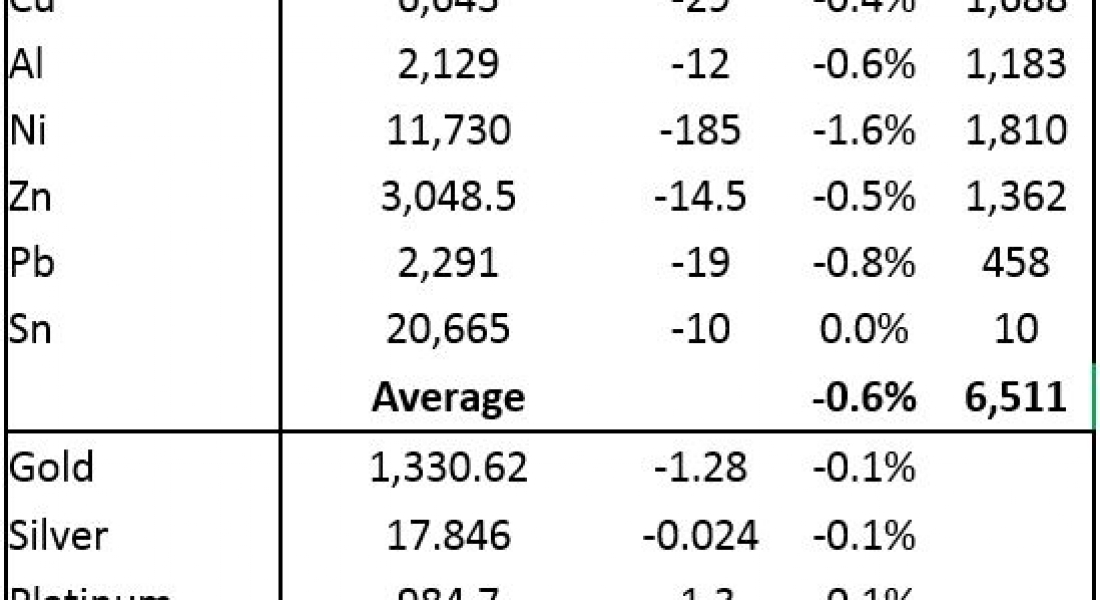

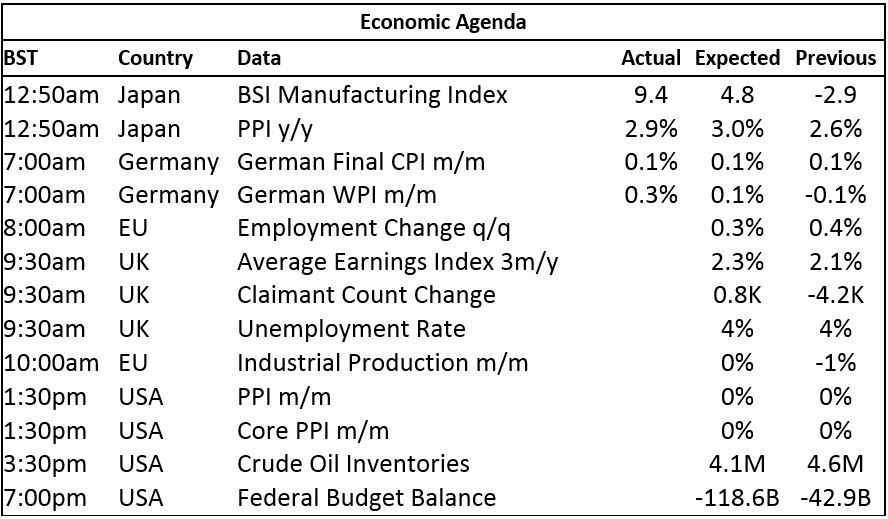

Base metals prices on the London Metal Exchange are down across the board by an average of 0.6% this morning, Wednesday September 13. Three-month nickel prices lead the decline with a 1.6% drop to $11,730 per tonne, while tin prices are little changed and the rest are down by between 0.4% for copper ($6,643 per tonne) and 0.8% for lead ($2,291 per tonne).

Volume has been average with 6,511 lots traded as of 06.37 BST.

This follows a mixed day of trading on Tuesday, where copper, zinc and tin prices ended lower, down an average of 0.8%, while aluminium, nickel and lead prices closed up an average of 1%. Out of all the base metals, aluminium is the metal where prices are holding up the best.

Precious metals are uniformly off 0.1% this morning, with spot gold prices at $1,330.62 per oz. This follows a day of general dip buying on Tuesday, although platinum prices continued to correct.

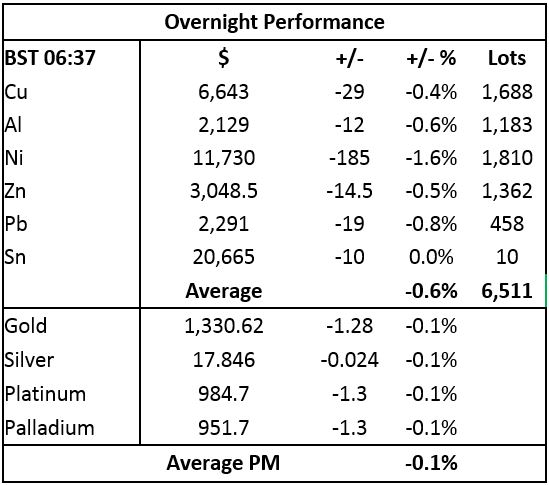

On the Shanghai Futures Exchange (SHFE) this morning, zinc and copper prices are down either side of 0.9% with copper prices at 51,150 yuan ($7,825) per tonne, while the rest are unchanged to stronger, with lead up 3%, nickel up 0.4%, tin little changed and aluminium prices unchanged. Spot copper prices in Changjiang are down 0.4% at 51,180-51,330 yuan per tonne and the London/Shanghai copper arb ratio has edged higher to 7.70, compared with 7.68 on Tuesday.

Steel rebar prices on the SHFE are down 0.6%, while iron ore prices for January delivery are down 0.3% at 534.50 yuan per tonne on the Dalian Commodity Exchange. Back on the SHFE, gold prices are down 0.4% and silver prices are off 1.2%.

In international markets, spot Brent crude oil prices are down 0.14% at $54.13 per barrel and the yield on US ten-year treasuries has firmed to 2.16%, while the German ten-year bund yield has climbed to 0.39%.

In Asian equities this morning, the Nikkei is up 0.5%, the Kospi is up 0.2%, the ASX 200 and CSI 300 are little changed and the Hang Seng is down 0.24%. US markets were stronger with the Dow closing up 0.28% at 22,118.86, while in Europe, the Euro Stoxx 50 climbed 0.5% to 3,512.56.

The dollar index’s rebound has halted for now – at 91.79, the index is below Tuesday’s rebound highs of 92.08. Sterling is pushing higher at 1.3307, the euro is working higher at 1.1983, the yen is weaker at 110.02 and the Australian dollar at 0.8031 is consolidating in high ground. We are still waiting to see if spikes in the dollar and currencies on September 8 were a turning point and whether the dollar will continue to go higher, which could be a headwind for metals, or is the recent strength in the dollar just a mini-countertrend move?

The Chinese yuan has been weakening since September 8, but at 6.5216, it is starting to show some strength today. The recent weakness may have just been a knee-jerk reaction to the relaxation in restrictions on shorting the yuan, but if the appetite to short the currency is not there then perhaps the yuan will continue to strengthen. The rupiah, rand, ringgit and real, that had been showing strength are now consolidating, while the peso and rupee remain fairly flat.

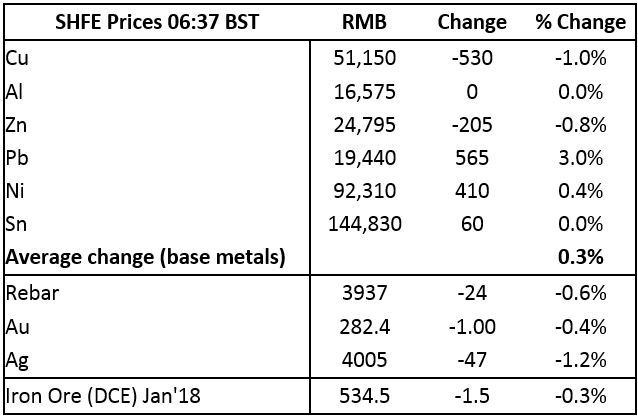

Data out already today showed better Japanese BSI manufacturing index and PPI data, while German CPI was unchanged at 0.1% and German WPI climbed 0.3%, after a 0.1% fall previously. Data out later includes EU employment change and industrial production, UK employment data, with US data including PPI, crude oil inventories and the Federal budget balance.

For the most part LME base metals prices are in correction/consolidation-at-lower-numbers mode, the exception is aluminium where prices are holding up well. There is dip buying evident in all the metals, so it is now a case of when the buying pressure overcomes what selling pressure there is. Although prices have corrected, there does not seem any rush for the exits so we do see this as the markets correcting having run ahead of the fundamentals, rather than sentiment turning less bullish. For now we would give the market more time to adjust to recent price moves and wait to see if there are further large stock increases. Overall, we would not be surprised to see prices pull back further, but we would be on the lookout for buying opportunities.

Gold prices are consolidating at lower numbers, silver and palladium are following gold’s lead, while platinum prices are still correcting. For now we would watch the direction of the dollar and of course developments in North Korea. If the dollar does resume its rebound then gold prices may come under further downward pressure.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices consolidate; eyes on the dollar appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News