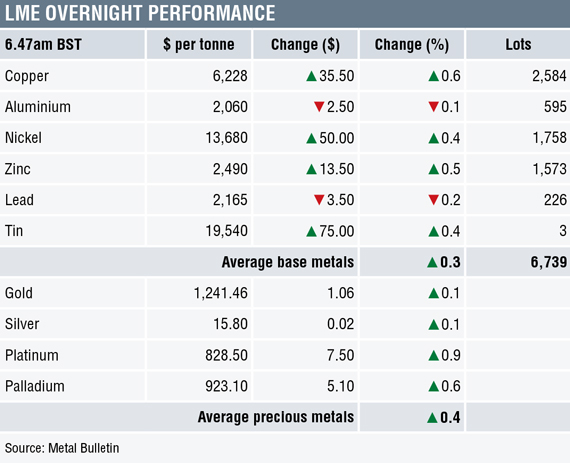

Gold and silver prices were both up by 0.1% this morning, while platinum and palladium prices were up by 0.9% and 0.6% respectively. Gold and silver prices were little changed on Monday, platinum prices closed down by 0.6% and palladium prices dropped by 2%.

Gold prices are only just managing to stay above water having retested support on July 13, with prices breaching the early July support at $1,237.95 per oz to establish a fresh low at $1,236.85 per oz, but that was still just above the December low at $1,236.55 per oz. Given so much uncertainty over US trade policy and the possible contagion from that, it is surprising gold is not more sought after as a haven asset. Silver and the platinum group metals are following gold’s lead and all are looking vulnerable, even palladium, which has the strongest fundamentals of them all.

With the yen and gold in retreat, it does seem as though the main haven asset is the US treasury market – at these low gold prices, gold could look a more attractive haven asset again, especially if the China/US trade war prompts China to reduce its buying, or even sell, US treasuries.

Three-month base metals prices on the London Metal Exchange were mixed during morning trading on Tuesday July 17, with aluminium and lead prices down 0.1% and 0.2% respectively, while the rest of the metals were up between 0.4% for nickel and tin and 0.6% for copper. The three-month copper price recently was quoted at $6,228 per tonne.

For now, copper, aluminium and tin prices are consolidating off their recent lows, while the rest are at or near their lows and are still peering lower.

Volume has been average with 6,739 lots traded across the complex as at 6.47am London time.

This follows a generally weak performance on Monday, when apart from aluminium that closed up by 1.3%, the rest of the complex closed down by an average of 2.1% – led by a 4.2% fall in zinc.

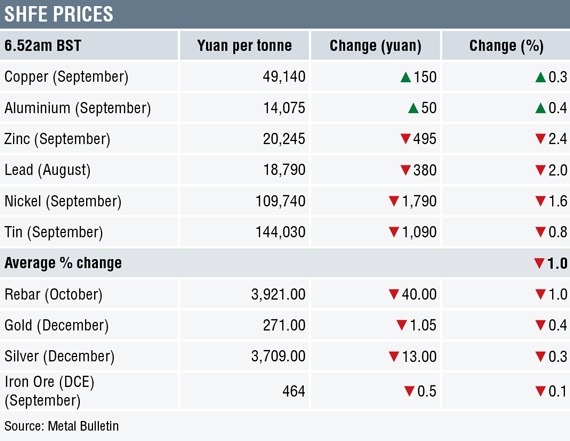

In China, base metals prices on the Shanghai Futures Exchange were split, with copper and aluminium prices up by 0.3% and 0.4% respectively, with the most-actively traded September copper contract recently quoted at 49,140 yuan ($7,345) per tonne, while the rest were weaker. Zinc led on the downside with a 2.4% drop, followed by a 2% fall in lead, a 1.6% decline in nickel and a 0.8% drop in tin.

In other metals in China, the September iron ore contract on the Dalian Commodity Exchange was off by 0.1% at 464 yuan per tonne. Meanwhile on the SHFE, the October steel rebar contract was down by 1%, the December gold was off by 0.4% and the December silver was down by 0.3%.

Spot copper prices in Changjiang were down by 0.2% at 48,660-48,860 yuan per tonne and the LME/Shanghai copper arbitrage ratio was stronger at 7.90 after 7.89 on Monday.

In wider markets, spot Brent crude oil prices were down by 0.15% at $71.69 per barrel this morning, this after another heavy down day on Monday, led by hopes Libya’s oil ports will reopen. The yield on US 10-year treasuries was firmer at 2.8641%, as were the German 10-year bund yield at 0.3050%.

Asian equity markets were broadly down on Tuesday: Nikkei (+0.61%), Hang Seng (-1.32%), CSI 300 (-1.45%), the Kospi (-0.16%) and the ASX200 (-0.61%). This follows a mixed performance in western markets on Monday, where in the United States the Dow Jones closed up by 0.18% at 25,064.36, and in Europe where the Euro Stoxx 50 closed down by 0.16% at 3,449.08.

The dollar index was weaker at 94.39, with last week’s rally stalling – suggesting the double high in the second half of June at 95.54 still dominates. This has provided some lift for the euro (1.1731), sterling (1.3252) and the Australian dollar (0.7431), while it has halted the latest sell-off in the yen (112.36).

The yuan is holding in low ground at 6.6809 – the recent low being 6.7167. For now, the other emerging market currencies we follow are diverging with the peso and rand strengthening, while the real, the rupiah and ringgit are holding in low ground.

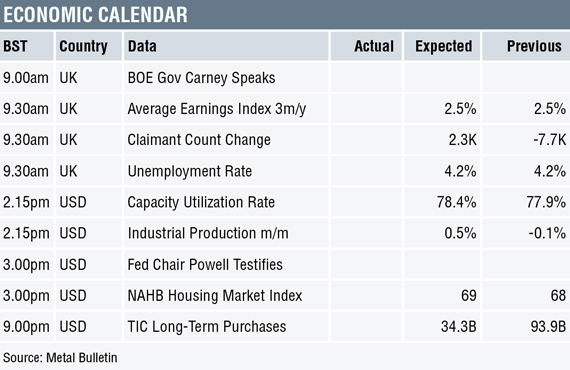

On the economic agenda, we have UK employment data and US releases that include industrial production, capacity utilization, the National Association of Home Builders index and Treasury International Capital long-term purchases. In addition, Bank of England governor Mark Carney and US Federal Reserve chair Jerome Powell are speaking.

The metals remain in a falling knife configuration with the summer lull, uncertainty over how extended the trade wars with the US will be and slower economic growth all weighing on sentiment. With the dollar’s latest rise reversing, a weaker dollar may encourage some bargain hunting, but key would then be whether there is follow-through buying – given prices have fallen 17% since the June high some buyers may be tempted. In this environment, however, traders are likely to stay on the sidelines for as long as they can, but it may be they are destocking and buying hand-to-mouth, which is likely to be followed at some time by restocking.

The post METALS MORNING VIEW 17/07: Metals prices begin to perk up after mixed start in Asia appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News