FastMarkets

The precious metals prices are also all off slightly this morning, Thursday June 1, with gold and silver prices off 0.2% and with the platinum group metals little changed. This after a general day of strength on Wednesday that saw the complex close up an average of 0.6%.

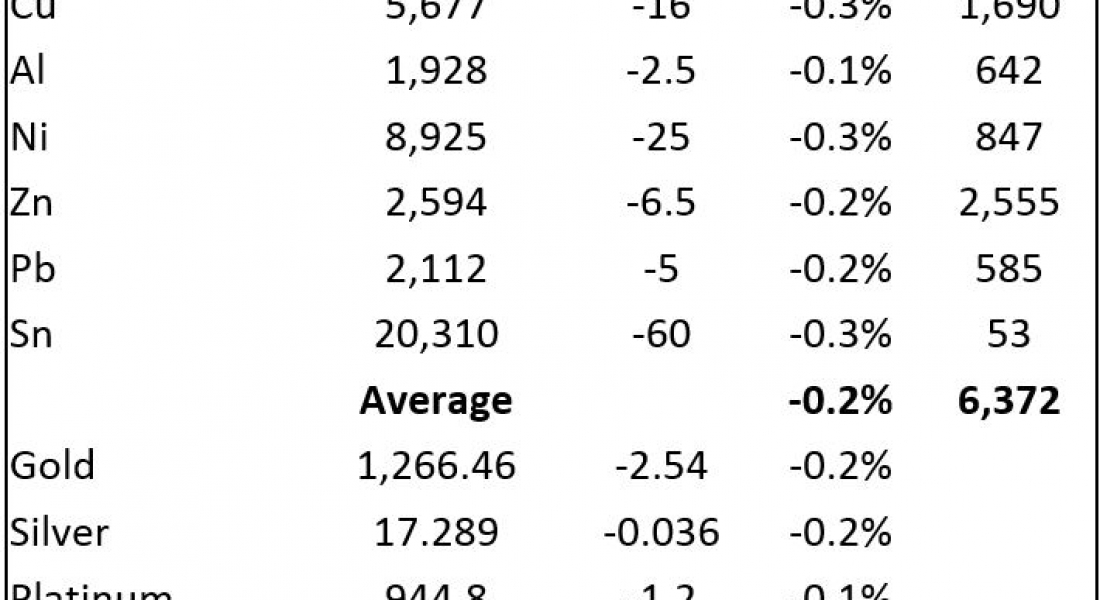

The base metals on the London Metal Exchange are down across the board by a fairly uniform amount of between 0.1% and 0.3% this morning, with three-month copper prices off 0.3% at $5,677 per tonne.

Volume has been slightly above average with 6,372 lots traded as of 06:11 BST; zinc has seen the highest volume with 2,555 lots traded, compared with 1,690 lots of copper. Zinc prices are off 0.2% at $2,112 per tonne.

Weak Chinese Caixin manufacturing PMI that dropped to 49.6 from 50.3 and below the 50.2 expected, is a depressing factor this morning. The Caixin reading is for medium to smaller companies, rather than the official reading, out on Wednesday that is for larger and state-owned enterprises (SOEs) that held steady at 51.2. The poor Caixin number no doubt reflects the liquidity squeeze underway in China that will be affecting private companies more that the larger SOEs.

Base metals prices on the Shanghai Futures Exchange (SHFE) are generally weaker this morning, down an average of 0.6%, although lead has for once bucked the trend on the upside with a 0.5% gain. Conversely, zinc is down 1.9%, nickel prices are down 1.1% and July copper prices are off 0.6% at 45,280 yuan ($6,720) per tonne. Spot copper prices in Changjiang were down 0.8% at 45,190-45,390 yuan per tonne and the LME/Shanghai copper arb ratio is weaker at 7.98, implying SHFE prices are falling at a faster pace than LME prices, which is further increasing the negative arbitrage gap.

Other metals prices in China are also weaker today with September iron ore prices on the Dalian Commodity Exchange down 4.3% at 419.50 yuan per tonne, while on the SHFE, steel rebar prices are down 3.3% and gold and silver prices are off 0.1%.

In international markets, spot Brent crude oil prices are up 0.4% at $51.15 per barrel. The yield on the US ten-year treasuries is weaker 2.21%, which suggests a degree of risk-off.

Equities were weaker on Wednesday with the Euro Stoxx 50 closing down 0.2% and the Dow closed down 0.1% at 21,008.65. Asia, this morning, is mainly firmer with the Nikkei up 1.2%, the Hang Seng is up 0.4%, the ASX 200 is up 0.1%, while the Kospi is down 0.1% and the CSI 300 is down 0.2%.

The dollar index’s latest rebound attempt has stalled with the index recently quoted at 97.03 after a peak of 97.78 on Tuesday. The trend in the dollar is still downward, which is odd given the market is so convinced of an interest rate rise in June. The euro is trying higher again at 1.1240, sterling shook off its poll jitters on Wednesday, it is firmer at 1.2862, the yen is treading water at 110.97 but the Australian dollar at 0.7402 is suffering on the back of weaker commodity prices and the poor Chinese PMI number.

The yuan is racing higher, it was recently quoted at 6.7317, after 6.8446 on Friday May 26. Most of the other emerging market currencies we follow are flat, although the rupee and real are firmer.

The economic agenda is busy today, in contrast to the Chinese PMI, Japan’s data has been stronger with capital spending rising 4.5%, against expectations of 3.8% rise and its manufacturing PMI climbed to 53.1, from 52. Later there is data on UK house prices and manufacturing data out across Europe, with US data including Challenger job cuts, ADP non-farm employment change, initial jobless claims, revised non-farm productivity, unit labour costs, final and ISM manufacturing PMIs and prices, construction spending, oil inventories, natural gas storage and total vehicle sales – see table below for more details.

Wednesday’s initial weaker tone on the LME did run into some buying for copper, aluminium, lead and tin, while nickel and zinc were weaker. Generally, we would put nickel in its own washed-out space for now, although looking oversold, nickel prices may well fall further until more news about supply emerges. For the rest, copper, aluminium and tin seem content to hold up near recent high ground, while lead and zinc consolidate nearer low ground, but still considerably up from the lows, unlike nickel. Overall we feel prices will remain rangebound, the slowdown in China is a concern, but we expect it will be well managed, while we also see the weakness in metals prices as being partially due to the surge in supply that the post-US election rally produced. As this extra supply is absorbed, we expect the supply fundamentals will tighten up again.

Gold prices continue to hold up well and if the dollar heads lower again that should remain the case, especially as political uncertainty remains in place in the USA, EU/US relationships are strained, Italy could call an early election and the UK election, combined with the approaching start of Brexit negotiations, could cause some market jitters. We expect gold prices to remain robust.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Gold prices hold up well, looking robust appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News