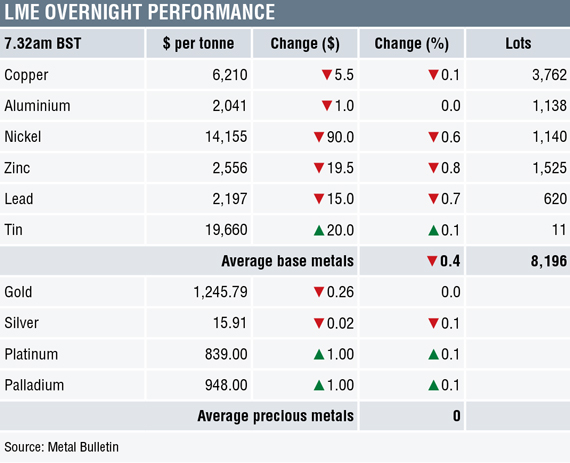

Base metals markets remain jittery following continued rhetoric from US President Donald Trump over trade. Three-month prices on the London Metal Exchange were down by an average of 0.4% as at 7.32am London time on Friday July 13, with copper prices off by 0.1% at $6,210 per tonne.

This follows a general day of consolidation and recovery on Thursday when the complex closed with gains averaging 0.8%.

From the June highs to the recent lows, the base metals have fallen by an average of 15.6%, ranged between a 22.3% decline in zinc prices and a 9.8% drop in tin prices. Copper prices fell by 17.2%.

The precious metals prices were little changed this morning while they consolidate after a 0.9% rebound on Thursday – spot gold prices were recently quoted at $1,245.79 per oz. From the June highs, precious metals prices have fallen by an average of 9.2%, ranged between 5.5% for gold prices and 12.7% for platinum prices.

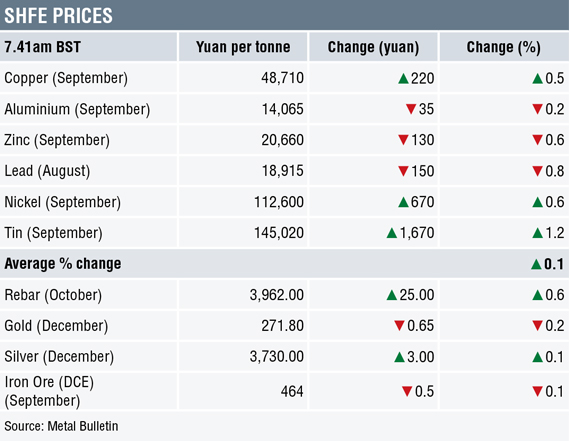

In China, the base metals on the Shanghai Futures Exchange were mixed, with copper, nickel and tin prices up by 0.5%, 0.6% and 1.2%, respectively, while lead, zinc and aluminium prices were down by 0.8%, 0.6% and 0.2% respectively. The most-actively traded September copper contract was recently quoted at 48,710 yuan ($7,295) per tonne.

In other metals in China, the September iron ore contract on the Dalian Commodity Exchange was down by 0.1% at 464 yuan per tonne. Meanwhile on the SHFE, the October steel rebar contract was up by 0.6%, the December gold was down by 0.2% and the December silver was up by 0.1%.

Spot copper prices in Changjiang were up by 0.3% at 48,500-48,650 yuan per tonne and the LME/Shanghai copper arbitrage ratio was at 7.85.

In wider markets, spot Brent crude oil prices were down by 0.59% at $74.00 per barrel this morning. The yield on US 10-year treasuries, recently quoted at 2.8535%, has started to firm, while the German 10-year bund yield continues to weaken at 0.2930%.

While the metals were still nervous, Asian equity markets were firmer on Friday: Nikkei (+1.85%), Hang Seng (+0.28%), CSI 300 (+0.37%), the Kospi (1.13%) and the ASX200 (unchanged). This follows a stronger performance in western markets on Thursday, where in the United States the Dow Jones closed up by 0.91% at 24,924.89, and in Europe where the Euro Stoxx 50 closed up by 0.68% at 3,445.49.

The dollar index, at 95.02, was climbing again – the recent high being the double high in the second half of June at 95.54. As the dollar rebounds, most of the major currencies are retreating: euro (1.1640), sterling (1.3150) and yen (112.67), while the Australian dollar (0.7399) is consolidating.

The yuan is holding in low ground at 6.6715, the recent low being 6.7167. For now, the other emerging market currencies we follow are holding in low ground too, although the Mexican peso is consolidating well up from recent lows.

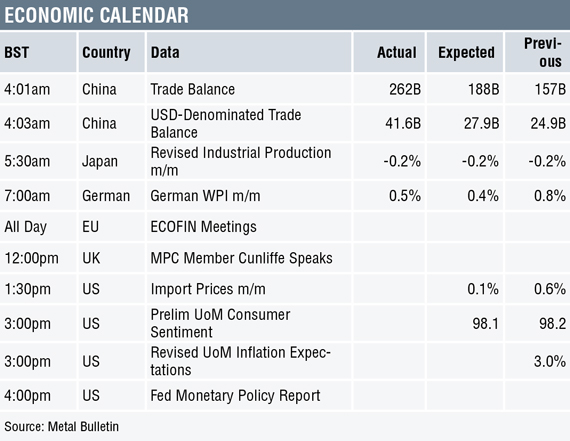

Economic data already out this morning shows China’s exports rose 11.3% and imports increased 14.1%, both figures were less than expected, which suggests slower global economic activity. Japan’s revised industrial production remained unchanged with a 0.2% decline and Germany’s wholesale price index was up 0.5%, after a 0.8% rise previously.

Data out later includes US import prices, preliminary University of Michigan consumer sentiment and inflation expectations, a US Federal monetary policy report and UK Monetary Policy Committee member Sir Jon Cunliffe is speaking.

While the trade wars pan out, there is unlikely to be much confidence in the metals markets but now that prices have fallen significantly, underlying global growth may well support sideways prices until the fundamentals start to change.

On the bearish side, a fall-off in trade may well dampen demand, while on the bullish side, the overall lower levels of capital expenditure by producers over the past five years are likely to lead to supply tightness in many of the metals.

The precious metals prices remain under pressure, no doubt as the dollar has started to climb again. Key support for spot gold lies around $1,236 per oz. we wait to see whether these lower gold prices now make gold more interesting as a haven asset in these troubled times.

The post METALS MORNING VIEW 13/07: Metals struggle to find support appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News