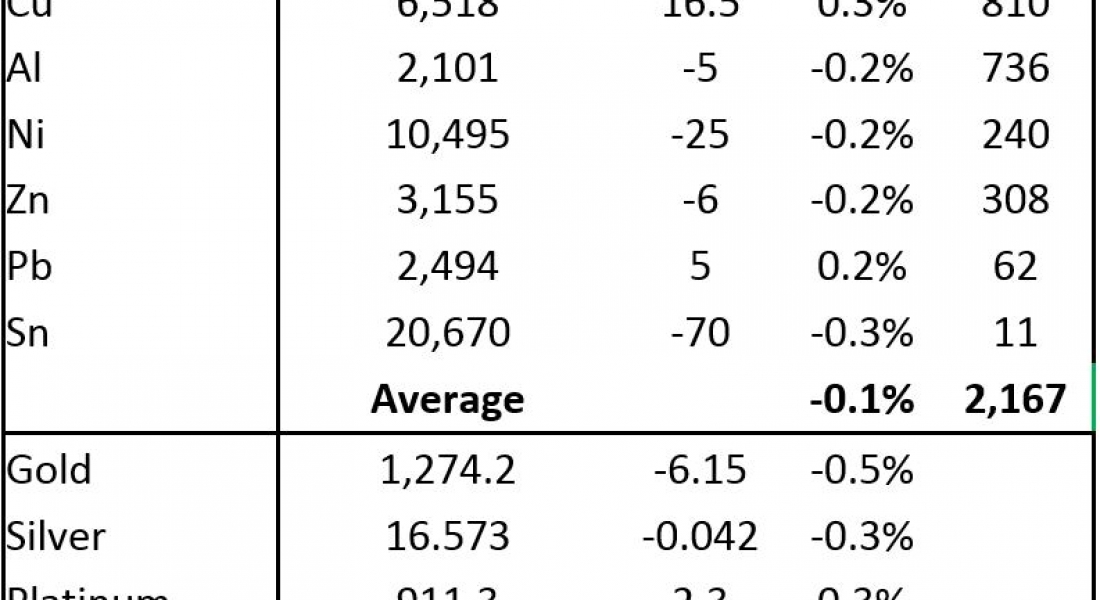

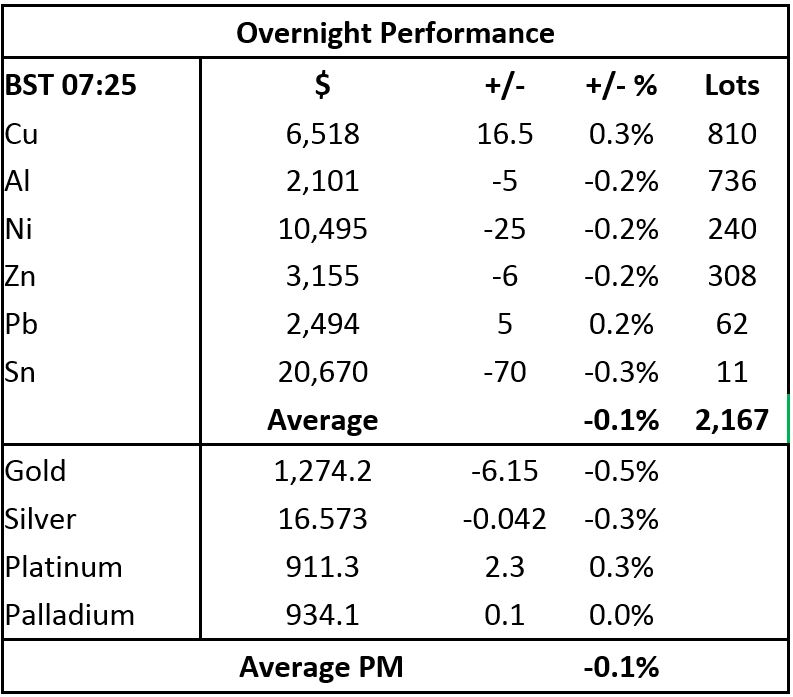

Base metals prices on the London Metal Exchange are for the most part weaker this morning, Monday October 2. The exception is copper with a 0.3% rise to $6,518 per tonne, while the rest are lower by an average of 0.2%. With Chinese markets closed for the country’s National Day Golden Week holiday, trading has been quiet with 2,167 lots traded as of 07:25 BST.

This after a divergent day’s trading on Friday when copper and aluminium prices dropped 0.8% and 1.5% respectively, while nickel closed up 0.7% and the rest were little changed.

Precious metals prices are split this morning between bullion prices that are weaker and firmer platinum group metal prices. Spot gold and silver prices are off by 0.5% and 0.3%, respectively, with gold at $1,274.20 per oz, while platinum prices are up by 0.3% and palladium prices are slightly firmer at $934.10 per oz. This follows losses on Friday of 1.4% for silver, 1.3% for platinum and 0.5% for gold, while palladium closed up 0.5%.

In international markets, spot Brent crude oil prices are off by 0.3% at $56.52 per barrel, the yield on US ten-year treasuries has climbed to 2.36% and the German ten-year bund yield is firmer 0.48%.

Asian equities that are open are for the most part positive this morning with the Nikkei up by 0.2% and the ASX 200 up by 0.8%.This follows a firmer session on Friday, where in the USA, the Dow closed up by 0.11% at 22,405.09; and in Europe, the Euro Stoxx 50 closed up by 0.88% to 3,594.85.

The dollar’s rise paused on September 28 and 29, but it is trying higher again this morning and at 93.42, is below the recent high of 93.67. We are still waiting to see if the dominant downward trend reasserts itself, or whether the downward trend has run its course and the ship has turned. A move up above 94.15, would suggest the latter. The direction of the dollar could have a meaningful impact on the underlying trends in the metals, especially gold. With the dollar firmer, the currencies are looking weaker again with the euro at 1.1760, sterling at 1.3350, the yen at 112.89 and the Australian dollar at 0.7814.

Emerging market currencies are mixed with the rupiah and ringgit continuing to slide, the rupee is showing some strength after recent weakness, as is the real, while the rand and peso are consolidating.

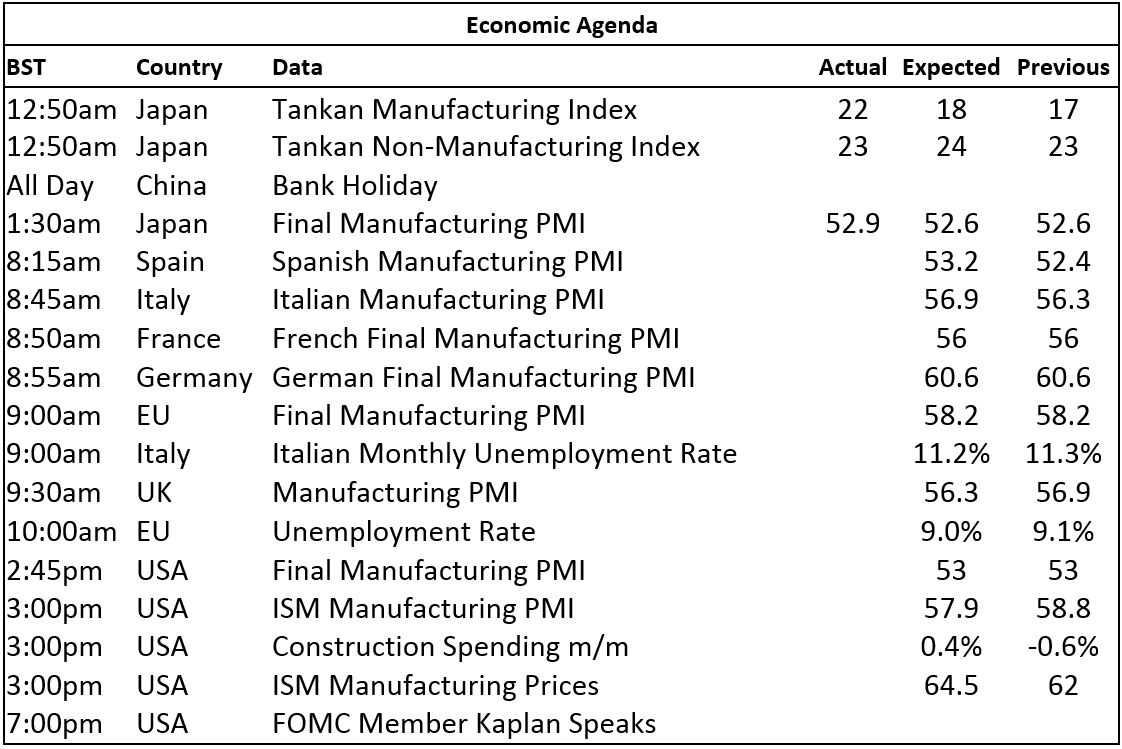

The economic agenda is busy today, with Japan’s Tankan manufacturing index rising to 22, from 17, and the Tankan non-manufacturing index unchanged at 23, while its final manufacturing PMI climbed to 52.9 from 52.6. Later there is manufacturing PMI out across Europe, the UK and USA, as well as data on Italian and EU unemployment, US construction spending and ISM manufacturing prices. In addition, US Federal Open Market Committee member Robert Kaplan is speaking. Data out on Saturday showed China’s official manufacturing PMI climb to 52.4 from 51.7, the non-manufacturing PMI rise to 55.4 from 53.3, while the Caixin manufacturing PMI dropped to 51, from 51.6.

The base metals are looking mixed; lead and zinc are the ones looking the strongest, copper and nickel prices started to rebound, but seem to lack energy, tin is holding up in high ground, but also lacks energy, while aluminium prices are under downward pressure. With lead, zinc and tin cash/three-month spreads backwardated, tightness is likely to underpin prices, while large contangoes in copper and nickel suggest profit-taking and or increased availability. Generally, we remain quietly bullish, but where weakness is being seen we see it as the market reacting to overbought conditions.

Gold, silver and platinum prices continue to correct and the stronger dollar and lull in tensions over North Korea, seem to be weighing on prices. We would let the corrections run their course, but the North Korean situation is likely to escalate again at some stage, so the next rally in gold prices may not be that far away. Palladium prices appear to have put in a base, so we wait to see if follow-through buying re-emerges.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices remain under pressure as dollar firms appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News