Japan’s manufacturing purchasing managers’ index (PMI) for May surprised to the upside at 52.8, having been expected to remain at April’s level of 52.5, while China’s Caixin PMI came in at 51.1, which was unchanged from April’s reading. Taking into account yesterday’s better-than-expected reading on China’s official PMI, economic data may be picking up again, which could bode well for the metals.

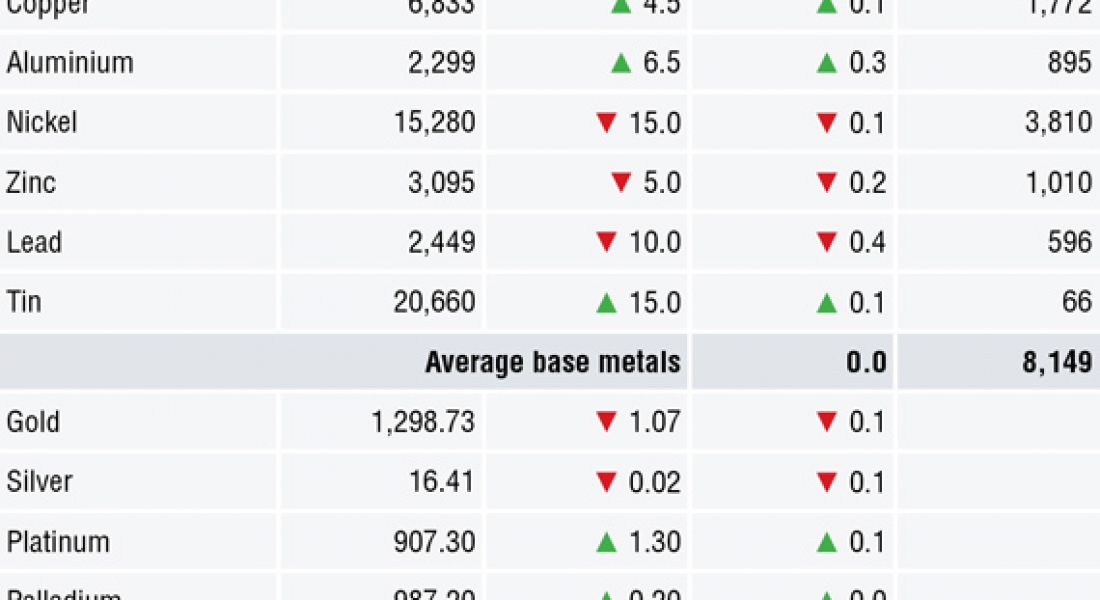

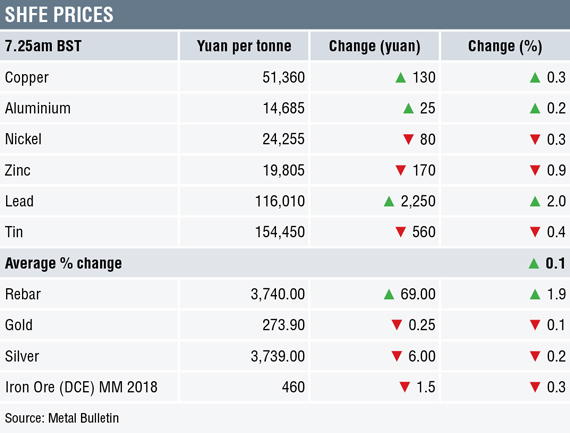

Three-month base metals prices on the London Metal Exchange were mixed on the morning of Friday June 01, with copper ($6,833 per tonne) and tin prices both up 0.1%, aluminium prices up 0.3%, while the rest were weaker: lead was down 0.4%, zinc down 0.2% and nickel down 0.1%.

Volume has been higher than average with 8,149 lots traded as at 07:20 am London time.

This follows mixed performance on Thursday that saw zinc prices close down by 1.4%, nickel prices rise by 1.5% and aluminium prices climb by 1.1%, while lead and tin prices closed up by 0.5% and 0.4%, respectively and copper prices closed off by 0.2%.

The precious metals this morning were little changed, with gold prices off 0.1% at $1,298.73 per oz, which followed a generally weaker performance on Thursday that saw gold prices close down 0.2%.

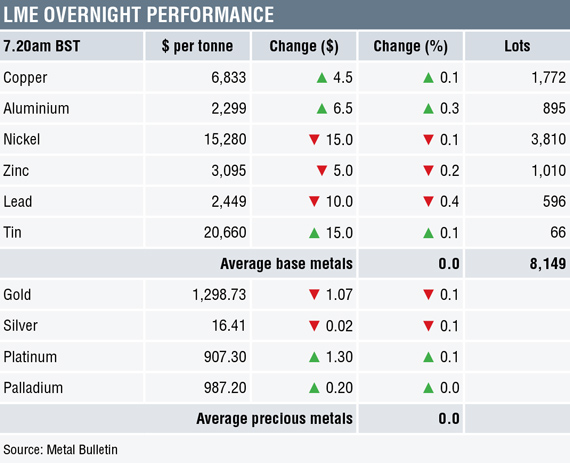

In China, base metals prices on the Shanghai Futures Exchange were diverging, with nickel prices up by 2% and lead prices down by 0.9%. Copper and aluminium prices are up by 0.3% and 0.2%, respectively, with copper at 51,360 yuan ($8,004) per tonne. Zinc and tin prices were down by 0.3% and 0.4%, respectively.

Spot copper prices in Changjiang were up by 0.3% at 51,200-51,320 yuan per tonne and the LME/Shanghai copper arbitrage ratio was unchanged at 7.50.

In other metals in China, iron ore prices were off by 0.3% at 460 yuan per tonne on the Dalian Commodity Exchange, while on the SHFE, steel rebar prices were up by 1.9%, while gold and silver prices were down by 0.1% and 0.2%, respectively. The fact that steel rebar and nickel prices are up around 2% seems odd given the United States has widened the number of countries that will be affected by steel import tariffs.

In wider markets, spot Brent crude oil prices were up by 0.1% at $77.64 per barrel this morning and the yield on US 10-year treasuries was firmer at 2.8819%, as was the German 10-year bund yield at 0.384%. With Italy now able to form a government, the potential crisis has been avoided, at least for now.

Equity markets in Asia were mainly weaker on Friday with the exception of the Kospi that was up by 0.66%: the Nikkei was down by 0.14%, the Hang Seng was unchanged, the CSI 300 fell by 0.86% and the ASX 200 was down 0.36%. This follows the weaker performance in western markets on Thursday, where in the US the Dow Jones closed down by 1.02% at 24,415.84, and in Europe where the Euro Stoxx 50 closed down by 1.0% at 3,406.65. The widening of US trade tariffs has undermined market confidence.

The dollar index was little changed at 94.07, this after retreating on Wednesday to 94.09 from Tuesday’s high of 95.03. With treasury yields rebounding, the dollar may well resume its rally.

The rebounds that started to be seen in the other major currencies in recent days have halted: euro (1.1689), sterling (1.3274), the Australian dollar (0.7552) and the yen (109.17).

The yuan (6.4113) is also consolidating, as are most of the emerging currencies we follow, although the rupiah and rupee are higher.

Today’s economic agenda is busy, with further PMI data scheduled to be released across Europe and the US. In addition, there is the US employment report and data on US construction ISM manufacturing prices and total vehicle sales.

In addition, the G7 meeting continues today.

Consolidation with a mild upward bias remains in force across most of the base metals. The exception is nickel where prices spiked higher in the early hours to $15,690 per tonne, but the higher prices have since attracted selling, although the market remains upbeat. We wait to see what European and US PMI data says about the global economy, any sign of a recovery could bode well for the metals.

Gold prices are consolidating around the $1,300 per oz level, prices did not react much to the potential Italian political problems, so they should not react too negatively now that an Italian government has been formed. Markets may, however, feel more corncerned about the potential of a US trade war and that could lead to more risk-off in broader markets that might spur a pick-up in safe-haven demand that could lift gold prices.

The post METALS MORNING VIEW 01/06: Metals prices consolidating, waiting for direction from economic data appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News