Each quarter FastMarkets and Sucden Financial produce an analysis and forecast report on the precious and base metals – The Sucden Financial Metals Reports, April 2016.

Below is the gold report, to download a PDF copy of the full report covering all the metals in pdf form click here.

Subscribers have access to these reports before they are published through the research tab in FastMarkets Professional.

Gold – Bullish combination could prevail

Summary

Gold rallied 16 percent in the first three months of 2016 after falling about 10 percent in 2015. Factors in the rise included higher risk aversion, downward revisions to the Fed’s tightening cycle and brighter sentiment across commodities. While we expect gold to strengthen further and range between $1,180 and $1,325 in the second quarter because these positive drivers may endure, we expect downward pressure to re-emerge later in 2016 stemming from a stronger dollar and rising US real interest rates.

Overall trend – Gold enjoyed a spectacular rally in the first quarter of the year, rising 16 percent to an intraday high of $1,283 per ounce on March 11 before consolidating – it closed at $1,232 on March 31. The range of factors that drove its impressive performance in the early months of 2016 include growing uncertainty over global growth, lower Fed interest rate expectations and a broad-based improvement in commodities. While we believe these factors will remain at play in the second quarter, providing gold with further upward pressure, we expect them to reverse in the second half of the year, which should result in fresh weakness.

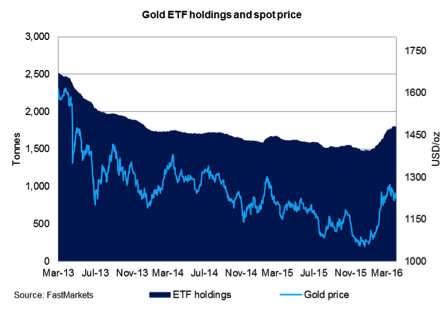

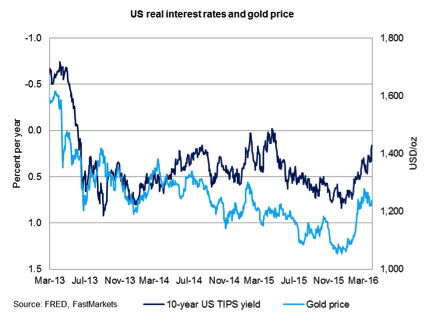

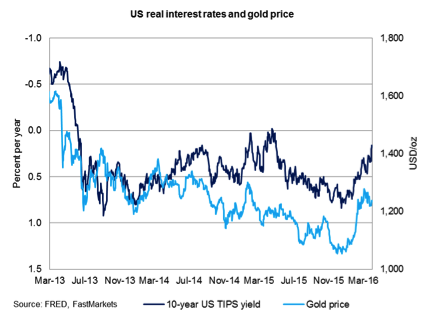

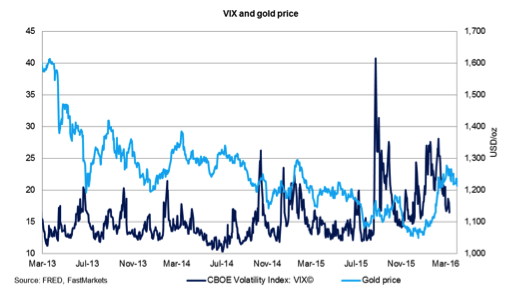

Impressive Q1 rally – Gold’s sharp rise at the start of the year was triggered by fears over a hard landing in China, which resulted in a sharp sell-off in Chinese equities that extended to other parts of the world. This sent investors toward safe-haven assets, boosting ETF holdings. Buying pressure in gold was bolstered by downward revisions to the expected path of US interest rates from investors and the Fed. Fed tightening expectations through the first quarter pushed gold higher by pressuring the dollar four percent lower and by moving real yields on the 10-year US Treasuries to their lowest since April 2015. Finally, gold benefited from a positive shift in speculative sentiment in favour of commodities, which resulted in strong inflows into commodity index funds. The significant increase in net speculative long positions in gold on Comex via long accumulation and short-covering played a major role in the first-quarter rally.

Demand set to remain strong in Q2 – We believe investment and speculative demand could remain strong in the second quarter because macroeconomic environment is increasingly vulnerable to downside risks from growing political uncertainty in the US and Europe. First, in the US, investors face an election year after a two-term presidency, an event that has historically had a negative impact on equities amid higher uncertainty. While US equities managed to rebound sharply in February and March, a sell-off could boost safe-haven demand for gold. Second, in Europe, two clouds are on the horizon – the British referendum in June and the unsustainable trajectory of Greek debt. While growing “Brexit” fears continue to hurt investor sentiment and could have negative effects on the global financial markets, the latest Greek bailout programme is another source of tension against a backdrop of growing discord between the IMF and Germany, which could also trigger some turbulence in financial markets. Should gold continue to be viewed as a safe haven, as we think it will, investors could boost their ETF buying and speculators could extend their long positions on Comex, which would bode well. But muted jewellery demand (50 percent of total demand) partly owing to a slightly weaker China (32 percent of jewellery demand) due to unattractive prices and India (27 percent of jewellery demand) because of strikes by jewellers that could offset strong investment demand.

But gold could spring negative surprises later this year – Despite a challenging global environment and downside risks from abroad, we expect the US economy to remain resilient in 2016. We believe the Fed will continue to tighten, albeit gradually, by raising rates twice this year – in line with the latest FOMC projections. But since the market currently expects only one increase in 2016, as the 30-day Fed-fund futures show, we believe investors are underestimating the future path of US policy. So we think that a re-pricing of tightening expectations is likely in the second half, which should exert upward pressure on the dollar and US real interest rates. Investment demand could weaken via outflows from ETF holdings while speculative buying on Comex could turn into strong selling should money managers start to unwind their long positions. So we reiterate our view that gold prices could move lower toward $1,000 in the second half of 2016.

ETF holdings rose 320 tonnes in the first quarter compared with a fall of 54 tonnes in the fourth quarter of last year and a rise of only 20 tonnes in the first quarter of last year. ETF investors could continue to buy gold steadily in the second quarter despite higher prices.

Money managers bought a record 514 tonnes on Comex in the first quarter after selling 324 tonnes of gold last year. While speculative positioning is overstretched, we believe that spec sentiment will remain positively skewed in the second quarter, which should translate into further speculative buying.

The negative correlation between gold prices and US real interest was high in the first quarter (-0.86 versus -0.65 in the whole of 2015). The fall in real interest rates, partly driven by lower Fed tightening expectations, could continue on increased risk aversion, which in turn could push gold prices higher still.

Although the relationship between financial market volatility and gold prices is not always stable, it was relatively strong in the first quarter at -0.59. Assuming this correlation remains in place in the second quarter, higher risk aversion amid growing political uncertainty could continue to boost gold prices.

Download a PDF copy of the full report here.

The post Gold price forecast and analysis for Q2 2016 appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News