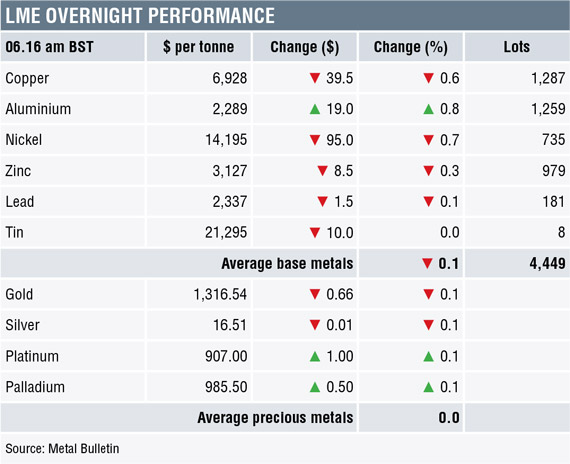

Base metals prices on the London Metal Exchange were broadly down this morning, Friday April 27, with only aluminium in positive territory – up by 0.8% at $2,289 per tonne. The rest were all lower by an average of 0.3%.

Volume is up from this time on Thursday, but at 4,449 lots as of 06.16 am London time is still below average.

Thursday’s trading started on a weak footing, but most of the metals ended the day in positive territory, which suggested dip buying and support are features of the market.

Precious metals prices were little changed this morning, with gold and silver prices off by 0.1% – with the former at $1,316.54 per oz. Meanwhile, the platinum group metals were both up by 0.1%.

This follows a mixed performance for the precious complex on Thursday when gold, silver and platinum prices were weaker, while palladium prices climbed by 1.2%.

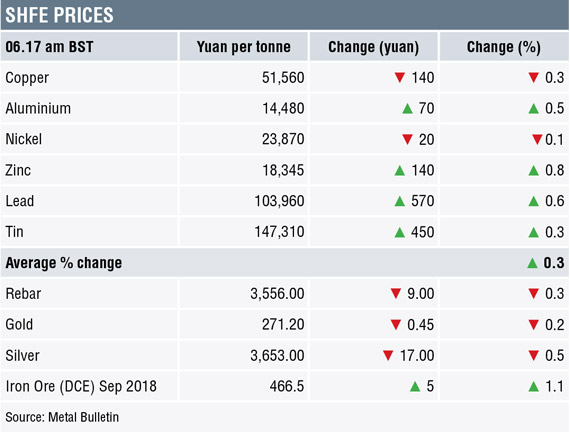

On the Shanghai Futures Exchange this morning, zinc and copper prices were off by 0.1% and 0.3% respectively, with the latter at 51,560 yuan ($8,144) per tonne, while the rest of the complex saw gains of between 0.3% for tin prices and 0.8% for lead prices.

Spot copper prices in Changjiang were off by 0.3% at 51,560-51,710 yuan per tonne and the LME/Shanghai copper arbitrage ratio had firmed to 7.44 from 7.42 on Thursday.

In wider markets, spot Brent crude oil prices were weaker, with prices off by 0.29% at $74.47 per barrel and the yield on US 10-year treasuries had dipped back below 3% at 2.97%, with the German 10-year bund yield also easier at 0.59%.

Equity markets in Asia were generally stronger on Friday with the Nikkei (+0.53%), Kospi (+0.75%), ASX 200 (+0.58%), Hang Seng (+0.37%) all up, while the CSI 300 is weaker by 0.85%. This follows a stronger performance in western markets, where in the United States the Dow Jones closed up by 0.99% at 24,322.34, and in Europe where the Euro Stoxx 50 closed up by 0.58% at 3,506.03. The meeting between North and South Korea and the dip in the US treasury yield below 3%, seemed to provide some support.

The dollar index remained firm at 91.56, whether it will continue to trend higher remains to be seen now that the yield is back below 3%. For now, while the dollar remains strong, the other major currencies remain on a back footing: euro (1.2109), yen (109.26), sterling (1.3925) and the Australian dollar (0.7547). The yuan was also weaker at 6.3335, but the recent weakness across the emerging market currencies we follow appears to have halted for now.

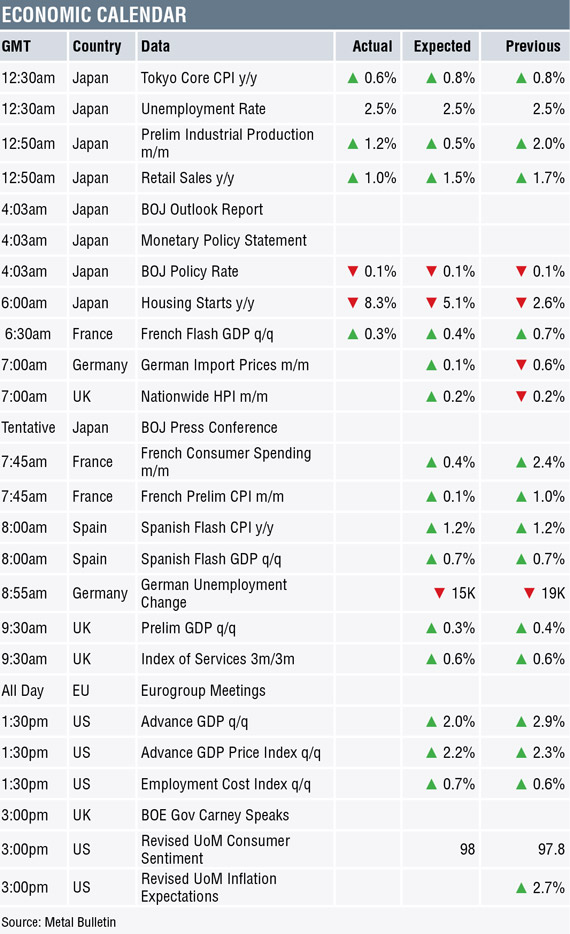

The economic agenda is busy today – data already out in Japan is showing weakness with the consumer price index (CPI) dipping to 0.6% from 0.8%, the unemployment rate holding at 2.5%, industrial production easing to 1.2% from 2%, retail sales falling to 1% from 1.7% and housing starts falling 8.3% after a 2.6% drop previously.

Data out later includes German data on import prices and unemployment; French data on gross domestic product (GDP), consumer spending and CPI; Spanish data on CPI and GDP; UK data on GDP and index of services as well as US data which includes GDP, employment cost index, and revised University of Michigan consumer confidence and inflation expectations. In addition, there is a Eurogroup meeting and Bank of England governor Mark Carney is speaking.

Volatility in aluminium and nickel continues as sanction concerns remain, while zinc prices have become volatile on the back of recent large stock inflows. The rest of the metals seem to be content consolidating. With economic data pointing to softer growth, consumers probably feel in no need to be too active, while lack of upside price progress is likely to be leading to stale long liquidation.

On balance, while the shifting stance on sanctions is likely to keep aluminium, nickel and palladium prices on edge, we expect the other metals to remain rangebound, with a possible downward bias, although we are not bearish per se.

Precious metals are on a back footing, talks between North and South Korea have potential to make the world a safer place, although that could change if the US pulls out of the Iran nuclear deal. A firmer dollar is also a headwind for gold prices. For now, the path of least resistance for the precious metals seems to be to the downside.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW 27/04: Metals prices continue to see volatility appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News