FastMarkets

Gold prices are up 0.2% at $1,224.32 per oz this morning, Tuesday July 4, silver prices are little changed, while the PGMs are stronger with gains averaging 0.8%. This comes after a weak performance in bullion prices on Monday that saw silver prices drop 2.7%, gold prices drop 1.5% and platinum fall 2.2%, while palladium bucked the trend with a 0.4% rise. What is surprising is that the PGMs are up despite poor US total vehicle sales that came in at an annualised 16.5 million units in June – the lowest since April 2015.

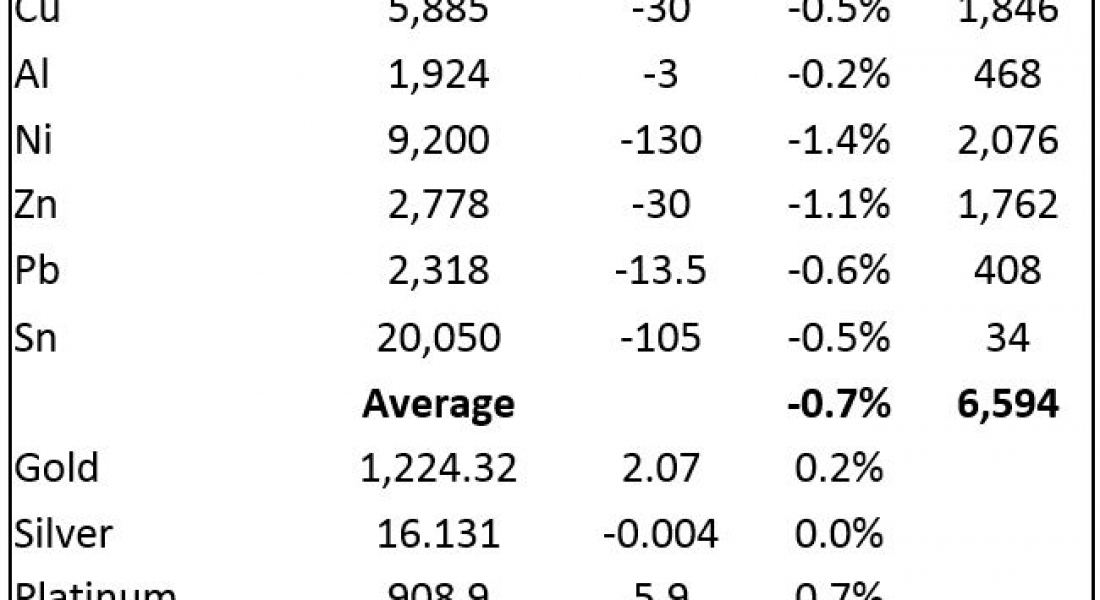

Base metals prices on the London Metal Exchange are down across the board by an average of 0.7% this morning.

Nickel and zinc prices lead the declines with losses of 1.4% and 1.1%, respectively, while three month copper prices are off 0.5% at $5,885 per tonne. Volume has been above average with 6,594 lots as of 06:14 BST.

Today’s performance comes after a generally stronger day on Monday when some solid gains were seen in zinc, lead and tin, that closed up an average of 1.4%, while aluminium closed up 0.2% and copper and nickel bucked the trend with losses of 0.7% and 0.5%, respectively – copper did not do too badly considering stocks climbed a net 28,575 tonnes.

The base metals on the Shanghai Futures Exchange (SHFE) are for the most part weaker, zinc bucks the trend with a 0.5% gain, while the rest are down between 0.1% for aluminium prices and 2.1% for nickel prices. Copper prices are down 0.8% at 47,130 yuan per tonne ($6,932 per tonne). Spot copper prices in Changjiang are down 0.4% at 46,900-47,100 yuan per tonne and the LME/Shanghai copper arb ratio has firmed to 8.00.

September iron ore prices on the Dalian Commodity Exchange are down 1.1% at 473 yuan per tonne. On the SHFE, steel rebar prices are up 0.4%, gold prices are down 1.1% and silver prices are off 3%.

In international markets, spot Brent crude oil prices are down 0.3% at $49.40 per barrel and the yield on the US ten-year treasuries has climbed to 2.35%. The firmer yield seems to be underpinning the dollar.

Equity markets continued their rebound following last week’s early jitters – the Euro Stoxx 50 closed up 1.5% and the Dow closed up 0.6%. In Asia this morning, however, most markets are weaker with the Nikkei down 0.3%, the Hang Seng is down 1.6%, the Kospi is down 0.7%, the CSI 300 is down 0.9%, while the ASX 200 bucks the trend with a 1.6% gain as the central bank left interest rates unchanged. Asian stock markets seem to have been rattled by another North Korean missile test.

The dollar index at 96.28 is rebounding, the rising treasury yield no doubt providing support as did some of Monday’s data, especially ISM manufacturing PMI that climbed to 57.8 from 54.9. As the dollar strengthened other currencies have weakened with the euro at 1.1342, sterling at 1.2936 and the Australian dollar has fallen to 0.7608, while the yen (113.00) has strengthened on the pick-up in geopolitical tension over North Korea’s latest missile test – the eleventh test this year. The regime also said it would make an ‘important announcement’ on Tuesday afternoon.

The yuan is weaker again today at 6.7986, this after a strong move last week and the other emerging market currencies we follow are also weaker, which suggests some pick-up in concerns – either about a strengthening dollar, or on the back of geopolitical tension.

With the USA on holiday for July 4 celebrations, the economic agenda is light – the Bank of Japan’s core CPI climbed to 0.3% from 0.2%, later there is data on Spanish unemployment change, UK construction PMI and EU PPI.

The stronger tone of late in the base metals has ended for now with prices either pausing or starting to put in a down-day today. With the USA closed today, there may have been some profit-taking around and also option declaration tomorrow may prompt some selling too. Overall we remain quietly bullish for the metals and expect dips to be well supported although there may be some volatility ahead of option declaration.

Gold prices have been under pressure in recent days/weeks and we put that down to a general easing in geopolitical and political tensions, but with another missile test by North Korea, with US president Donald Trump cranking up the rhetoric again and this all happening ahead of this weekend’s G20 meeting, geopolitical tensions may rise further. The yen is firmer and gold is edging higher so we wait to see if buying swings back into gold. Silver is testing support at $16.05 per oz, but we would expect it to continue to follow golds’ lead, platinum is looking weak and remains vulnerable, but like silver, prices are likely to follow gold’s lead, while palladium has also run into dip buying.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Gold prices edge higher as geopolitical tensions pick-up again appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News