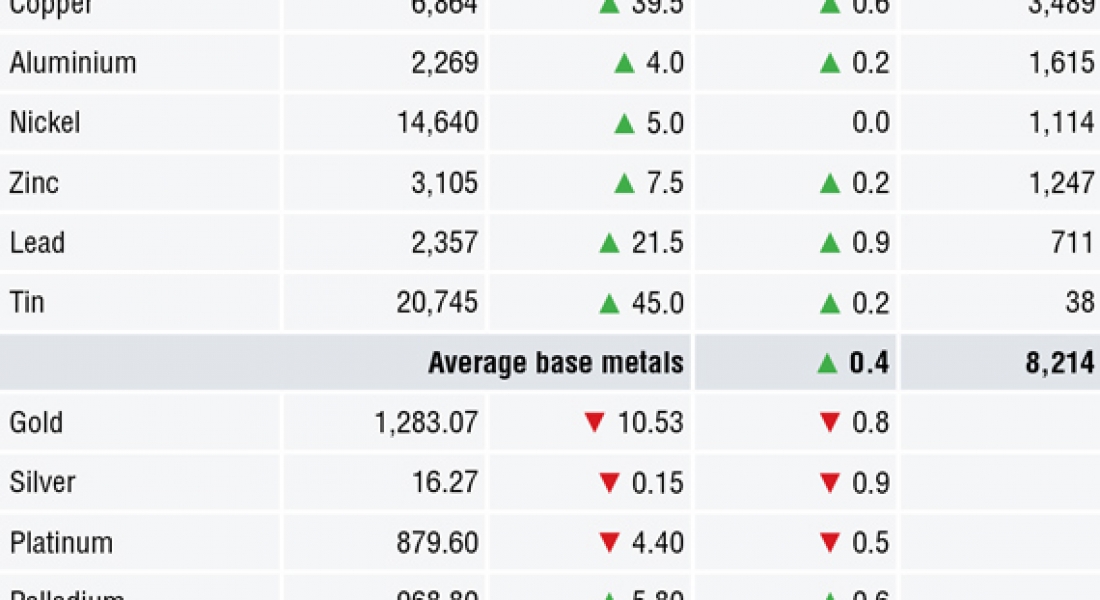

Base metals prices on the London Metal Exchange were firmer on the morning of Monday May 21, with prices up by an average of 0.4%. Lead was out in front with a 0.9% rise, while copper was up by 0.6% at $6,864 per tonne.

Volume on the LME has been above average with 8,214 lots traded as at 07.54 am London time.

This follows a mixed performance last Friday where the metals were either little changed or weaker, with aluminium and lead off by 1.1% and 1.2% respectively.

Gold, silver and platinum prices were weaker this morning, with prices down by an average of 0.7%. Spot gold prices were down by 0.8% at $1,283.07 per oz, while palladium prices bucked the general weakness with a 0.6% gain.

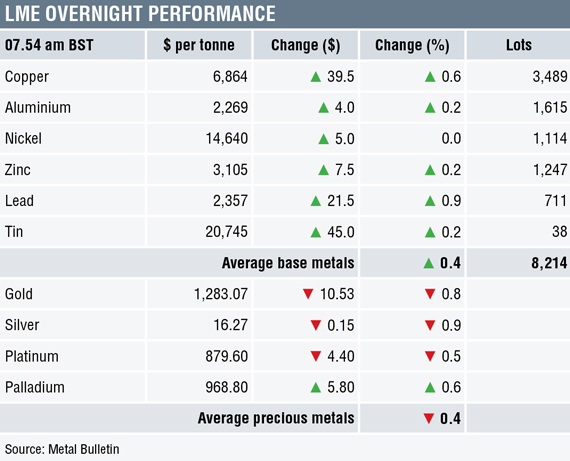

The base metals prices on the Shanghai Futures Exchange were generally stronger with aluminium and nickel prices down by 0.4% and 0.2% respectively, while the others were up by between 1.6% for lead and 0.4% for copper, the latter of which was recently quoted at 51,430 yuan ($8,062) per tonne.

Spot copper prices in Changjiang were up by 0.4% at 51,150-51,310 yuan per tonne and the LME/Shanghai copper arbitrage ratio was firmer at 7.50.

In other metals in China, iron ore prices were down by 3.2% at 465 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices were down by 1.7%, while gold and silver prices were down by 0.1% and 0.5% respectively.

In wider markets, spot Brent crude oil prices were up by 0.38% at $78.93 per barrel this morning. The yield on US 10-year treasuries remains firm at 3.0577%. Meanwhile, the German 10-year bund yield has eased to 0.5590%.

Equity markets in Asia were mainly positive on Monday: Nikkei (+0.31%), Hang Seng (+0.82%), Kospi (+0.20%), CSI 300 (+0.47%), but the ASX 200 was down by 0.05%. This follows a mixed performance in western markets on Friday, where in the United States the Dow Jones closed up by 1.11 points at 24,715.09, and in Europe where the Euro Stoxx 50 closed down by 0.51% at 3,573.76. Avoidance of a trade war between the United States and China seems to be underpinning the firmer tone in equities.

The dollar index at 94.02 is climbing again and on course to reach our next target at 95.00.

The other major currencies are weaker as a consequence of the stronger dollar: Euro (1.1723), sterling (1.3411), the Australian dollar (0.7509) and the yen (111.35).

The yuan is also weakening (6.3916), as are the emerging market currencies we follow.

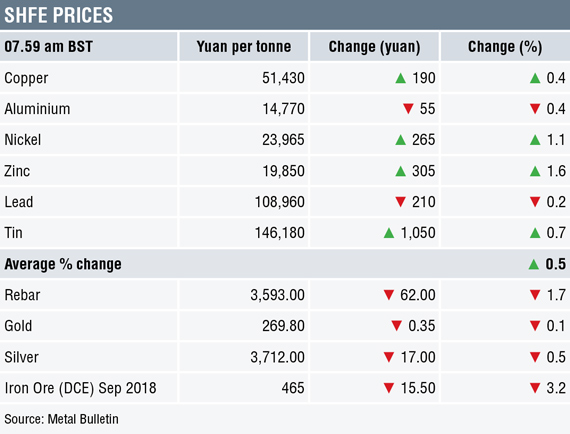

Today’s economic data included data on UK house prices, which climbed 1% and Japan’s trade balance increased to a 550 billion yen ($4.96 billion) surplus, boosted by strong car exports to the US. Later there is a European Central Bank financial stability review and US Federal Open Market Committee Raphael Bostic is speaking.

The base metals generally remain rangebound, volumes have picked up and on balance the mood is more positive this morning helped by the easing trade tensions between China and the US. The strong dollar is likely to remain a headwind, but the market does seem to be waiting for direction. For now economic data generally shows growth but not strong growth, so we expect range trading to continue.

Gold prices, along with the other precious metals, are under pressure from the strong dollar and upward trending US treasury yields. The path of least resistance looks set to remain to the downside.

The post METALS MORNING VIEW 21/05: Metals prices mainly firmer after US-China trade war avoided appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News