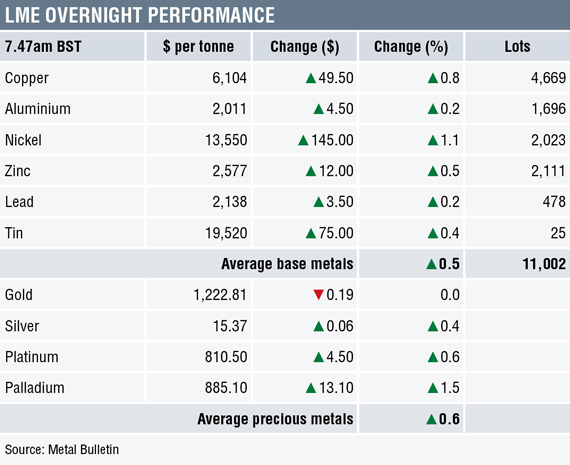

Three-month base metals prices on the London Metal Exchange were up across the board by an average of 0.5% on the morning of Friday July 20. Gains were ranged between 0.2% for aluminium and lead and 1.1% for nickel, with copper up by 0.8% at $6,104 per tonne.

Volume has been above average with 11,002 lots traded across the complex as at 7.47am London time.

This follows an extremely weak performance by the LME base metals on Thursday, when at their lows prices were down by an average of 3.1%, led by a 4.8% drop in zinc prices. They ended the day being down by an average of 1.6%, with copper setting a low of $5,988 per tonne.

Gold prices were little changed at $1,222.81 per tonne this morning, while the more industrial precious metals were firmer by an average of 0.8%. This follows from Thursday’s losses that averaged 1.7%, led by a 3.8% fall in palladium prices.

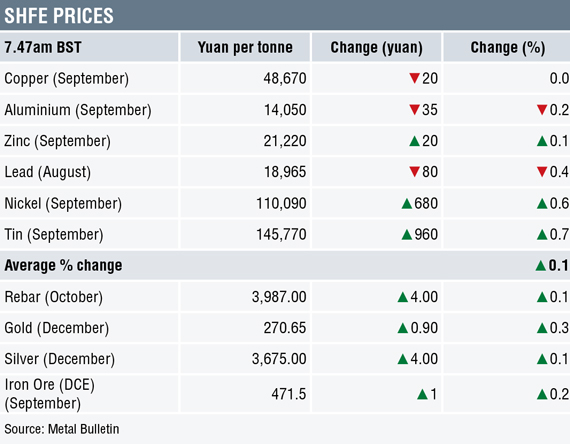

In China, base metals prices on the Shanghai Futures Exchange were mixed, with copper, aluminium and lead prices off between being slightly lower for copper and 0.4% for lead prices, with the most-actively traded September copper contract at 48,670 yuan ($7,195) per tonne.

Interestingly spot copper prices in Changjiang were up down by 1.1% at 48,180-48,340 yuan per tonne, which highlights how prices were lower in the morning when spot copper prices were set, with the futures since rebounding. The LME/Shanghai copper arbitrage ratio has strengthened to 7.97 from 7.83 on Thursday, suggesting SHFE copper prices have held up relatively better than LME prices.

In other metals in China, the September iron ore contract on the Dalian Commodity Exchange was up by 0.2% at 471.50 yuan per tonne. Meanwhile on the SHFE, the October steel rebar contract was up by 0.1%, the December gold was up by 0.3% and the December silver was up by 0.1%.

In wider markets, spot Brent crude oil prices were up by 0.57% at $72.92 per barrel this morning and the yield on US 10-year treasuries was weaker at 2.8426%, while the German 10-year bund yield was stronger at 0.3160%.

Asian equity markets were generally firmer on Friday, the exception being the Nikkei (-0.29%) as the yen strengthened: Hang Seng (0.61%), CSI 300 (1.82%), the Kospi (0.30%) and the ASX200 (0.37%). This follows a weaker performance in western markets on Thursday, where in the United States the Dow Jones closed down by 0.53% at 25,064.50, and in Europe where the Euro Stoxx 50 closed down by 0.39% at 3,471.64.

The dollar index is consolidating after Thursday’s strength that saw it reach 95.66, which breached the double high seen in the second half of June at 95.54 – it was recently quoted at 95.15. This has led to consolidation in the euro at 1.1644 and the Australian dollar at 0.7362, while sterling is weaker at 1.3007and the yen is firmer at 112.38.

The yuan weakened to a low of 6.8105 earlier today before rebounding to 6.7723 and there are reports that China’s central bank may be intervening. Most of the other emerging market currencies we follow are on a back foot, the exception is the real that is getting some lift off recent low ground.

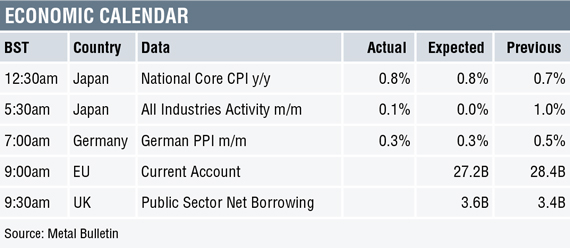

On the economic agenda, Japan’s consumer price index (CPI) edged higher by 0.8%, from 0.7% previously, while the country’s all industries activity climbed 0.1%, having previously been up 1%. Germany’s producer price index (PPI) climbed 0.3%, after a 0.5% gain. Later there is data on the European Union’s current account and on the United Kingdom’s public sector borrowing requirement.

After Thursday’s slump, the base metals prices are having another go at rebounding, as they did on Wednesday. With two attempted rebounds in three days, it suggests bargain hunting is emerging – whether this turns into another “dead-cat bounce” remains to be seen. But, with copper prices having retreated 18.5% since the June high, it may be that the sell-off has run its course for now, even if the US trade war has not finished yet. If there is follow-through buying then short-covering could lead to some sharp rebounds.

Underlying tails on the spot gold price chart suggests dip buying was around on Thursday and earlier this morning. Given the precious metals have sold off along with the industrial metals, then a rising tide may well lift all boats/metals. If gold price do find a base then these low price levels may well mean gold starts to be seen now as a relatively cheap haven asset next time one is needed.

The post METALS MORNING VIEW 20/07: Second rebound attempt in three days for metals appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News