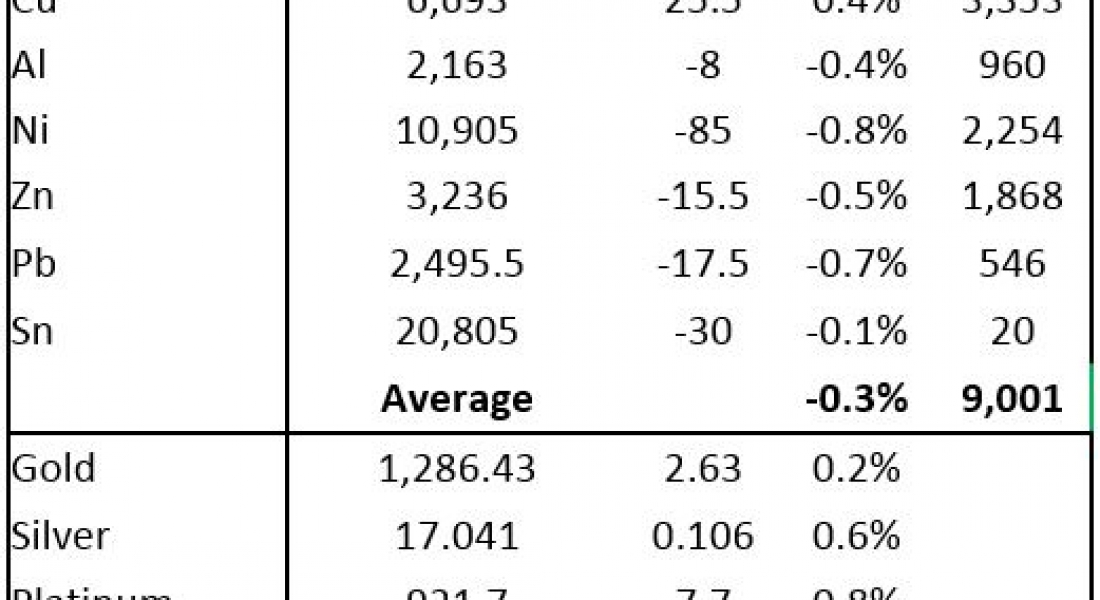

Base metals prices on the London Metal Exchange are for the most part weaker this morning, Tuesday October 10, with prices down by an average of 0.3%. The exception is copper where three-month prices are up by 0.4% at $6,693 per tonne. The rest are off between 0.1% for tin prices and 0.8% for nickel prices. Volume has been average with 9,001 lots as of 07:11BST.

This after a generally stronger performance on Monday when nickel prices outperformed with a 3.9% rise, gains of 1.1% were seen in aluminium and tin prices, zinc and copper prices increased by 0.2%, while lead bucked the general uptrend – dropping by 0.8%.

Gold prices are rebounding for a third day now, with prices up by 0.2% at $1,286.43 per oz, which follows a 0.6% gain on Monday. Silver and the platinum group metals (PGMs) are up by between 0.6% and 0.8% this morning. On Monday, silver prices rallied 0.8%, platinum prices were little changed, while palladium prices jumped 1.7%.

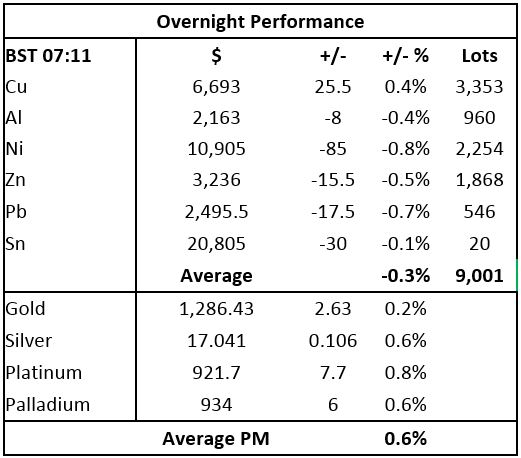

In Shanghai, the base metals are giving a mixed performance on the Shanghai Futures Exchange (SHFE) today; nickel prices leads on the upside with 1.7% gain; lead prices are down by 1.9%; zinc prices are off by 1%; tin prices are 0.4% weaker; while aluminium and copper prices are little changed with the latter up by 0.1% at 52,070 yuan ($7,860) per tonne. Spot copper prices in Changjiang are also up 0.1% at 52,330-52,550 yuan per tonne and the London/Shanghai copper arb ratio is little changed at 7.78.

In other metals in China, iron ore prices continue to weaken – they are off by 1.8% at 441 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices are down by 4.2%, while gold and silver prices are down 0.1% and 0.2%, respectively.

In international markets, spot Brent crude oil prices are up by 0.16% at $55.85 per barrel, the yield on US ten-year treasuries has edged higher to 2.37% and the German ten-year bund yield has eased to 0.45%.

Equities in Asia are all open again, the Kospi that was closed most of last week and Monday has reopened with a 1.6% gain, the Nikkei is up by 0.6%, the Hang Seng is up by 0.5%, while the ASX 200 is little changed and the CSI 300 is off 0.4%. This follows a mixed performance on Monday, where in the USA, the Dow closed down slightly by 0.06% at 22,761.07; and in Europe, where the Euro Stoxx 50 closed up by 0.20% at 3,610.50.

The dollar index is weaker again this morning at 93.47. This comes after the index set a fresh high of 94.27 on October 6 – breaching the August rebound peak of 94.15, which was a bullish development. With the dollar weaker for the second day now, we need to see if this is just consolidation, or is a precursor for further weakness. For now, we expect this is just consolidation. Against a weaker dollar, the currencies are broadly firmer – euro (1.1777), sterling (1.1371) and Australian dollar (0.7788), while the yen is consolidating at 112.58. Since China’s markets reopened on Monday, the Chinese yuan has been rebounding following the September 8-29 weakness – it was recently quoted at 6.5949, after 6.6819 on September 29. The other emerging currencies we follow are for the most part consolidating, although the real and peso are showing some weakness.

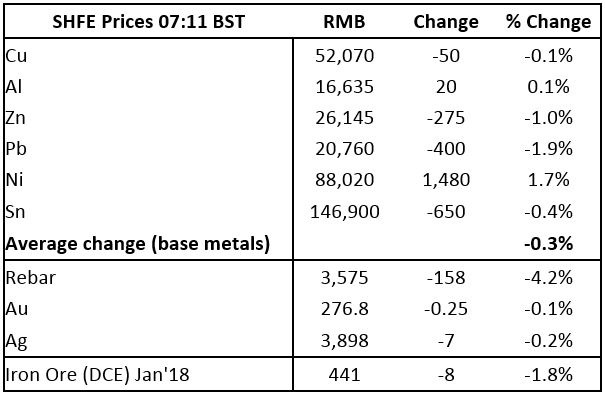

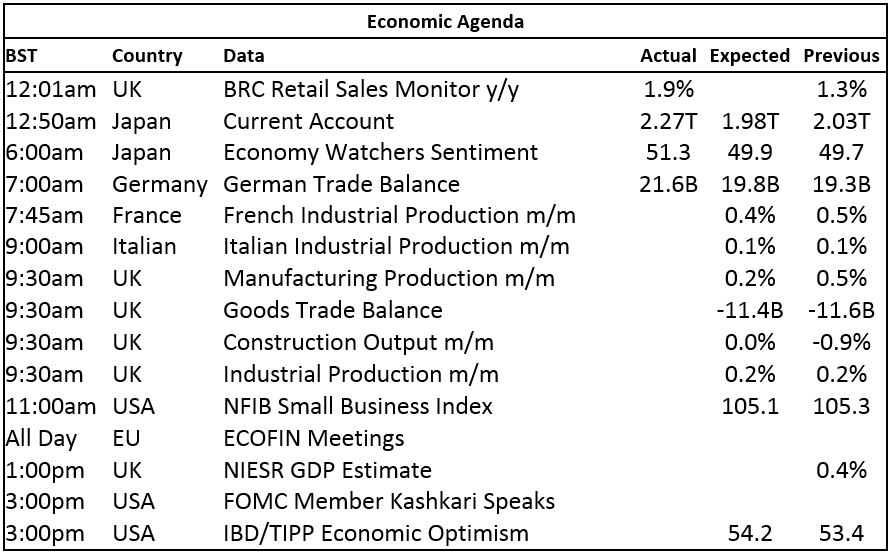

The economic agenda is busy today, with data out already showing UK BRC retail sales climbed 1.9%, better than the 1.3% gains seen previously, Japan’s data beat expectations, as did Germany’s trade balance. Later there is data on French, Italian and UK industrial production as well as UK manufacturing, goods trade balance, construction output and GDP estimate. US data includes the NFIB small business index and IBD/TIPP economic optimism. In addition, there is an EU Ecofin meeting and US Federal Open Market Committee member Neel Kashkari is speaking.

The base metals seem well placed to work higher again, but these already high prices are attracting scale-up selling, which is most noticeable in lead and zinc, but is likely to be seen in the other metals that are in high ground. The two metals below high ground are copper and nickel, so they may have an easier time on the upside.

Gold and silver prices are leading the rebounds, platinum is following but looks less certain, while palladium continues to consolidate, but it did not pull back to the same extent as the other precious metals. For now with the dollar drifting, gold prices have a tailwind, but we are not sure how far the dollar will retrace.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices buoyant as dollar drifts appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News