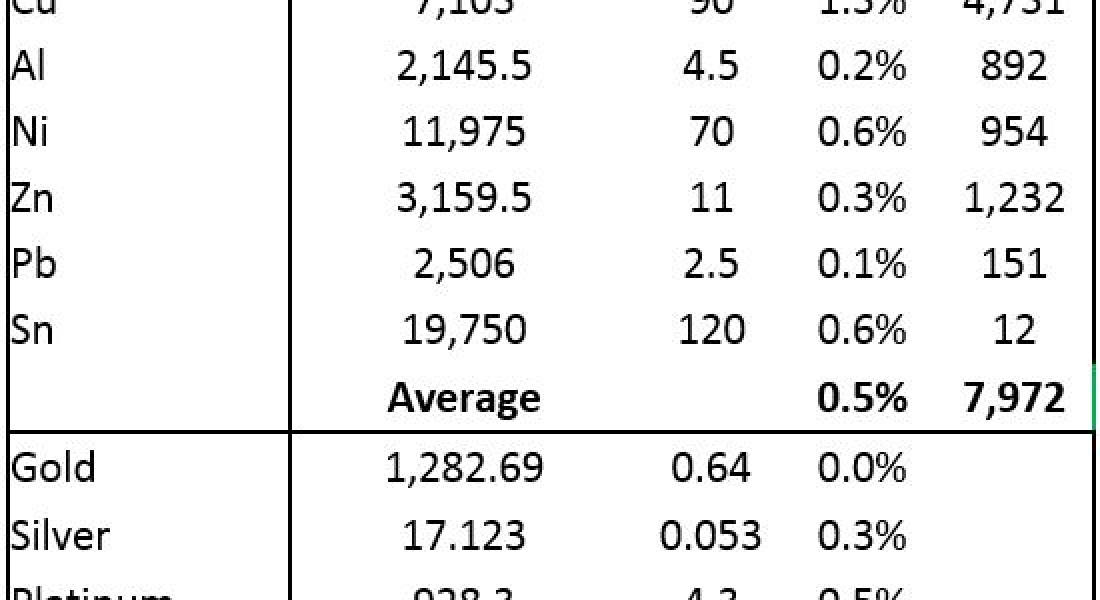

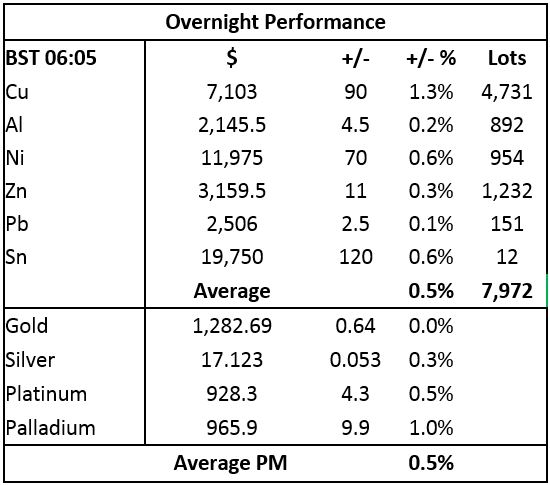

Base metals prices on the London Metal Exchange are firmer by an average of 0.5% this morning, Tuesday October 24. Three-month copper prices lead the advance with a 1.3% gain to $7,103 per tonne, with tin and nickel both up by 0.6% and aluminium, lead and zinc up by an average of 0.2%.

Volume has been above average with 7,972 lots traded as of 06:05 BST.

This follows a day of strength on Monday, when the base metals complex closed up by an average of 1%, with nickel, lead and zinc prices firmer by around 1.5%, while copper prices rose 0.6% and aluminium and tin prices closed up by 0.3%.

Precious metals prices are stronger this morning, led by a 1% gain in palladium prices to $965.90 per oz, with platinum prices up by 0.5%, silver prices 0.3% firmer and gold prices up marginally at $1,282.69 per oz. This after a divergent day of trading on Monday that saw palladium prices drop 1.9%, while the rest were up by between 0.2% and 0.6%.

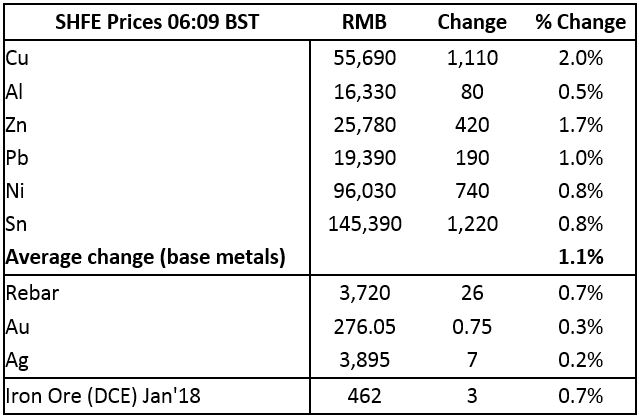

Base metals on the Shanghai Futures Exchange (SHFE) are up across the board this morning with some healthy gains being seen: copper prices are 2% higher at 55,690 yuan ($8,401) per tonne; zinc prices are up by 1.7%; lead prices are 1% firmer; nickel and tin are both up by 0.8% and aluminium prices are up by 0.5%. Spot copper prices in Changjiang are up by 1.9% at 55,690-56,190 yuan per tonne while the London/Shanghai copper arbitrage ratio is steady at 7.84.

The steel-orientated metals in China are firmer this morning with iron ore prices climbing by 0.7% to 462 yuan per tonne on the Dalian Commodity Exchange, while steel rebar prices on the SHFE are also up by 0.7%. Gold and silver prices on the SHFE are up by 0.3% and 0.2%, respectively.

In international markets, spot Brent crude oil prices are up by 0.23% at $57.43 per barrel. The yield on US ten-year treasuries has eased to 2.37% and the German ten-year bund yield is little changed at 0.43%.

Equities in Asia are stronger with the CSI 300 up by 0.5%, the Nikkei is 0.3% firmer, the Kospi is up by 0.2%, the ASX 200 is up by 0.1% and the Hang Seng is little changed. Western markets were mixed on Monday, in the USA, the Dow closed down by 0.23% at 23,273.96 and in Europe, the Euro Stoxx 50 closed up by 0.1% at 3,608.87.

The dollar index at 93.78 is well placed to work higher to challenge the top of the recent 92.75-94.27 range – the jury remains out as to whether this is a pause in the downward trend that has been in effect all year, or whether it is the start of a turning point for a move higher – the latter looks likely. If so then that could prove to be a headwind for the metals. That said, with US president Donald Trump reported close to deciding who will be the next US Federal Reserve chair, the dollar could see some short-lived volatility. The euro at 1.1756 is also consolidating, but is looking possibly toppy, while sterling is looking stronger at 1.3216, the Australian dollar at 0.7811 is under pressure, while the yen is trending lower, but saw some counter-trend strength on Monday.

The Chinese yuan remains weak, it was recently quoted at 6.6290, while the other emerging currencies we follow are slightly weaker, the exceptions being the Brazilian real which has weakened to 3.2362 from around 3.1500 on October 20, this on the back of political issues, while the rupee is looking firmer.

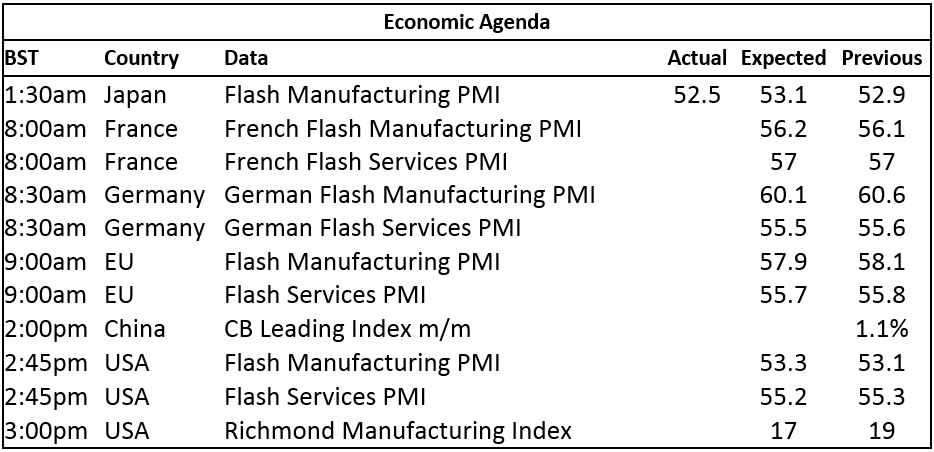

Today’s economic data is focused on flash purchasing managers’ index (PMI) data, out across much of Europe and the USA, and there is also data on China’s leading indicators. Data out already shows Japan’s flash manufacturing PMI dropped to 52.5 from 52.9 – it has averaged 52.55 so far this year.

Some strength emerged in the base metals camp on October 20, which did not last, but we did see another attempt on the upside on Monday and there has been follow-through strength so far today. This does suggest the pullback in the metals prices from last week’s early show of strength has run its course, so we now need to see if buying pressure is strong enough to see prices challenge the highs again. Our view of late has been to remain quietly bullish, but expect trading to become choppier as prices are generally in high ground, so we should expect more bouts of scale-up selling along the way. A firmer dollar is also likely to be a headwind for prices, but as it stands this morning, the complex is looking bullish. Tin has been the metal that has corrected the most; previous dips have turned out to be downward spikes so we wait to see if last week’s dip also turns out to be a spike.

Gold prices gapped lower on Monday and put in a low at $1,272.40 per oz, but as we have expected, the market has remained well supported and the dip attracted buying. With the metals and oil prices looking stronger, it may be that we see more buying of commodity baskets – which may be needed if gold prices are to stand firm against a stronger dollar. Needless to say, North Korea also remains a potentially bullish factor.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Weaker gold prices run into dip buying appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News