FastMarkets

Precious metals are little changed this morning, Wednesday June 21, gold, silver and palladium are up slightly, with gold at $1,246.10 per oz, while platinum prices are off 0.1%. This comes after a generally quiet day on Tuesday which saw gold, silver and platinum prices close 0.1% higher, while palladium prices closed up 1.2% at $870 per oz.

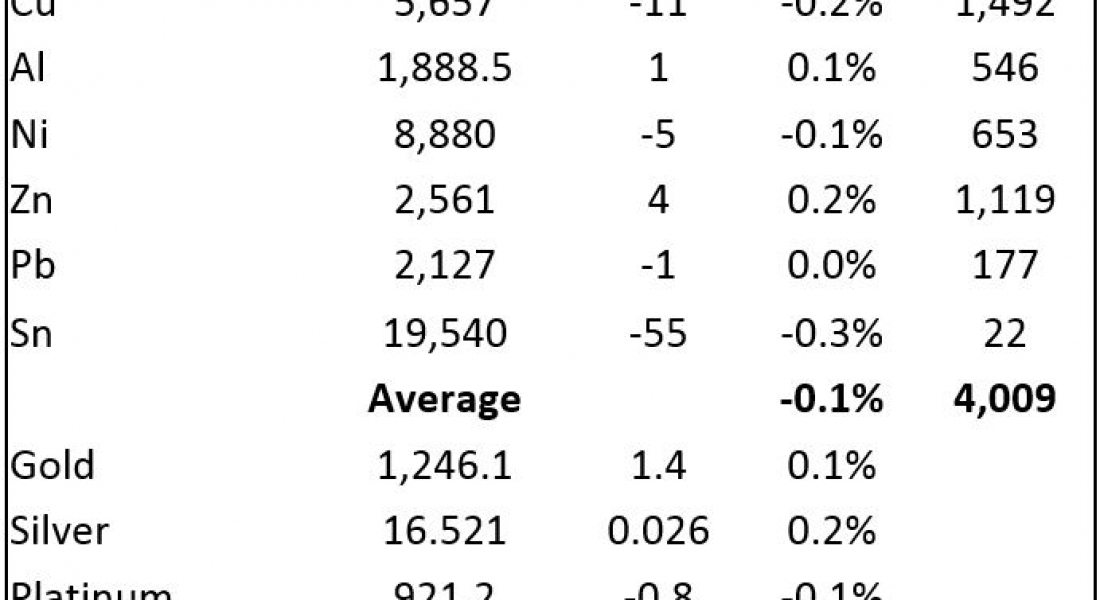

It has been a quiet start on the London Metal Exchange this morning, as base metals prices remain little changed with price movements ranged between down 0.3% for tin and up 0.2% for zinc – copper prices are down 0.2% at $5,657 per tonne. Volume has been light with 4,009 lots traded as of 06:22 BST.

This follows a general down day on Tuesday when prices closed off an average of 0.4%, with tin the only base metal to close in positive territory with gains of 0.4%, while the rest were down an average of 0.6%.

In Shanghai this morning, base metals prices on the Shanghai Futures Exchange (SHFE) are split with nickel, copper and tin prices down, 1.7%, 0.8% and 0.4%, respectively, with copper prices at 45,540 yuan per tonne ($6,668 per tonne) while aluminium, lead and zinc are up an average of 0.2%. Spot copper prices in Changjiang are down 0.7% at 45,350-45,470 yuan per tonne and the LME/Shanghai copper arb ratio is at 8.05.

Other industrial metals in China are weaker with September iron ore prices on the Dalian Commodity Exchange down 1.5% at 425.5 yuan per tonne. On the SHFE, steel rebar prices are off 2.2%, while gold and silver prices are little changed.

In international markets, spot Brent crude oil prices are weak at $45.89 per barrel and the yield on the US ten-year treasuries has fallen to 2.16%.

Equities ended Tuesday on a weaker note, dragged down by weaker oil prices, with the Euro Stoxx 50 closing down 0.5% and the Dow down 0.3% at 21,467.14. In Asia this morning, markets are mixed but generally weaker; the ASX 200 is off 1.5%, the Kospi is down 0.5%, the Hang Seng is off 0.4%, Nikkei is down 0.3%, while the CSI 300 bucks the trend with a 0.2% gain.

The dollar index pushed up through recent highs of 97.78 to reach 97.87 on Tuesday, thereby suggesting a break higher. It was recently quoted at 97.75 and is looking firmer, which is likely to prove a headwind for commodity prices in general, especially gold prices. Conversely, the euro is weaker at 1.1129 as are sterling at 1.2629 and the Australian dollar at 0.7558, while the yen at 111.26 is consolidating recent weakness.

The yuan continues with its weaker trend at 6.8317, giving back some of the gains seen in the second half of May, which came after its credit downgrade. The other emerging market currencies we follow are all weaker too, no doubt reflecting a firmer dollar, which suggests a possible change in trend may now be underway.

The economic agenda is light today; data out of Japan showed all industries activity rising 2.1%, better than the 1.7% expected, while later there is data on UK public sector borrowing requirement, with US data including existing home sales and crude oil inventories. With oil prices on a back footing, the inventory data could prompt some increased volatility in oil. In addition, UK Monetary Policy Committee member Andrew Haldane is speaking – see table below for more details.

The recent firmer tone in the base metals appears to have once again run out of steam suggesting a generally lacklustre market with dips being supported, while any price strength attracts selling. We expect more of the same while the market waits for more directional news flow.

Gold, silver and platinum prices are retreating but doing so in an orderly manner, while palladium prices appear to have found some support. If the dollar does push through with its firmer tone then that may well apply downward pressure on the precious metals prices, at least while there is an absence of any pick-up in geopolitical, or political tensions.

The post All quiet in bullion, gold prices little changed appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News