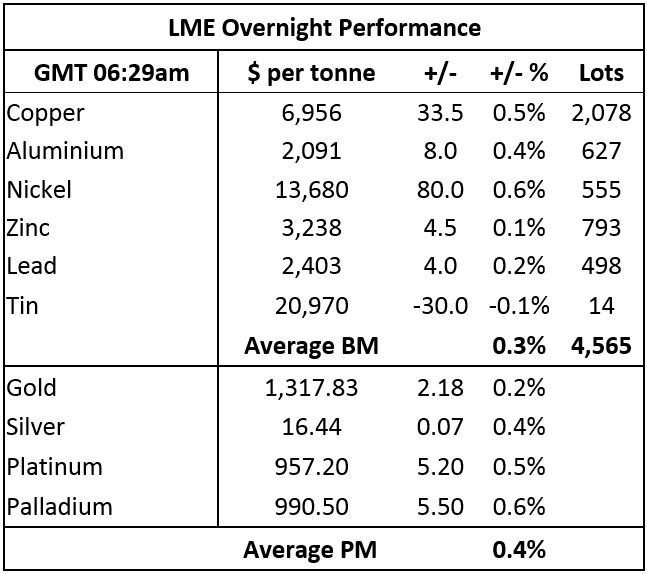

The precious metals prices are showing gains across the board this morning: Gold (+0.2%) at $1,317.83 per oz, silver (+0.4%), platinum (+0.5%) and palladium (+0.6%). This follows weakness on Thursday when the complex closed down by an average of 1%.

The precious metals are also consolidating in recent low ground, which suggests investors are also waiting on the sidelines, as they are with the base metals – we expect dips to remain well supported.

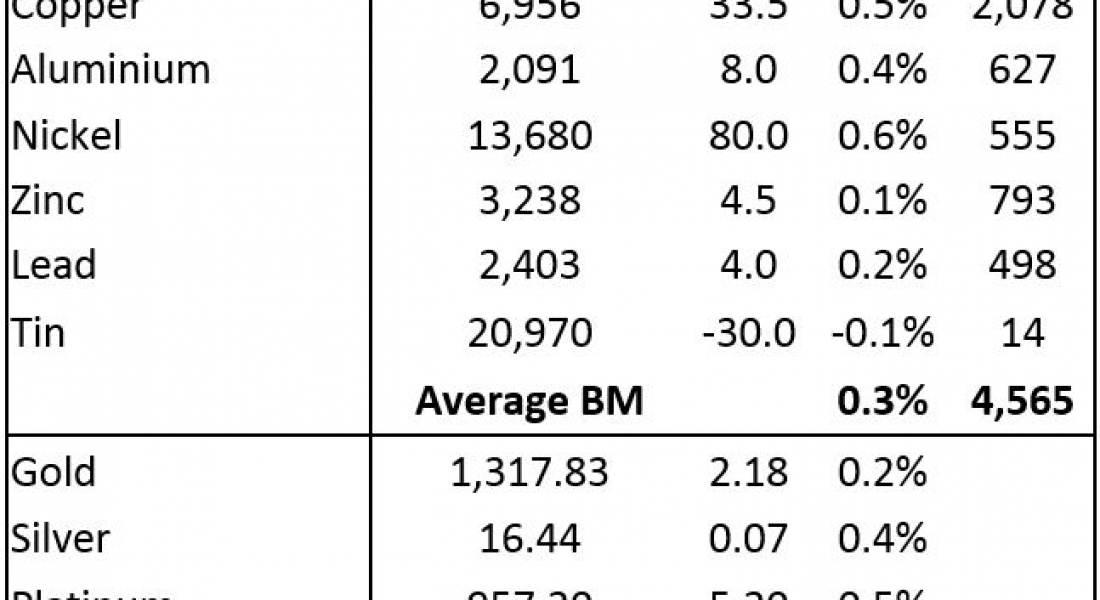

Base metals prices on the London Metal Exchange are for the most part stronger this morning, Friday March 16, with all of the metals, except tin, showing average gains of 0.4%. Copper is up by 0.5% at $6,956 per tonne, while tin is off by 0.1% at $20,970 per tonne.

Volume has been light with 4,565 lots traded as of 06.29am London time.

This follows a day of weakness on Thursday, with the complex closing down by an average of 1.1%, ranged between unchanged for lead and down by 2.1% for nickel.

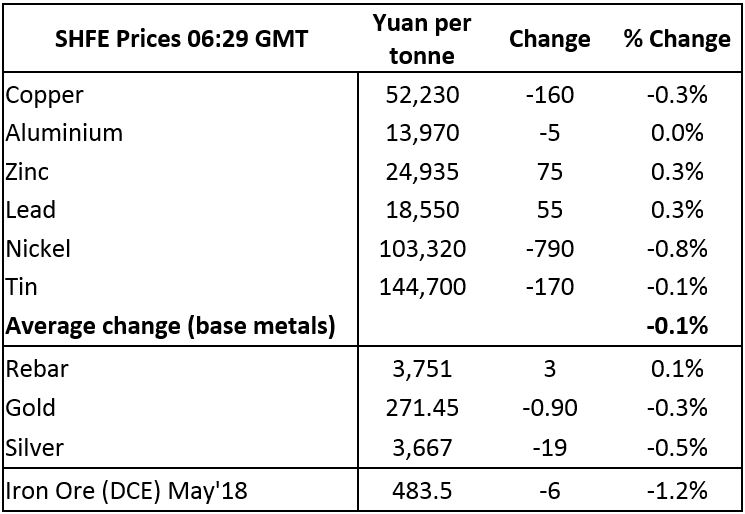

On the Shanghai Futures Exchange this morning, lead and zinc prices are up by 0.3%, aluminium prices are little changed, nickel prices are off by 0.8%, copper prices are down by 0.3% at 52,230 yuan ($8,262) per tonne and tin prices are off by 0.1%. Spot copper prices in Changjiang are down by 0.7% at 51,280-51,460 yuan per tonne and the LME/Shanghai copper arbitrage ratio is at 7.50.

In other metals in China, iron ore prices are down by 1.2% at 483.50 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices are up by 0.1%, while gold and silver prices are weaker by 0.3% and 0.5% respectively.

In wider markets, spot Brent crude oil prices are up by 0.09% at $65.13 per barrel and the yield on US 10-year treasuries is at 2.83%, while the German 10-year bund yield is weaker at 0.57%.

Equity markets in Asia are mixed this morning: Nikkei (-0.58%), Hang Seng (-0.13%), CSI 300 (-0.48%), ASX 200 (+0.48%) and Kospi (+0.06%). This follows strength in western markets on Thursday, where in the United States the Dow Jones closed up by 0.47% at 24,873.66, and in Europe where the Euro Stoxx 50 closed up by 0.68% at 3,414.13.

The dollar index at 90.02 is still consolidating above what could be a base formation that had built up in late-January and mid-February. The other major currencies we follow are also consolidating: Euro (1.2317), sterling (1.3946), yen (106.92) and the Australian dollar (0.7801). The yuan is likewise consolidating at 6.3237, while the emerging market currencies we follow are for the most part still consolidating.

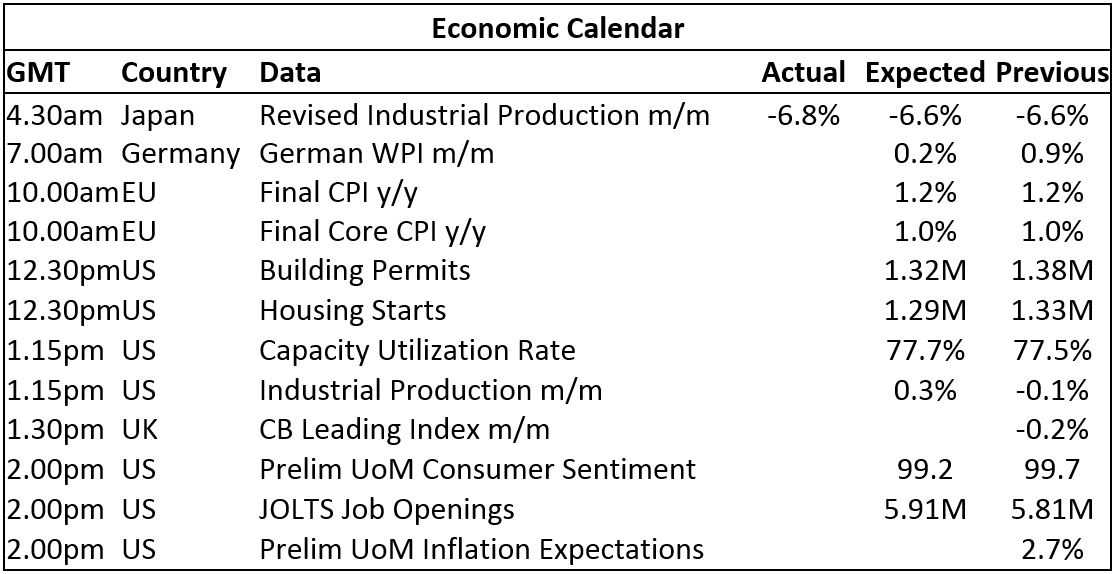

Economic data already out shows weaker Japanese industrial orders that fell 6.8%, while data out later includes German wholesale price index (WPI), EU consumer price index (CPI), UK leading indicators. US data including building permits, housing starts, industrial production and capacity utilization, University of Michigan (UoM) consumer sentiment and inflation expectations and Jolts job openings is also due.

For the most part the base metals are consolidating, with aluminium and tin continuing to show weakness, while nickel prices have held up the best overall in recent weeks.

A comment from International Monetary Fund managing director Christine Lagarde in a recent blog post sums up the current situation well: “Even though the sun still shines in the global economy, there are more clouds on the horizon. Think of the growing concerns over trade tensions, the recent spike in volatility in financial markets, and more uncertain geopolitics.”

Overall, we see the base metals prices as consolidating as they wait to see how strong China’s demand is post Lunar New Year and how far the trade wars reach.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW 16/03: Gold prices showing gains across the board appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News