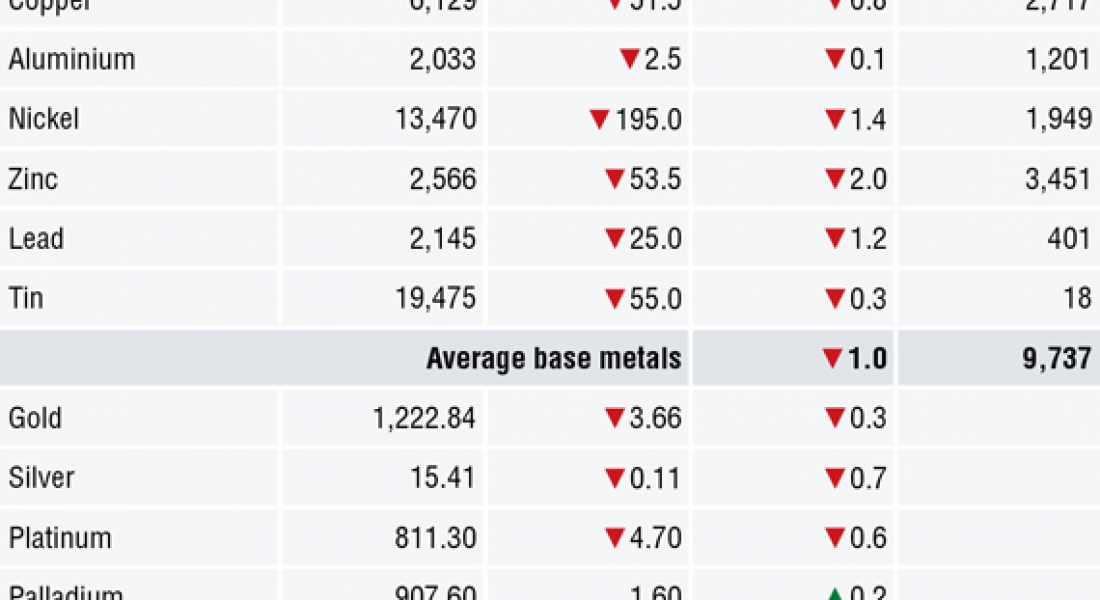

Three-month base metals prices on the London Metal Exchange were down across the board by an average of 1% on the morning of Thursday July 19. Losses were ranged between a 0.1% drop for aluminium and a 2% fall for zinc. The three-month copper price was down by 0.8% at $6,129 per tonne.

Volume has been above average with 9,737 lots traded across the complex as at 7.22am London time.

This follows a generally stronger performance by the LME base metals on Wednesday, when the majority of the complex ended the day higher. The exception was lead which closed down by 0.2%, while the rest were up by an average of 1.2% – led by a 4.4% rebound in zinc.

Gold, silver and platinum prices were weaker again this morning, down between 0.3% for spot gold ($1,222.84 per oz) and 0.7% for silver, while palladium was up by 0.2%.

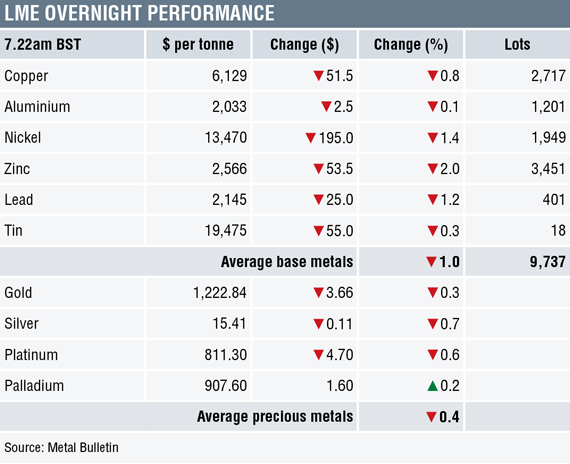

In China, base metals prices on the Shanghai Futures Exchange were up across the board as they took their cue from Wednesday’s LME direction. September zinc led the way with a 3.9% rally, while the most-actively traded September copper contract was up by 0.4% at 48,700 yuan ($7,249) per tonne.

In other metals in China, the September iron ore contract on the Dalian Commodity Exchange was up by 0.6% at 469 yuan per tonne. Meanwhile on the SHFE, the October steel rebar contract was up by 1.3%, the December gold was up by 0.1% and the December silver was down by 0.2%.

Spot copper prices in Changjiang were up by 0.7% at 48,690-48,940 yuan per tonne and the LME/Shanghai copper arbitrage ratio was weaker at 7.83.

In wider markets, spot Brent crude oil prices were down by 0.51% at $72.68 per barrel this morning and the yield on US 10-year treasuries was firmer at 2.8840%. The German 10-year bund yield was weaker at 0.2880%.

Asian equity markets were generally down on Thursday: Nikkei (-0.13%), Hang Seng (-0.26%), CSI 300 (-0.17%), the Kospi (-0.34%), while the ASX200 ticked up by 0.28%. This follows a stronger performance in western markets on Wednesday, where in the United States the Dow Jones closed up by 0.32% at 25,199.29, and in Europe where the Euro Stoxx 50 closed up by 0.80% at 3,485.08.

The dollar index is climbing again and was recently quoted at 95.19, this after a recent low of 93.71. We now wait to see if this rally clears the double high seen in the second half of June at 95.54. With the dollar stronger, the major currencies are weaker: euro (1.1625), sterling (1.3050) and the yen (112.80), while the Australian dollar is consolidating at 0.7400.

The yuan has resumed its sell-off and was recently quoted at 6.7454, the weakest it has been since July last year and is down some 7.5% from the highs seen in March this year. The other emerging market currencies we follow are either extending losses (ringgit), consolidating in low ground (real and rupiah) or are starting to give back recent gains (peso and rand).

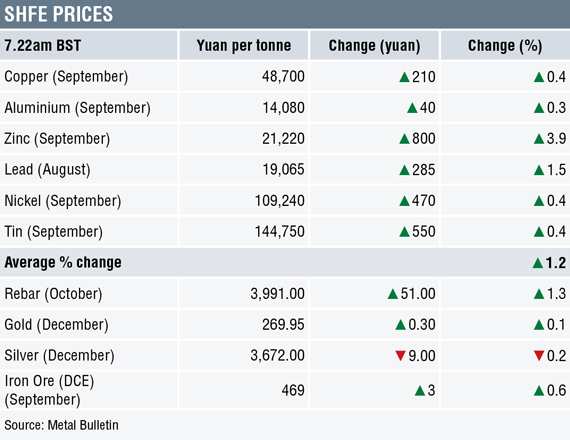

On the economic agenda, Japan’s trade balance returned to a surplus after two months of being in a deficit. Data out later includes the UK’s retail sales and US releases including the Philadelphia Fed Manufacturing Index for July, initial jobless claims, leading indicators and natural gas storage.

The base metals attempted to rebound on Wednesday, but it was a dead cat bounce as this morning the metals are in negative territory and copper has extended its lows to levels last seen in July last year. Aluminium and lead prices are also extending lower, while the others are for now still above recent lows. The trends on the chart are firmly to the downside and the main driver seems to be the US trade war, with the firmer dollar not helping matters.

Gold prices are also extending on the downside and are the lowest since last July. The same is true for silver and palladium prices, which are extending recent lows, while platinum prices are the lowest since 2008.

With the base metals and industrial precious metals all falling and gold prices also declining, this is a clear sign of deleveraging on the back of concerns that trade wars will impact manufacturing and industrial production. We saw some bargain hunting on Wednesday, but selling has dominated into the rebound, but the fact there was buying suggests some traders are beginning to think the metals are starting to look oversold.

The post METALS MORNING VIEW 19/07: ‘Dead cat bounce’ after Wednesday’s rebound in metals prices stalls appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News