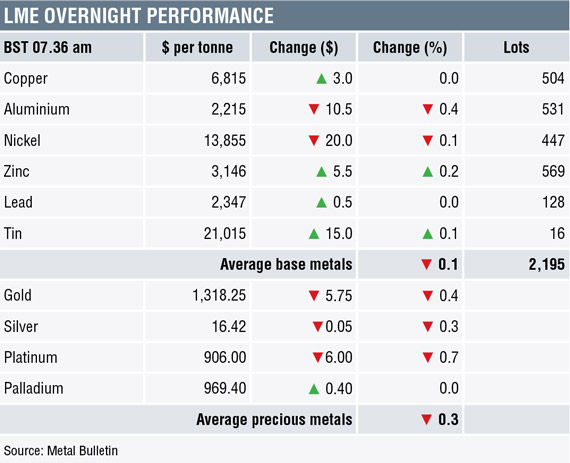

Base metals prices on the London Metal Exchange were for the most part little changed this morning, Monday April 30. Lead, zinc, tin and copper were slightly firmer, with the latter at $6,815 per tonne, while aluminium and nickel were slightly weaker.

With Chinese and Japanese markets closed, volume has been light with 2,195 lots traded as at 07.36 am London time.

This follows a generally weak day on Friday that saw copper, aluminium and nickel prices all fall by more than 2%, tin off by 1.4% and lead and zinc bucking the trend with gains of around 0.2%.

Precious metals prices were broadly weaker this morning with gold ($1,318.25 per oz), silver and platinum prices down by an average of 0.5%, while palladium prices are little changed.

In wider markets, spot Brent crude oil prices were weaker, with prices off by 1.36% at $73.39 per barrel, the yield on US 10-year treasuries was at 2.96%, and the German 10-year bund yield was easier at 0.58%.

The equity markets in Asia that are open are firmer with the Kospi up by 0.92%, the Hang Seng up by 1.46% and the ASX 200 up by 0.49%. Positive developments between North and South Korea have helped boost sentiment. This follows a mixed performance in western markets on Friday, where in the United States the Dow Jones closed off by 0.05% at 24,311.19, and in Europe where the Euro Stoxx 50 closed up by 0.36% at 3,518.78.

The dollar index remained firm at 91.51 and it looks as though the dollar is now heading higher having spent most of the year, up until recently, in a sideways base formation. This is likely to prove another headwind for metals prices. The euro seems to have found some support, it was last at 1.2138, sterling remained under pressure at 1.3766, the yen was consolidating at 109.19, as was the Australian dollar at 0.7560. The weakness in the emerging market currencies we follow appears to have halted for now.

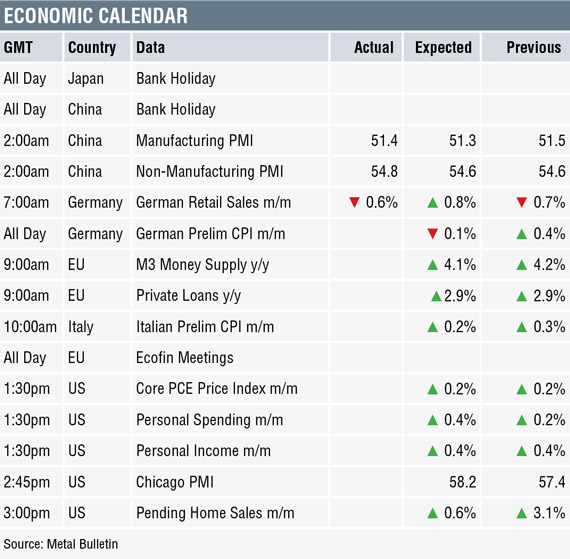

The economic agenda is busy today: data already out shows a mixed picture in China with the official manufacturing purchasing managers’ index (PMI) slipping to 51.4 from 51.5, although it was expected to dip to 51.3. The non-manufacturing PMI climbed to 54.8 from 54.6. Meanwhile, Germany’s retail sales fell by 0.6%, against an expected increase of 0.8%, having fallen by 0.7% previously.

Data out later includes German and Italian consumer price index (CPI), EU money supply and private loans and there is an Ecofin meeting. In the US, there is data on personal income, spending and prices, Chicago PMI and pending home sales.

The base metals are looking weak, although lead and zinc prices have found some dip buying, while the rest continue to look vulnerable as they test support levels. We expect the markets to now take their next direction from the manufacturing PMI data that will emerge over the next two days. If there are signs that growth is slowing further then the metals may well have further to fall. Conversely, better PMI data may help to underpin support levels. Overall we remain quietly bullish, but think it will take a new run of bullish economic data before prices react.

Precious metals are on a back footing, the positive talks between North and South Korea have helped to reduce haven demand, while the firmer dollar is a headwind. For now, the path of least resistance for the precious metals seems to be to the downside.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW 30/04: Quiet start to the week with China on holiday appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News