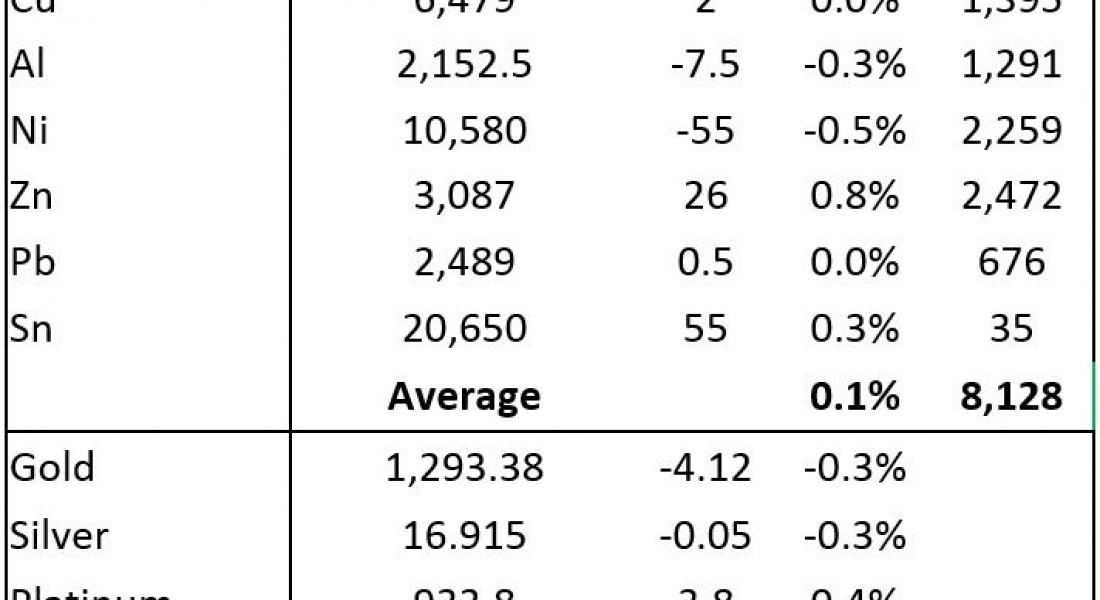

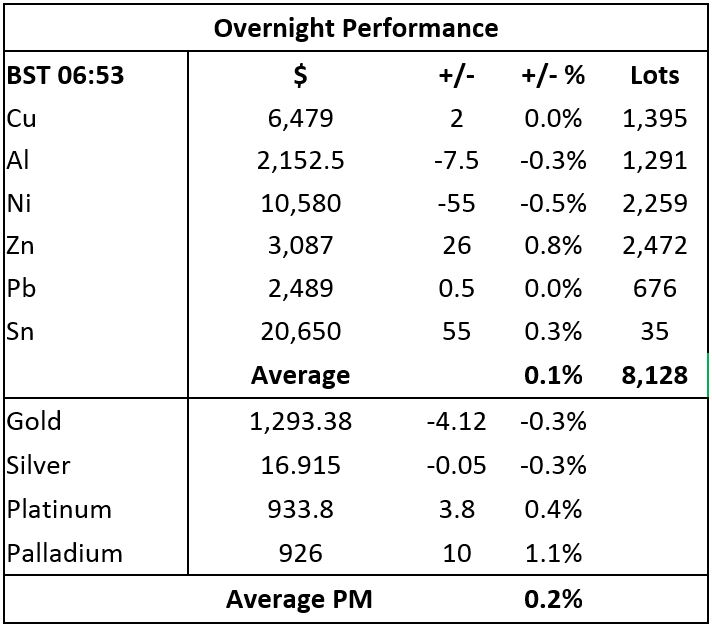

Base metals traded on the London Metal Exchange are on divergent paths this morning, Monday September 25, with zinc and tin prices higher by 0.8% and 0.3%, respectively; lead and copper prices are little changed with three-month copper at $6,479 per tonne; and nickel and aluminium prices are weaker by 0.5% and 0.3%, respectively.

Volume on the exchange has been fairly high with 8,128 lots traded as of 06:53 BST. This follows a generally stronger day on Friday when the complex rebounded to close up by an average of 0.4%, with nickel the only metal to close in negative territory.

Bullion prices are weaker this morning with gold and silver prices both down by 0.3%, with spot gold prices at $1,293.38 per oz. The platinum group metals are firmer with platinum prices up by 0.4% and palladium prices up by 1.1% at $926 per oz.

This follows on from Friday when gold and palladium prices closed up by 0.4% and 0.5%, respectively, while silver prices were off by 0.1% and platinum prices dropped by 0.6%.

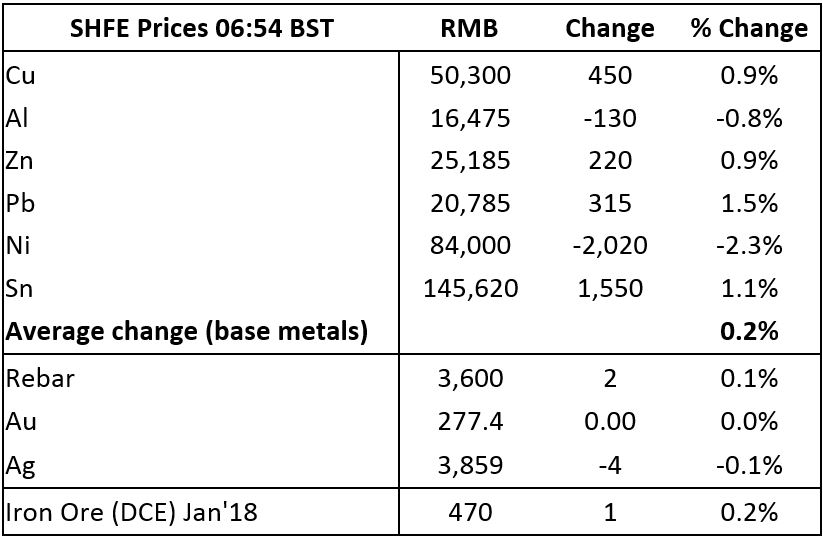

On the Shanghai Futures Exchange (SHFE) this morning, aluminium and nickel prices are down 0.8% and 2.3%, respectively, while the rest are up by between 0.9% for copper, which was recently quoted at 50,300 yuan ($7,623) per tonne and 1.5% for lead. So lead prices continue to steam ahead in China.

Spot copper prices in Changjiang are up by 1.1% at 50,340-50,510 yuan per tonne and the London/Shanghai copper arb ratio has edged higher to 7.77 from 7.76 on Friday.

The recent spell of weakness in iron ore and steel rebar prices has halted this morning, with January iron ore prices up by 0.2% at 470 yuan per tonne on the Dalian Commodity Exchange, while SHFE steel rebar prices are up by 0.1%. Gold prices on the SHFE are unchanged while silver prices are off 0.1%.

In international markets, spot Brent crude oil prices are up by 0.1% at $56.79 per barrel and the yield on US ten-year treasuries is unchanged at 2.25%, while the German ten-year bund yield is little changed at 0.44%.

Asian equities are for the most part weaker this morning with the Hang Seng off 1.1%, the CSI 300 is down 0.4%, the Kospi is down 0.3%, the ASX 200 is little changed, while the Nikkei is bucking the trend with a 0.5% gain on reports Japanese prime minister Shinzō Abe is planning to introduce another stimulus package. This follows a mixed performance on Friday, where in the USA, the Dow closed down by 0.04% at 22,349.59, while in Europe, the Euro Stoxx 50 climbed 0.05% to 3,541.42.

The dollar became quite choppy last week, but at 92.27 the index is looking supported and looks to be trying to work higher, which could be a headwind for metal prices. The euro at 1.1921 is holding up in high ground, but looks a bit toppy, as are sterling at 1.3556 and the Australian dollar at 0.7961, while the yen is looking weak at 112.23.

The Chinese yuan continues to weaken, it was recently quoted at 6.6063. The rupee at 64.84 is consolidating recent weakness, while the rest of the emerging currencies we follow are fairly flat.

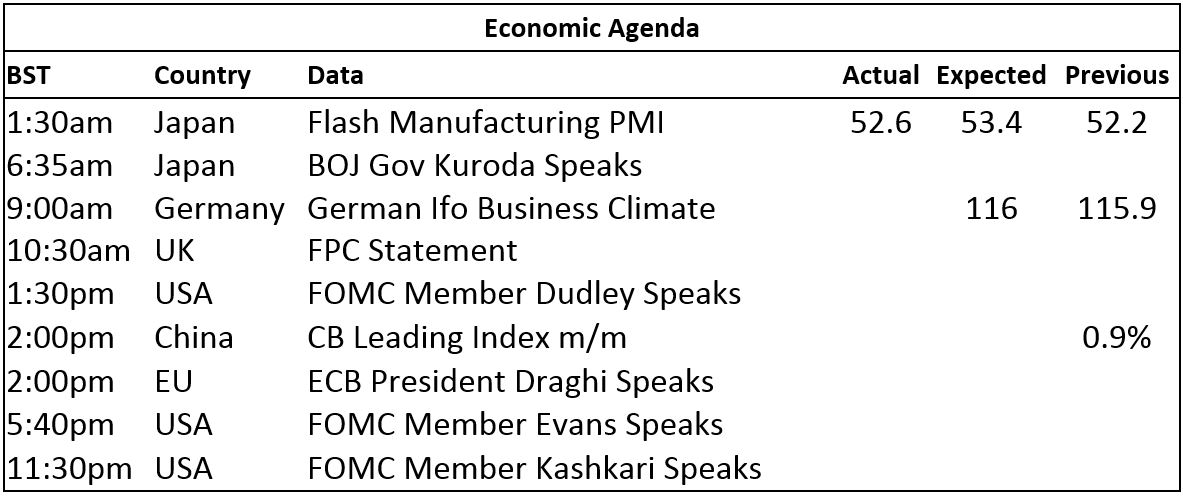

Data out already today showed Japan’s manufacturing PMI climb to 52.6 from 52.2. Later there is data on German Ifo business climate, a Bank of England Financial Policy Committee statement and Chinese leading indicators. In addition, US Federal Open Market Committee (FOMC) members William Dudley, Charles Evans and Neel Kashkari are speaking today.

The base metals are for the most part consolidating after recent gyrations, the exception is nickel where prices are still selling off. Copper prices ran into dip buying on Friday, while the rest are holding up in high ground and look well placed to challenge highs, although there does seem to be overhead selling around that may continue to either cap the advance or slow progress down.

Gold prices have been correcting recent gains, the pullback tested the break-up level at $1,295 per oz and it gave way, which is a sign of weakness. Prices also did not get too bullish ahead of the weekend when tensions over North Korea could have picked up, which is another sign that the market is tired. Silver and platinum look weak, with the latter starting to look oversold again, while palladium price weakness seems to be attracting support.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices looking for support appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News