FastMarkets

Gold prices are little changed at $1,285.40 per oz this morning, while the other more industrial precious metals prices are up between 0.2% for silver and 0.9% for palladium, again this was after a down day on Wednesday when the complex closed off an average of 1.4%.

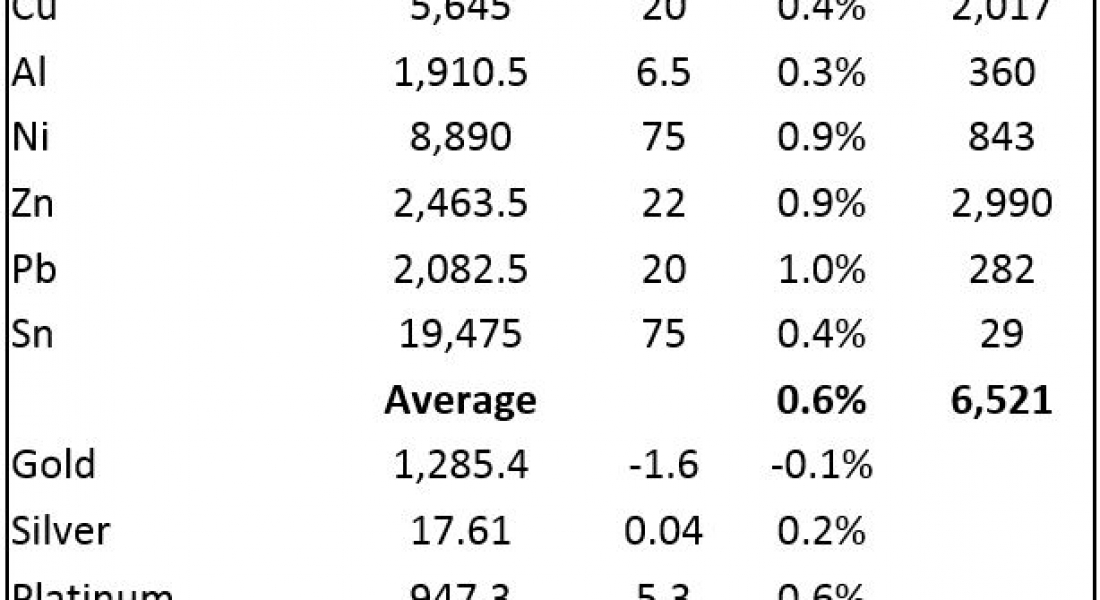

Base metals prices are up an average of 0.6% with gains seen across the board on the London Metal Exchange this morning, Thursday June 8, helped by better Chinese trade data that showed imports and exports picked up in May.

Volume has been average with 6,521 lots traded with prices up between 1% for lead and 0.3% aluminium. Three-month copper prices were up 0.4% at $5,645 per tonne as at 06:29 BST. This comes after a generally weak day on Wednesday when the base metals complex closed down by an average of 0.6%, led by a 1.5% drop in tin prices to $19,400 per tonne, while copper bucked the trend, with prices closing up 0.1%.

In Shanghai this morning, the base metals trading on the Shanghai Futures Exchange (SHFE) are split with copper, aluminium, lead and zinc up an average of 0.7%, with copper prices at 45,190 yuan ($6,651) per tonne, while nickel and tin prices are off around 0.4%.

Spot copper prices in Changjiang are down 0.1% at 44,940-45,140 yuan per tonne and the LME/Shanghai copper arb ratio is at 8.02.

In other metals in China, September iron ore prices on the Dalian Commodity Exchange are off 0.5% at 429.50 yuan per tonne, while on the SHFE, steel rebar prices are up 1.9% and gold and silver prices are down 0.5% and 0.4%, respectively.

In international markets, spot Brent crude oil prices are up 0.5% at $48.40 per barrel, this after falling on Wednesday on a pick-up in US oil inventories and the yield on the US ten-year treasuries is slightly firmer at 2.18%, showing some consolidation as we move into an eventful day on Thursday with the UK election, former US Federal Bureau of Investigation director James Comey’s testimony before the US Senate Intelligence Committee and the European Central Bank (ECB) policy decision.

Equities ended Wednesday mixed with the Euro Stoxx 50 closing down 0.2% and the Dow up 0.2% at 21,173.69. In Asia this morning, the Nikkei is down 0.3%, China’s CSI 300 is up 0.5%, the Hang Seng is up 0.1% and the Kospi and ASX 200 are little changed.

The dollar remains weak with the dollar index at 96.62, conversely the euro is firm at 1.1268, sterling at 1.2968 is climbing, as are the yen at 109.47 and the Australian dollar at 0.7550.

The yuan at 6.7931 remains firm and the other emerging market currencies we follow are flat-to-firmer.

The economic agenda is busy – in dollar terms China’s exports grew 8.7% in May and imports climbed 14.8%, both better than expected, especially imports. Japan’s final GDP was 0.3%, down from an advanced reading of 0.5%, bank lending was up 3.2%, the current account increased and Japan’s economic watchers sentiment climbed to 48.6 from 48.1. Later, there is data on German industrial production, the French trade balance, EU GDP, US initial jobless claims and natural gas storage. In addition, it is ECB monetary policy decision and statement day – see table below for more details.

Will China’s better trade data put a floor under the slide in base metals prices? Early trading suggests they are, but we need to see if follow through buying now takes advantage of the lower prices and the lower dollar.

Gold prices, having set a fresh high at $1,295.55 per oz on May 6, have since consolidated. The result of today key issues, the UK election result and its likely impact on Brexit negotiations, the ECB monetary policy direction and the market’s reaction to Comey’s testimony, are likely to set the near term direction for gold prices and we may end up having a choppy afternoon of trading. Silver and platinum are likely to follow gold’s lead, while palladium looks set to consolidate recent strength.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Gold prices consolidate ahead of today’s key events appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News