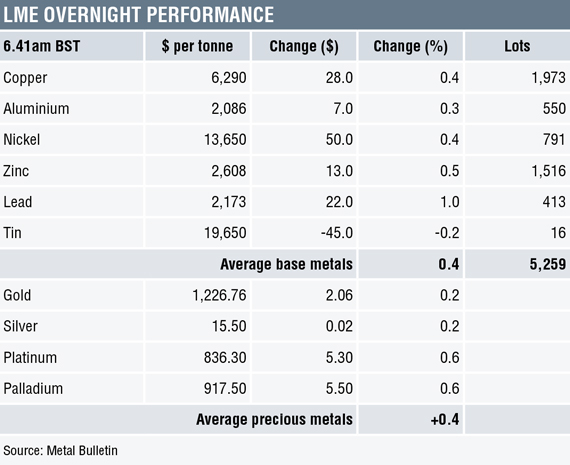

Three-month base metals prices on the London Metal Exchange were for the most part firmer on the morning of Wednesday July 25, with the complex up by an average of 0.4%. Tin (-0.2%) was the only metal showing a loss. Lead prices (+1%) led the advance, while copper prices rose by 0.4% to $6,290 per tonne.

Volume has, however, been average – some 5,259 lots had traded across the complex as at 6.41am London time.

The combination of some fresh stimulus from China with better flash manufacturing purchasing managers’ index (PMI) data out of Europe and the United States boosted sentiment on Tuesday, and that led to a rebound that saw the complex close up by an average of 1.4% – led by a 2.2% rebound in copper, that had at one stage been up by 3.3%.

The precious metals prices were also firmer on Wednesday morning with bullion prices up by 0.2% and the platinum group metal prices up by 0.6%. This follows gains in silver and platinum prices of 0.6% and 0.2% respectively on Tuesday.

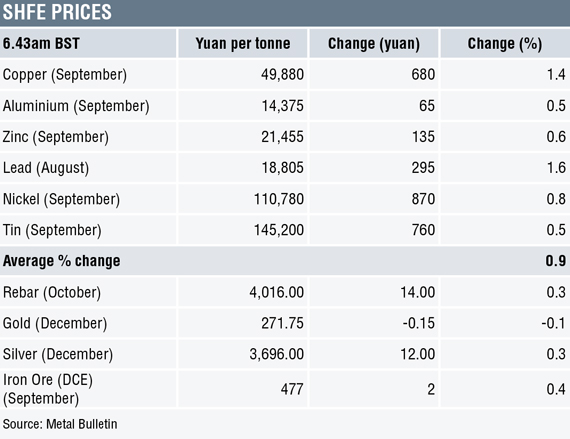

In China, base metals prices on the Shanghai Futures Exchange were up across the board with gains averaging 0.9%. As on the LME, lead was the outperformer with a 1.6% gain, while the most-actively traded September copper contract price increased by 1.4% to 49,880 yuan ($7,348) per tonne.

Spot copper prices in Changjiang were up by 1.3% at 49,740-49,880 yuan per tonne and the LME/Shanghai copper arbitrage ratio has eased to 7.94, from 8.03 on Tuesday.

In other metals in China, the September iron ore contract on the Dalian Commodity Exchange was up by 0.4% at 477 yuan per tonne. On the SHFE, the October steel rebar contract was up by 0.3%, the December gold was down by 0.1% and the December silver was up by 0.3%.

In wider markets, spot Brent crude oil prices were up by 0.29% at $73.93 per barrel this morning. The yield on US 10-year treasuries was weaker at 2.9383%, while the German 10-year bund yield was also weaker at 0.3947%.

Asian equity markets were mixed on Wednesday: Nikkei (+0.41%), Hang Seng (+0.64%), CSI 300 (-0.16%), Kospi (-0.35%) and the ASX200 (-0.35%), which shows some consolidation after strong initial gains following Tuesday’s Chinese stimulus boost. This follows a strong performance in western markets on Tuesday; in the United States, the Dow Jones closed up by 0.79% at 25,241.94, while in Europe the Euro Stoxx 50 closed up by 0.85% at 3,483.31.

The dollar index at 94.58 is consolidating after July 20’s weakness when it dropped from the previous day’s high of 95.66. Sterling is firmer at 1.3151, while the rest are consolidating with the Australian dollar at 0.7398, the euro at 1.1684 and the yen 111.19.

The yuan set a low at 6.8245 on Tuesday – it was recently quoted at 6.7869, while the other emerging market currencies we follow are also firmer, which may well indicate a return to risk-on.

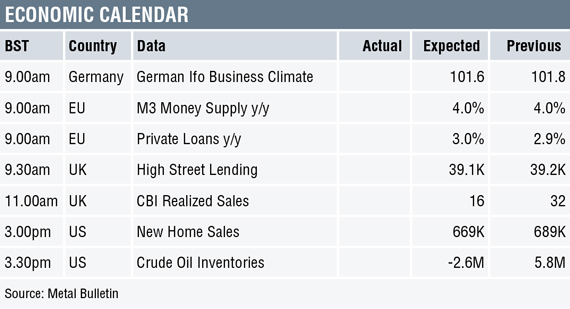

On the economic agenda, there is data on German Ifo business climate, the European Union’s money supply and private loans as well as UK data on high street lending and realized sales. US data out later includes new home sales and crude oil inventories.

We said on Tuesday that base metals prices have been trading sideways in recent days, often within the previous day’s range, which suggests consolidation. This pause is often a precursor to a bigger move. We saw that unfold on Tuesday, so now the big question is whether there will be follow-through buying, or will the move turn out to be another “dead cat bounce”?

Given the extent of the sell-off since the June highs we feel the metals are looking oversold and the better flash PMI data, combined with China’s move to support its economy in this tricky trade war environment, bodes well. That said, any rebound may well be volatile as US President Donald Trump fights his trade war via Twitter.

Underlying tails on the spot gold price chart suggest dip-buying was present on July 19 and 20 but there was little follow-through buying on Monday and Tuesday. We wait to see if more emerges.

Silver is following gold’s lead, while platinum and palladium seem to be catching the same tailwind that is pushing the base metals.

The post METALS MORNING VIEW 25/07: Metals generally firmer following Tuesday’s gains appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News