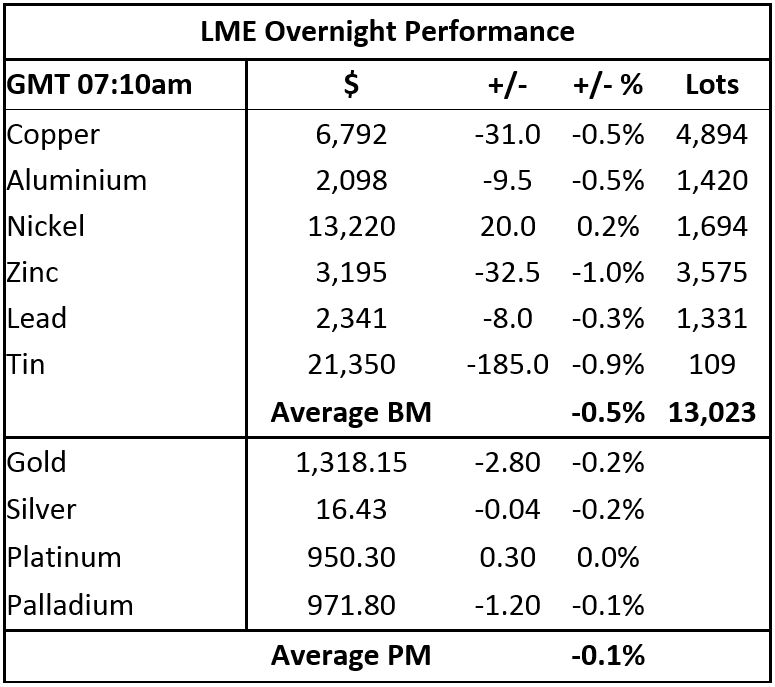

Gold and silver are down by 0.2% this morning, with gold prices at $1,318.15 per oz, while platinum prices are little changed and palladium prices are off by 0.1%. Gold prices are weaker following the news that the United States and North Korea have agreed to hold a summit.

On Thursday, gold and silver prices were off by an average of 0.2%, platinum was little changed, while palladium prices rose by 0.4%.

Gold prices are weaker but they are holding within their recent range. With the yen and gold prices on a back footing it does look as though the prospect of a North Korean/US summit is seeing some reduction is haven interest, although given risk-off in other markets we would not be surprised if haven buying against further market corrections picked up.

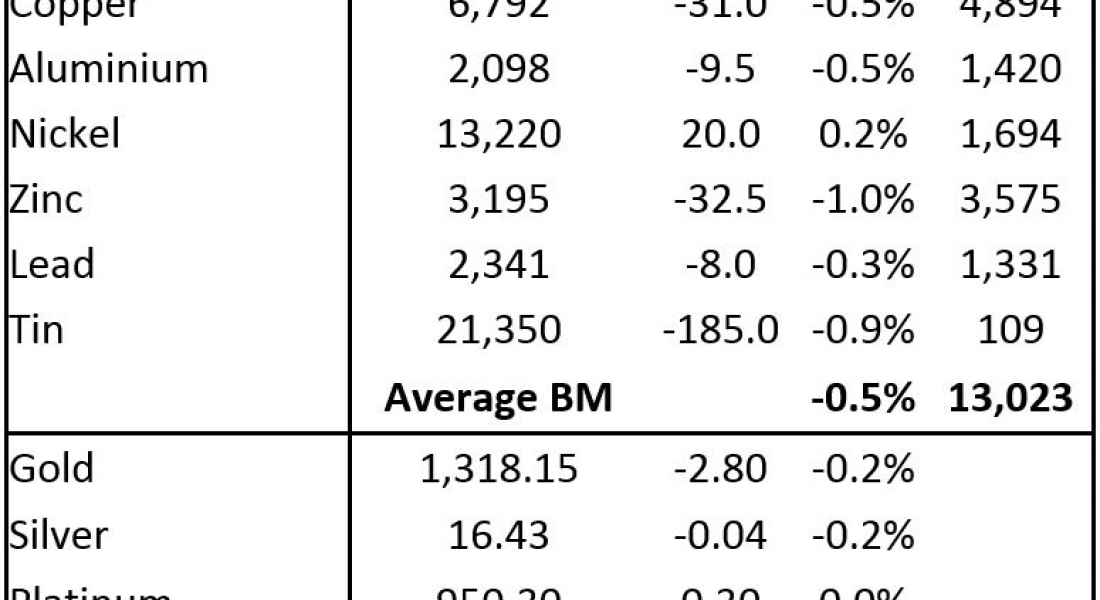

Base metals traded on the London Metal Exchange are for the most part weaker this morning, Friday March 9. The exception is nickel, where prices are up by 0.2%, while the rest are lower: Zinc (-1%), tin (-0.9%), aluminium (-0.5%), lead (-0.3%) and copper prices are off by 0.5% at $6,792 per tonne.

Volume has been high with 13,023 lots traded as of 07.10am London time – high volume and weak prices does not bode well.

Today’s weakness follows a mixed performance on Thursday when copper, nickel, zinc and lead fell by an average of 1.7%, while aluminium and tin were up by 0.4% and 0.6% respectively.

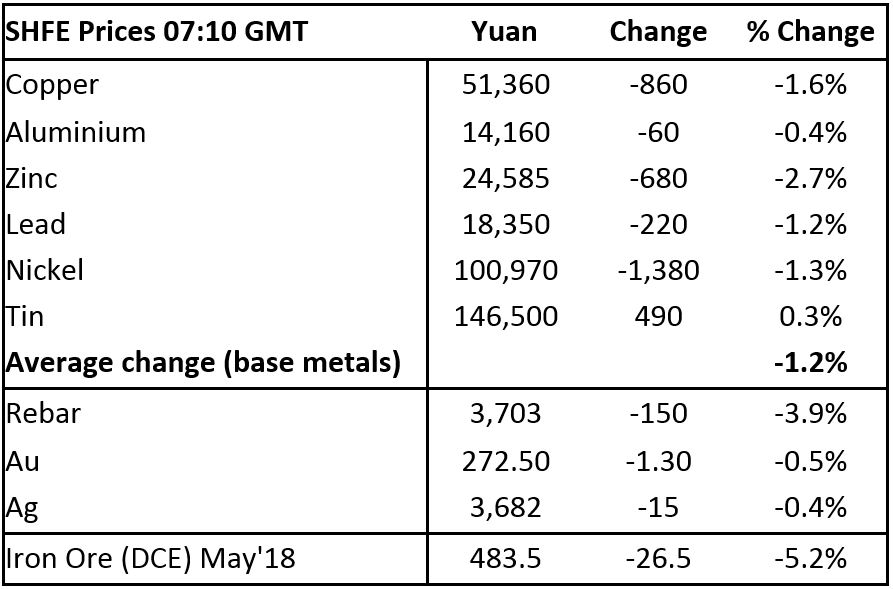

On the Shanghai Futures Exchange this morning, tin prices are up by 0.3%, the rest are weaker by an average of 1.5%, led by a 2.7% drop in zinc prices – copper prices are off by 1.6% at 51,360 yuan ($8,107) per tonne. Spot copper prices in Changjiang are off by 1.3% at 50,880-51,220 yuan per tonne and the LME/Shanghai copper arbitrage ratio has firmed to 7.56, from 7.52 on Thursday.

In other metals in China, the steel sector is down heavily with iron ore prices down by 5.2% at 483.50 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices are down by 3.9%, while gold prices and silver prices are down by 0.5% and 0.4% respectively.

In wider markets, spot Brent crude oil prices are off by 0.07% at $63.81 per barrel, while the yield on US 10-year treasuries has eased to 2.87%, while the German 10-year bund yield has also eased to 0.64%.

Equity markets in Asia are rebounding this morning on the back of hope that something positive might come of the North Korea/US summit: Nikkei (+0.47%), Hang Seng (+0.94%), CSI 300 (+0.77%), ASX 200 (+0.34%) and the Kospi (+1.08%). This follows a steadier tone in western markets on Thursday, where in the United States the Dow Jones closed up by 0.38% at 24,895.21, and in Europe where the Euro Stoxx 50 closed up by 1.06% at 3,413.28.

The dollar index is on the rise again, it was recently quoted at 90.17, which suggests the potential positives from any agreement with North Korea, outweighs the negatives of a potential trade war. The firmer dollar will be adding weight to an already weak metals complex. In contrast to the firmer dollar, the major currencies are weaker: euro (1.2316), sterling (1.3814), yen (106.66) and Australian dollar (0.7797). The yuan is slightly weaker at 6.3342, while the emerging market currencies we follow are mixed.

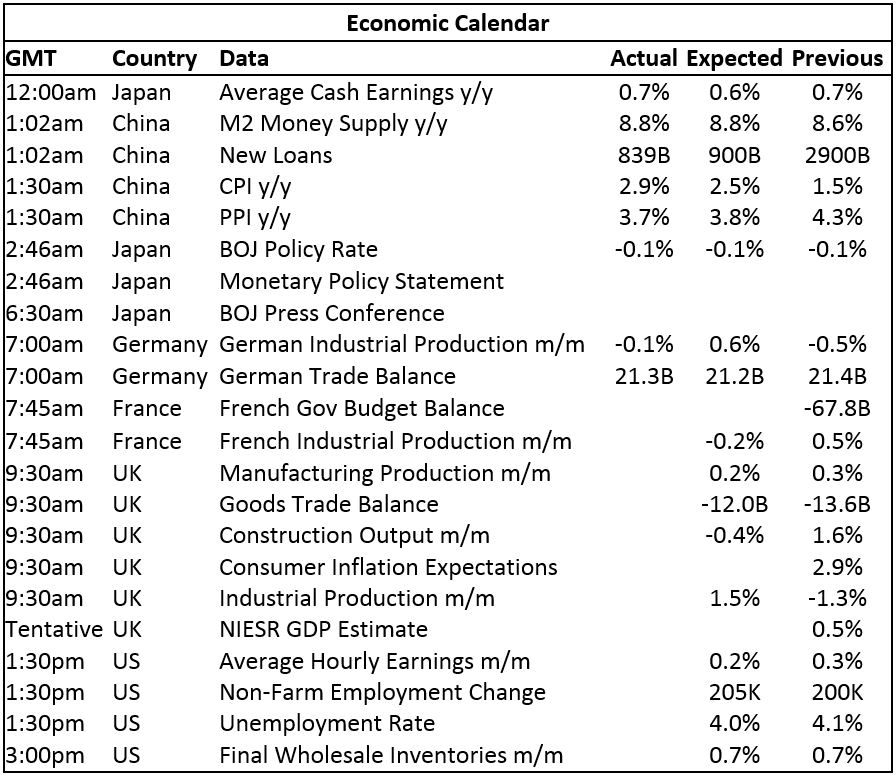

The economic agenda is busy today, especially as the US employment report is due this afternoon. Data out already today includes China’s new loans, consumer price index (CPI) and producer price index (PPI) and Germany’s industrial production and trade balance.

The main surprise has been China’s CPI that climbed 2.9% in February, from 1.5% in February last year, while its PPI fell to 3.7% from 4.3% over the same period. German industrial production fell 0.1%, it had been expected to climb 0.6%, but it was better than the previous reading of a 0.5% decline.

Data out later includes French government budget, French and UK industrial production, UK manufacturing production, UK construction output , UK goods trade balance and a gross domestic product (GDP) estimate. In addition to the US employment report, there is also data on wholesale inventories.

The base metals remain under pressure and so far the bargain hunting seems in no hurry to emerge in force. Given uncertainty over trade wars, it is not surprising risk is being taken off the table. As we have said of late, we expect these headwinds will pass and the underlying concerted global growth to underpin commodity prices, but sentiment may be weak for a while as these uncertainties prevail.

As such, we would let any weakness run its course but be on the lookout for buying opportunities once the winds start to change direction.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Metals morning view: Gold and silver prices down as US and N Korea agree to hold summit appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News