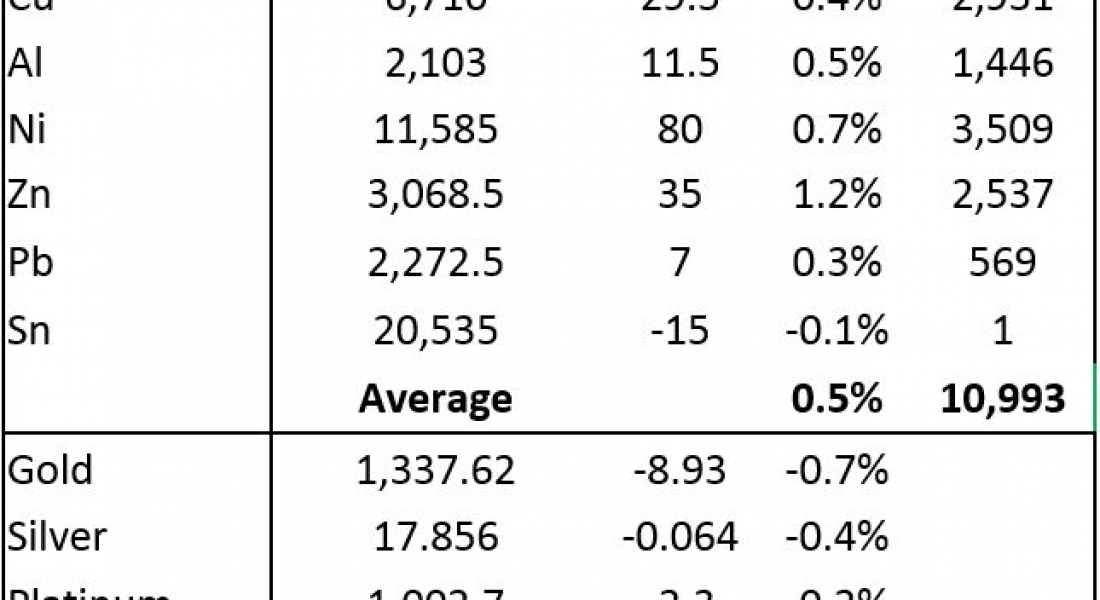

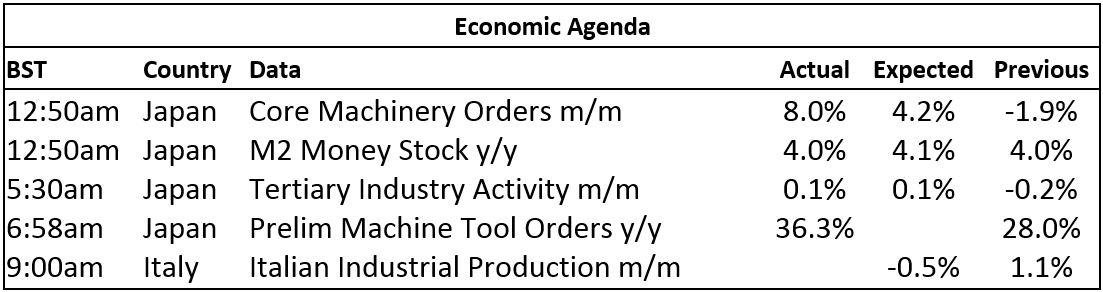

Base metals prices on the London Metal Exchange are up by an average of 0.5% this morning, Monday September 11, with prices ranged between up by 1.2% for zinc and down by 0.1% for tin – three-month copper prices are up by 0.4% at $6,710 per tonne.

Volume has been high with 10,993 lots traded, with nickel showing the highest volume with 3,509 lots, compared with copper’s 2,931 lots.

This follows an expected day of price correction on Friday when prices closed down an average of 3%, led by a 5.6% decline in nickel prices. We should now get a feel for how bullish underlying sentiment is by seeing how well supported the dips are.

Precious metals are split with palladium prices up by 0.8% at $941.10 per oz, while gold, silver and platinum prices are all down by between 0.7% and 0.2%, with spot gold prices at $1,337.62 per oz. This follows a day of weakness on Friday, when palladium prices dropped 2.1%, silver and platinum prices fell 0.9% and gold prices were down just 0.1%.

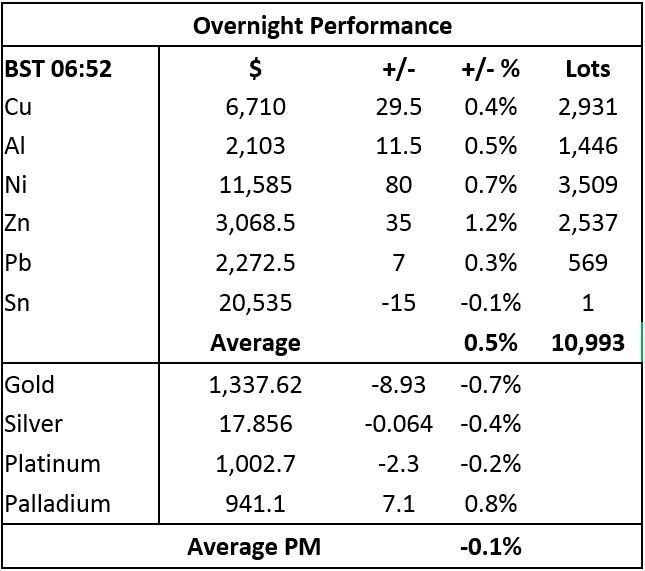

On the Shanghai Futures Exchange (SHFE) this morning, the base metals are mainly weaker, down an average of 1.3%, led by a 3.8% decline in nickel prices, while aluminium prices are up 0.7% and the rest are off between 0.1% for tin and 1.9% for copper, which was recently quoted at 51,380 yuan ($7,904) per tonne. Spot copper prices in Changjiang are down 2.7% at 51,150-51,250 yuan per tonne and the London/Shanghai copper arb ratio has dropped to 7.66 (7.74).

Steel rebar prices on the SHFE are weaker again this morning, off 0.6%, gold prices are down 0.4% and silver prices are off 1.2%. Iron ore prices for January delivery continue to retreat, with prices down 2% at 534.50 yuan per tonne on the Dalian Commodity Exchange.

In international markets, spot Brent crude oil prices are up by 0.6% at $54.05 per barrel and the yield on US ten-year treasuries has jumped to 2.09%, while the German ten-year bund yield has climbed to 0.33%.

Equities in Asia are for the most post part bullish with the Nikkei up 1.3%, the Hang Seng is up 0.98%, the ASX 200 is up 0.73%, the Kospi is up 0.62%, while the CSI 300 is little changed. US markets were little changed on Friday with the Dow closing up 0.06% at 21,797.79, while in Europe the Euro Stoxx 50 closed flat at 3,447.69.

The dollar index has recovered to 91.51 having set a fresh multi-year low at 91.01 on Friday, the euro is firm at 1.2016, having peaked at 1.2092 on Friday, sterling is strong at 1.3181 and the yen at 108.38, has weakened slightly after reaching 107.32 on Friday. Similarly, the Australian dollar at 0.8043 has pulled back from Friday’s peak of 0.8125. So were Friday’s spikes in the dollar and currencies a turning point?

The Chinese yuan has weakened to 6.5240, from Friday’s peak of 6.4345. Some relaxation in restrictions on shorting the yuan have led to the weakness. The rupiah, real, and ringgit have all strengthened or are holding on to recent gains, while the peso, rand and rupee are consolidating. The strength in the currencies suggests a degree of confidence in emerging markets.

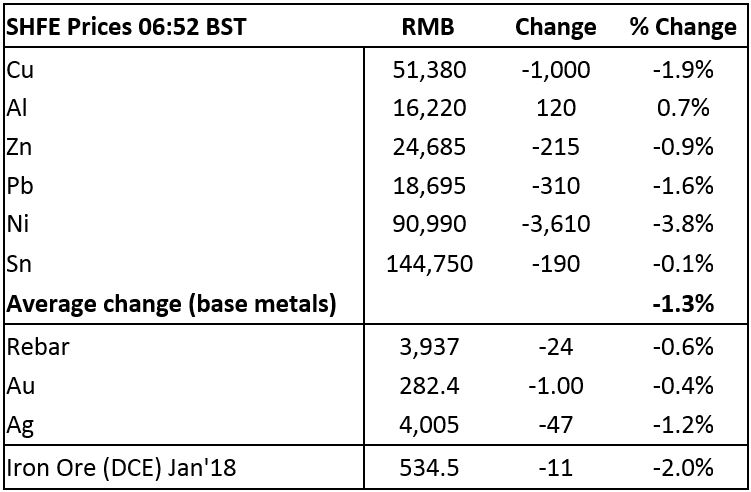

Data out already today showed Japan’s core machinery orders climb 8%, better than the 4.2% rise expected, M2 money supply climbed 4%, tertiary industry orders climbed 0.1% and preliminary machine tool orders climbed 36%. Italian industrial production is out later.

Friday’s corrections in the LME metals prices were to some extent expected and overdue as it has recently felt like prices had run ahead of the fundamentals. Copper and nickel prices were the hardest hit, but they were the ones that had climbed the fastest, while aluminium prices corrected the least with prices holding up well. With no missile launches from North Korea over the weekend the markets seem to be breathing a sigh of relief and the corrections have paused. Whether the pause continues to attract dip buying remains to be seen. We would not be surprised if there was further weakness, especially if the rebound in the dollar has further to go.

Gold prices are correcting recent strength and if North Korea avoids testing another missile for a while then prices may fall back into consolidation mode. That said, there is a UN vote on more sanction against North Korea today, which could stir up tensions again. On the charts, the precious metals prices are looking a bit toppy and with the dollar attempting to rebound, gold prices may face some profit-taking.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices correct as dollar rebounds appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News