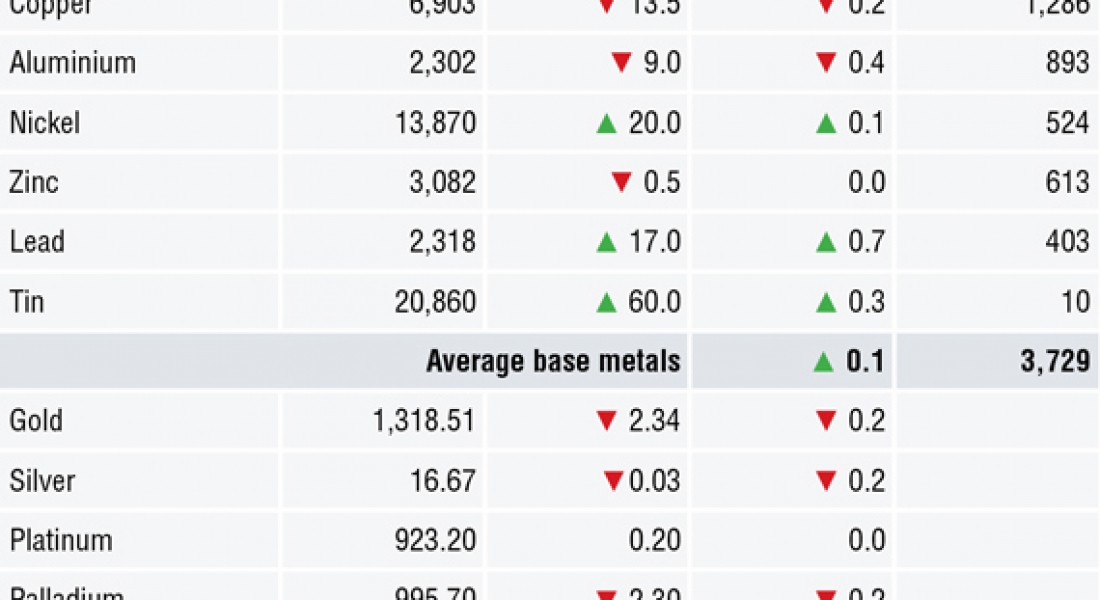

Base metals price performance was a mix bag this morning, with a small average gain of 0.1% as of London time 06:42 am.

The London Metal Exchange three-month copper and aluminium price were down (-0.2%) and (-0.4%) respectively while the rest of its peers managed to eke out gains. At the time of writing, LME lead outperformed with a strong gain of (+0.7%) followed by tin with (+0.3%) while nickel and zinc were almost unchanged.

But with a total trading volume at 3,729 lots, below the weekly average of 5,540 lots, this suggests a very quiet market as metals prices consolidates ahead of the annual LME Asia Week gathering in Hong Kong.

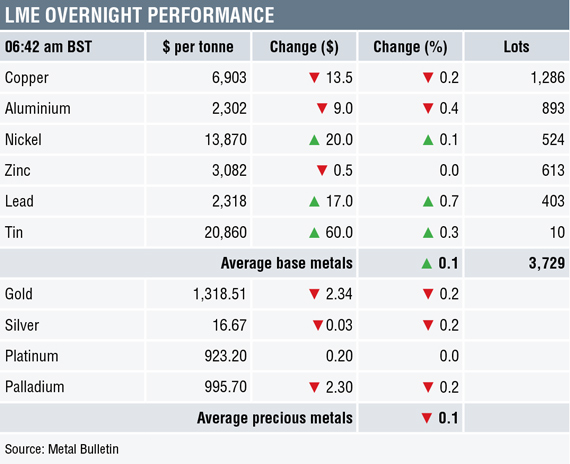

Meanwhile, both zinc and tin prices in the Shanghai Futures Exchange (SHFE) bucked the trend this morning, with a decline of (-0.3%) and (-0.2%) respectively. That said, the SHFE complex was up 0.3% on average, with lead, copper and aluminium securing gains. Steel rebar prices on the SHFE were up 2% at 3,666 yuan per tonne while gold and silver prices were up 0.1% and 0.5% respectively.

In other metals, Iron ore prices rose 3.1% at 484 yuan per tonne on the Dalian Commodity Exchange.

President Trump’s decision to opt out of the Iran nuclear deal was overshadowed by military actions between Iran-Israel forces in Syria. The fresh geo-political tensions in the Middle-East and a slightly weaker dollar index due to softer US inflation number, have supported both gold and silver prices higher on Thursday May 10. Similarly, the platinum groups of metals (PGMs) prices were consolidating near recent high, with platinum trading at $923.20 per oz and palladium at $995.70 per oz respectively.

Furthermore, a supply concern in the oil market has kept the spot Brent crude oil prices near recent high at $77.29 per barrel.

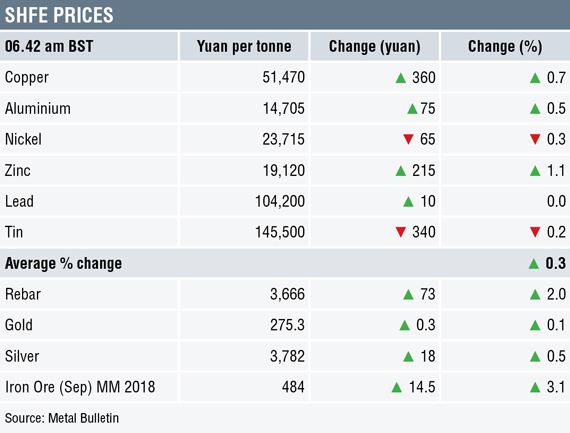

The economic agenda is rather light today, with overnight data out of Japan’s M2 money stock at 3.3%, above market expectation of 3.2% and better than previous reading of 3.1% and a poor month-on-month reading on Australia home loans data. Market focus will turn to Canadian unemployment rate, US import prices as well as preliminary UoM consumer sentiment and inflation expectations. ECB president Draghi is set to speak in Florence later today, but it is unlikely to be a market-moving speech.

Despite a respite in the dollar index and the potential peace talk for the Korean peninsula, overall sentiment in the base metals complex remains nervous. Fresh geo-political concerns in the Middle-East, on-going trade negotiations between US and China as well as sluggish growth data from key economies continue to suppress consumers need to chase prices any higher. As global metals and mining professional convene in Hong Kong, Metal Bulletin coverage of the event may shed light into their views for the second half of 2018.

As we approach the end of the trading week, both gold and silver should remain attractive as market attention turn to Syria. Any fresh military development between the Iranian and Israel forces could easily pushed risk-averse investors into haven-buying mode. Also, previously build-up in bearish exposure from the speculative funds community is likely to come under short-covering pressure, which should support the rally in both metals.

The post METALS MORNING VIEW 11/05: Metals prices consolidate ahead of LME Asia Week appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News