FastMarkets

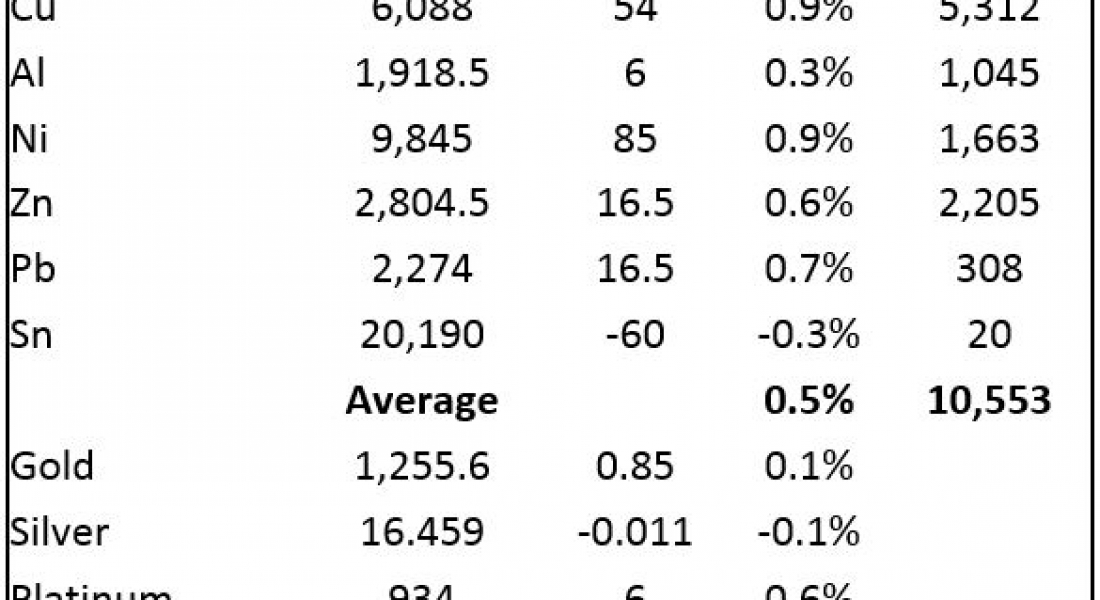

Gold and silver prices are little changed this morning, Tuesday July 25, with spot gold prices at $1,255.60 per oz and silver at $16.46 per oz, while the PGMs are looking stronger with gains of 0.6%. This comes after a quiet day on Monday for bullion, while platinum prices dropped 0.5% and palladium prices gained 0.7%.

Base metals prices on the London Metal Exchange are up by an average of 0.5% this morning. Tin is once again bucking the trend with prices off 0.3% at $20,190 per tonne, while the rest have gains of between 0.3% for aluminium and 0.9% for nickel and copper, with the latter at $6,088 per tonne basis three months.

Volume has been high with 10,533 lots traded as of 06:35 BST – the combination of high volume and prices gains bodes well. This comes after a bullish day on Monday when the base metals complex closed up an average of 0.8%, with aluminium the only metal to close weaker with a 0.2% dip to $1,912.50 per tonne.

Metals prices on the Shanghai Futures Exchange (SHFE) are up across the board with gains averaging 1.1%, led by a 2.6% rise in nickel prices, with zinc prices up 1.2% and copper prices up 1.1% at 48,440 yuan ($7,176) per tonne. Spot copper prices in Changjiang are up 1.3% at 48,060-48,360 yuan per tonne and the LME/Shanghai copper arb ratio is weaker at 7.96.

In other metals in China, September iron ore prices on the Dalian Commodity Exchange are up 3.3% at 527 yuan per tonne and on the SHFE, steel rebar prices are up 1.8%, but gold and silver prices are off 0.1% and 0.2% respectively.

In international markets, spot Brent crude oil prices are up 0.5% at $48.88 per barrel, the yield on US ten-year treasuries is steady at 2.25% and the German ten-year bund yield has eased to 0.50%.

Equities were mixed on Monday with the Euro Stoxx 50 little changed and the Dow closing off 0.3% at 21,513.178. Asian markets are similarly mixed, the ASX 200 is up 0.7%, the Nikkei and Hang Seng are little changed and the CSI 300 and Kospi are off 0.5%.

The dollar index continues to fall, it was recently quoted at 93.82, the euro is strong at 1.1665, sterling is firm at 1.3039, the yen is strong at 110.89 and the Australian dollar is stronger too at 0.7943. The yuan is also stronger at 6.7481 and the other emerging currencies we follow are little changed.

On the economic agenda today, German import prices dropped 1.1%, which was worse than the 0.7% decline expected, later there is data out of German Ifo business climate, UK CBI industrial order expectations, with US data including house prices, consumer confidence and Richmond manufacturing index. In addition, UK’s Monetary Policy Committee member Andrew Haldane is speaking.

The base metals are looking stronger and the run-up in good volume suggests a change in sentiment, especially as this is happening during the normally slower summer months. The second quarter was quiet when seasonally it is a busier time, so maybe we are witnessing a delayed busier time now, which is also being helped by the weaker dollar.

Gold’s rebound has found new energy on the combination of the weaker dollar, which we think stems from the weak political scene in Washington and from the less hawkish US Federal Reserve stance. Silver and the PGM prices are following gold’s lead.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Gold’s rebound runs into resistance appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News