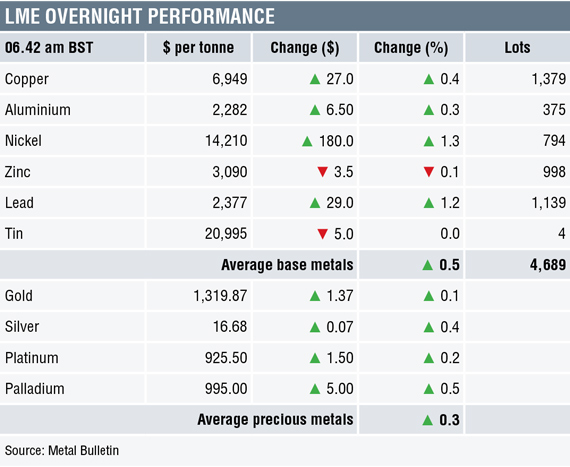

Base metals prices on the London Metal Exchange were broadly positive on the morning of Monday May 14, with all of the metals, except for zinc (-0.1%), up by an average of 0.6%. Nickel and lead were the frontrunners with gains of 1.3% and 1.2% respectively.

Volume on the LME has been average, with 4,689 lots traded as at 06.42 am London time.

The precious metals were firmer across the board this morning, with the complex up by an average of 0.3% – gold prices were up by 0.1% at $1,319.87 per oz. Once again it looks as though gold prices have found support above $1,300 per oz and prices are attempting to work higher.

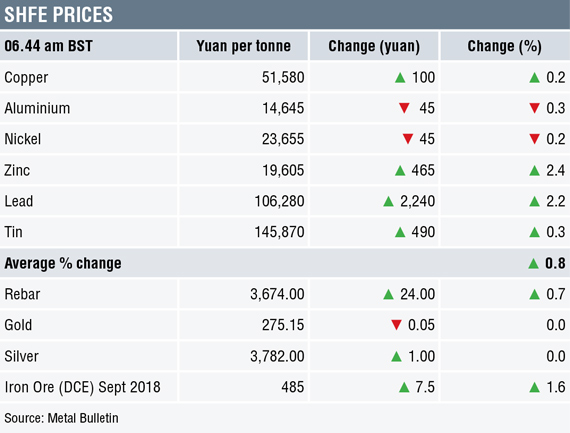

Lead and nickel prices on the Shanghai Futures Exchange also led the way this morning, with prices up by 2.4% and 2.2% respectively. Copper prices were up by 0.2% at 51,580 yuan ($8,140) per tonne, tin prices were up by 0.3%, while aluminium and zinc prices were down by 0.3% and 0.2% respectively.

Spot copper prices in Changjiang were up by 0.2% at 51,140-51,240 yuan per tonne and the LME/Shanghai copper arbitrage ratio has dropped to 7.42 from 7.51 for most of last week.

In other metals in China, iron ore prices were up by 1.6% at 485 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices were up by 0.7%, while gold and silver prices were little changed.

In wider markets, spot Brent crude oil prices were down by 0.33% at $76.70 per barrel. The yield on US 10-year treasuries has eased back from the 3% level and was recently quoted at 2.96%, while the German 10-year bund yield has firmed to 0.56%.

Equity markets in Asia were for the most part up on Monday: Nikkei (+0.51%), Hang Seng (+1.12%), CSI 300 (+0.92%) and the ASX 200 (+0.27%), but the Kospi was struggling with a 0.04% decline. This follows a mixed performance in western markets on Friday, where in the US the Dow Jones closed up by 0.37% at 24,831.17, and in Europe where the Euro Stoxx 50 closed down by 0.12% at 3,565.52.

The dollar index is weaker this morning at 92.39 – this is the third down day after a strong rally that peaked at 93.42 on May 9. Having travelled 4.7% in an all but straight line since April 17 – some consolidation is not surprising. With the dollar edging lower, most of the other major currencies are getting some lift: euro (1.1970), sterling (1.3567), and the Australian dollar (0.7552), but the yen remains flat at 109.32. The yuan has strengthened, it was recently quoted at 6.3364 and most of the emerging market (EM) currencies have halted their slide – the exception being the Brazilian real and the ringgit, which has reversed an early spike lower.

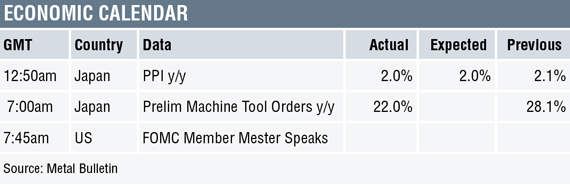

The economic agenda is light today with Japan’s producer price index (PPI) rising 2%, which was down slightly from 2.1% previously, and the country’s machine tool orders were up 22%, after a previous reading of 28.1%. Later, US Federal Open Market Committee member Loretta Mester is speaking.

The base metals are quite diverse: In recent weeks it was aluminium that was leading the pack, now it is lead, nickel and copper, while aluminium and tin have been consolidating after recent weakness and zinc has been moving sideways. The easier dollar should provide some support for base metals’ prices, but the fact each metal is moving to its own tune, suggests underlying sentiment is neither bullish, nor bearish. We have said in recent weeks that if metals prices do not sell off given the raised geopolitical tensions, then it will be a sign that demand is not weak, but we still fell that in the current climate consumers may feel little need to chase prices higher.

Gold prices have once again found support above $1,300 per oz and prices are trading either side of $1,320 per oz. The pull-back in the dollar is no doubt helping support prices and the underlying geopolitical tensions are likely to providing support too. Silver has rebounded strongly, as have platinum and palladium. While prices may have found underlying support, there does not seem to be too much bullishness around. As such, we expect more rangebound trading.

The post METALS MORNING VIEW 14/05: Metals start the week on firmer footing appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News