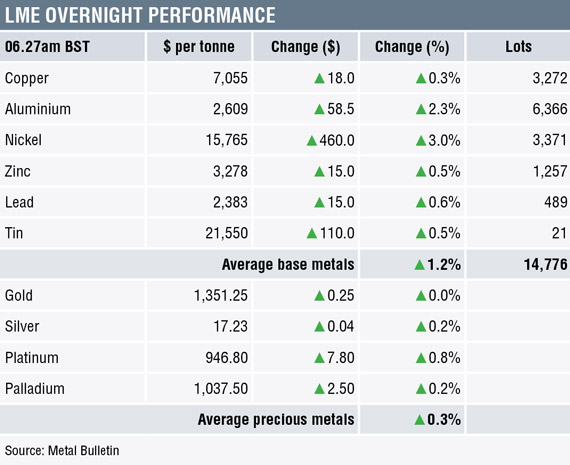

After the eventful rally on Wednesday April 18, both the base and precious metals prices have continued their upward momentum this morning. Broad-based commodity rally has supported all metals prices higher, with an average gain of 1.2% in base and a 0.3% rise in precious as of 06:27 London time.

Trading volume on the London Metal Exchange is significantly higher than previous day, with 14,776 lots already traded at the time of writing. The high trading volume indicate an active market that are supporting the current bullish trend.

The LME three-month nickel price is up 3% followed by sanctions-hit aluminium at 2.3%, while the rest of its peers are up 0.5% this morning. Aluminium prices continue to rise and remain well bid amid on-going concern over a supply crunch due to US sanctions against Russian aluminium producer Rusal. But nickel on the other hand, has outshined the light metal after the price surged 6.9% on Wednesday April 18 amid sanction hysteria. The metal has been subjected to panic buying and wild (potentially baseless) speculation that fresh US sanction is imminent against Norilsk which is partially owned by Russian tycoon Oleg Deripaska.

Palladium is on the same page, with a sharp U-turn from April 6 low at $897 per oz and it is now trading comfortably at $1,037.50 per oz, up 0.2% this morning. The bullish vibe runs in platinum too, up 0.8% while gold is unchanged at $1,351.25 per oz and silver traded higher, perhaps on short-covering rally towards $17.23 per oz. The weak dollar index has languished at 89.60 for a while and provided the metals complex with sufficient tailwind to continue higher.

In other currencies, the Euro and Sterling are down 0.1% while the Japanese yen weakened to 107.21 as geo-political tensions eased between the US and Russia over the alleged chemical attack in Syria. Currencies in developing economies such as Brazilian real, Indonesian rupiah and South African rand are a touch higher too as outlook on trade friction between the US and China has lightened up.

Similarly, with the outlook and prospect of an improved macro-economic backdrop, this has fuelled global equity market higher. Both the European and US equity indexes secured gains, with the UK FTSE 100 up 1.26% while US S&P500 gained 0.08% and settled above 2,700 points yesterday. In the early Asian trading session, the Hang Seng lead the rest of its peers after it rose 0.98%, ASX 200 up 0.33% and Nikkei gained 0.15%.

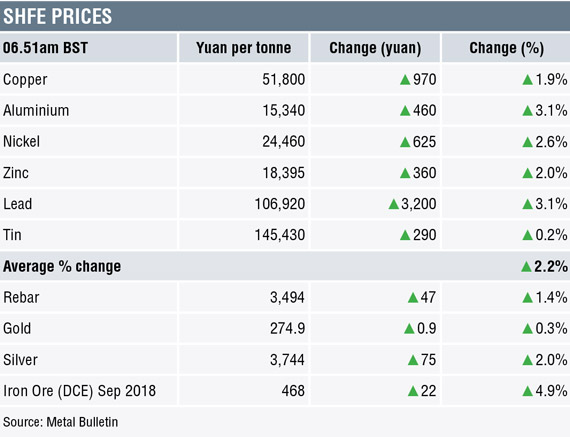

Metals prices on the Shanghai Futures Exchange made strong gains, with the base metals prices up an average 2.2%. Leading the gains are nickel and aluminium at 3.1%, followed by zinc and lead at 2.6% and 2% while copper managed to rise by 1.9% and tin, struggled to replicate similar gains, is up a modest 0.2%. The positive Q 1 Chinese GDP number, strong retail sales and the surprise cut by China central bank in bank reserve ratio requirements have fuelled metals demand. Rebar prices on the SHFE has also risen strongly, up 1.4% at 3,494 rmb. On other metals, September 2018 iron ore contract rose 4.9% and currently trade at 468 rmb.

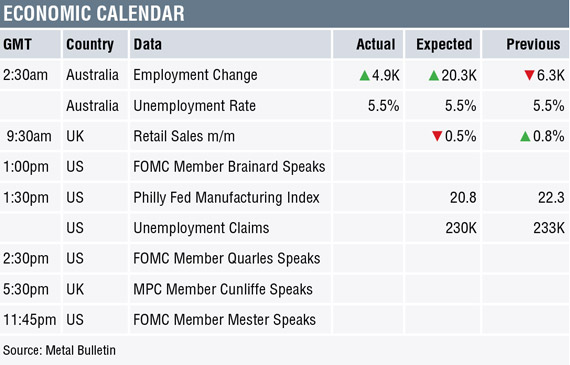

Economic data overnight is light, with employment numbers from Australia coming below market consensus but overall unemployment rate is stable at 5.5%. Later today, market focus will turn to UK retail sales, US Philly Fed manufacturing index and unemployment claims. Several Fed members are due to speak, with Brainard, Quarles and Mester.

The sharp swing higher in aluminium and nickel prices are dragging the rest of the base metals higher too. Recent economic data from both China and the US remained robust, which suggest that the health of the global economy is truly well and expanding on the back of a co-ordinated concerted growth. This has supported risk appetite and drown out previous uncertainties such as trade frictions and geo-political tensions in the Middle-East as mere market noises. Even though we continue to see higher prices, the current rally in both aluminium and nickel could get volatile and vulnerable to bouts of profit taking.

Precious metals prices should continue to consolidate higher, with silver the preferred choice among risk-averse investors. This is evident as the gold/silver ratio declined to 78.28 from April high at 82.55. Meanwhile, the PGMs are holding up well and continue to benefit from the broad-based commodity rally.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW 19/04: Metal prices higher on broad-based commodity rally appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News