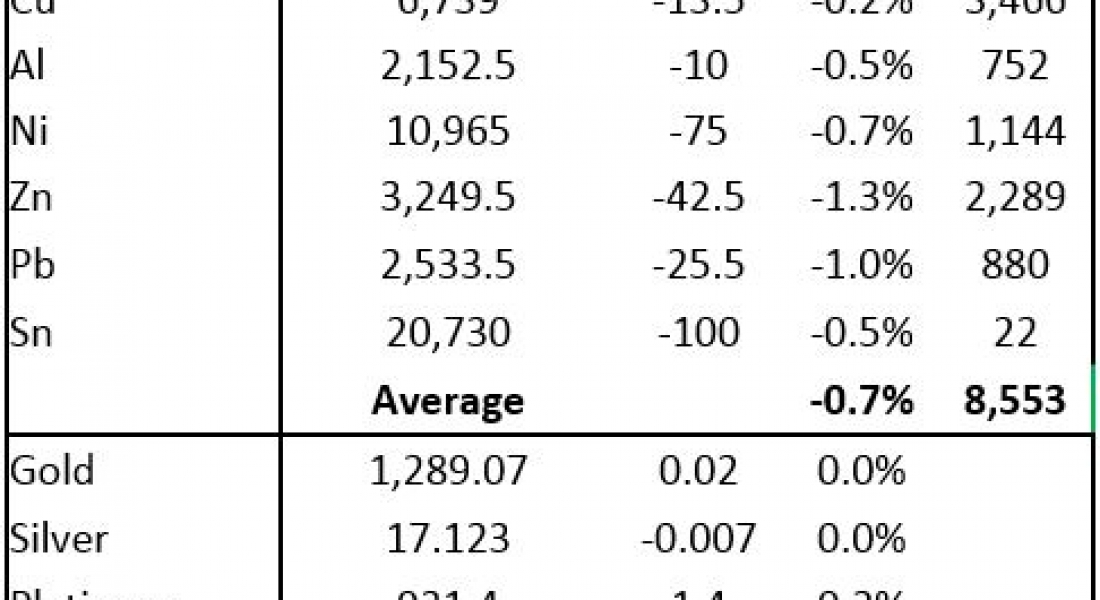

Base metals prices on the London Metal Exchange are mixed this morning, Friday October 13, with zinc and lead prices weaker by 0.3% and 1%, respectively; while aluminium and nickel prices are up by 0.2%, tin prices are firmer by 0.3% and copper prices are little changed at $6,875 per tonne.

Volume has been average with 5,881 lots traded as of 07:10 BST.

This morning’s trading follows a generally strong performance on Thursday when the base metals complex closed up by an average of 0.8%; led by a 2.1% gain in nickel, with copper prices up by 0.9%; while tin bucked the trend with a 0.4% fall.

Gold, silver and platinum prices are little changed this morning with spot gold prices at $1,295.75 per oz, while palladium prices continue to rally with a 0.6% gain to $978.80 per oz. This follows gains on Thursday that ranged from 0.1% for gold and 1.4% for palladium, with silver and platinum up either side of 0.4%.

In Shanghai, lead prices on the Shanghai Futures Exchange (SHFE) are off by 0.1%, while the rest of the complex are up by an average of 1.4%. Gains are ranged between 0.5% for tin prices and 2.6% for nickel prices, with copper prices up by 0.8% at 53,320 yuan ($8,090) per tonne. Spot copper prices in Changjiang are also firmer, up by 0.6% at 53,600-53,900 yuan per tonne while the London/Shanghai copper arbitrage ratio has eased to 7.75, after 7.79 on Thursday.

The steel-orientated metals in China appear to have turned a corner again with iron ore prices rallying by 3.9% to 450.50 yuan per tonne on the Dalian Commodity Exchange and steel rebar prices on SHFE are also up by 3.9%, while gold and silver prices are both up by 0.2%. If iron ore and steel rebar prices are heading higher again then that bodes well for commodities in general.

In international markets, spot Brent crude oil prices are up by 0.32% at $56.57 per barrel, the yield on US ten-year treasuries has eased to 2.32% and the German ten-year bund yield is weaker at 0.43%.

Equities in Asia are for the most part higher, led by a 1% rise in the Nikkei. The ASX 200 and CSI 300 are up by 0.3% and the Hang Seng and Kospi are little changed. This follows a slight pullback on Thursday, where in the USA, the Dow closed down by 0.14% at 22,841.01; while in Europe the Euro Stoxx 50 closed down by 0.05% at 3,605.54.

The dollar index’s pullback halted on Thursday and it is consolidating today around 93.00, the recent trading range being 91.01-94.27. The euro is consolidating at 1.1837, sterling is firmer at 1.3281, as are the yen at 111.93 and the Australian dollar at 0.7836.

The Chinese yuan has been firmer since the start of October but has been consolidating in recent days – it was recently quoted at 6.5818. The rand and rupee are both firmer, while the Mexican peso is weaker and the other emerging currencies are consolidating.

Data out already shows strong Chinese trade data with exports denominated in dollars climbing by 8.15% in September, up from 5.5% in August; while imports climbed by 18.7% in September, compared with 13.3% in August. This suggests a strong domestic market, as well as a healthy global market. Germany’s consumer price index (CPI) for September was confirmed as rising by 0.1%. Data out later includes US CPI, retail sales, UK leading indicators, preliminary University of Michigan consumer sentiment and inflation expectations, business inventories and the Federal budget balance. In addition, there is an International Monetary Fund meeting and US Federal Open Market Committee (FOMC) members Charles Evans and Robert Kaplan are speaking.

As we pointed out earlier in the week, copper and nickel had room on the upside and prices are climbing accordingly; while the base metals in or near high ground are having to absorb selling, which is keeping prices range-bound, albeit in high ground. They remain well placed to extend higher and a rebound in China’s iron ore and steel prices, combined with good Chinese trade day, may well be the catalysts. We remain quietly bullish, but expect trading to become choppier when prices run into more bouts of scale-up selling.

All the precious metals are looking firmer, although they have had a good run in recent days and with the slide in the dollar pausing, the metals’ rallies may pause too. That said, ahead of the weekend and with the North Korea crisis simmering in the background, we expect gold prices to remain well supported.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW 13/10: Gold prices edge higher despite halt in dollar’s slide appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News