Stronger than expected Chinese official PMI manufacturing data at 51.7, compared with 51.4 previous and 51.3 expected, has given most of the base metals a boost this morning, Thursday August 31.

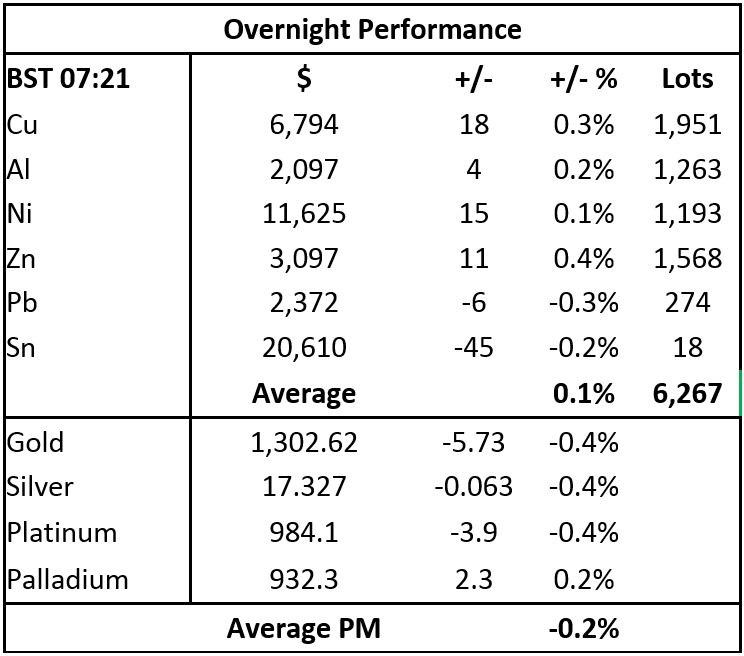

Zinc leads the way with a 0.4% rise, followed by copper prices (0.3%, at $6,794 per tonne), aluminium (0.2%) and nickel (0.1%), while lead and tin are lower by 0.3% and 0.2%, respectively. Volume has been average with 6,267 lots.

This comes after a generally weaker day on Wednesday that saw the base metals complex close down by an average of 0.3%, led by a 1% drop in nickel prices and a 0.8% fall in zinc prices, while copper prices closed off 0.4% at $6,776 per tonne. Tin was the main one to buck the trend with a 1% gain, while aluminium prices were little changed.

Precious metals are for the most part lower, with gold, silver and platinum prices all off 0.4%, with spot gold prices at $1,302.62 per oz, while palladium prices are up 0.2% at $932.30 per oz. This follows a day of weakness on Wednesday that saw the complex close down by an average of 0.6%.

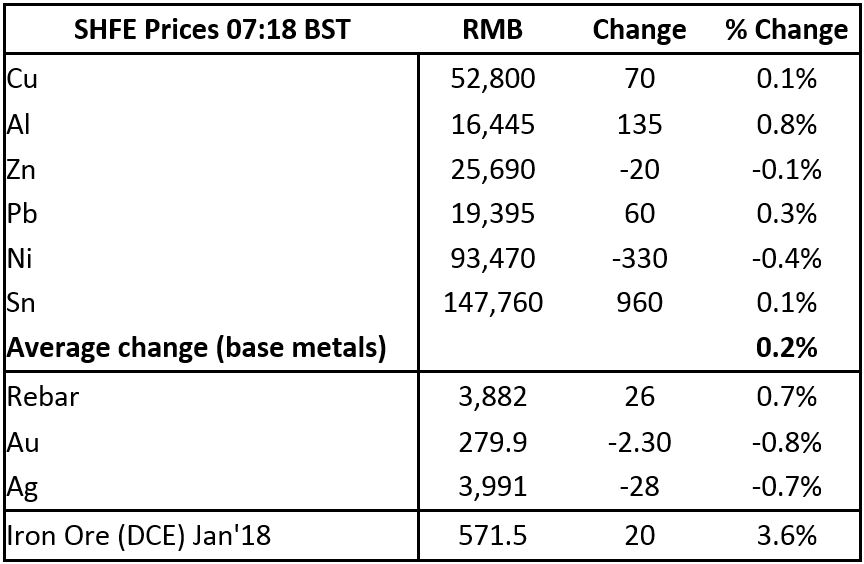

On the Shanghai Futures Exchange (SHFE) this morning, zinc and nickel prices are off by 0.1% and 0.4%, respectively, while the rest of the complex are up by between 0.1% for tin prices and copper prices – at 52,800 yuan ($8,009) per tonne – and 0.8% for aluminium prices. Spot copper prices in Changjiang are up 0.2% at 52,250-52,700 yuan per tonne and the London/Shanghai copper arb ratio is weaker at 7.77.

Steel rebar prices on the SHFE are up by 0.7%, gold and silver prices are off by 0.8% and 0.7%, respectively, while January 2018 iron ore prices on the Dalian Commodity Exchange have rebounded by 3.6% to 571.50 yuan per tonne.

In international markets, spot Brent crude oil prices are up 0.2% at $50.70 per barrel and the yield on US ten-year treasuries is unchanged at 2.15%, while the German ten-year bund yield is firmer at 0.37%.

In equities this morning, gains are being seen on the Nikkei (0.72%), the ASX 200 (0.79%), while loses are being seen on the Hang Seng (-0.68%), the CSI 300 (-0.42%) and on the Kospi (-0.38%). In the USA, the Dow Jones closed up 0.12% at 21,892.43 on Wednesday, while in Europe, the Euro Stoxx 50 closed up 0.46% at 3,403.71.

The dollar index at 92.93 is rebounding after Tuesday’s drop to 91.62, the weakness on the back of falling bond yields, which in turn appear to be a factor of the impact of Hurricane Harvey and the escalation in tension over North Korea. The rebound was given a boost on Wednesday by strong US data on employment and an upward revision to GDP that came in at an annualised rate of 3%, rather than 2.6%. Conversely, currencies are weaker with the euro at 1.1890, the yen at 110.47, the Australian dollar at 0.7902 and sterling is flat at 1.2917.

In emerging market currencies the yuan is consolidating recent gains, it was recently quoted at 6.6009, while the other currencies we follow are for the most part flat.

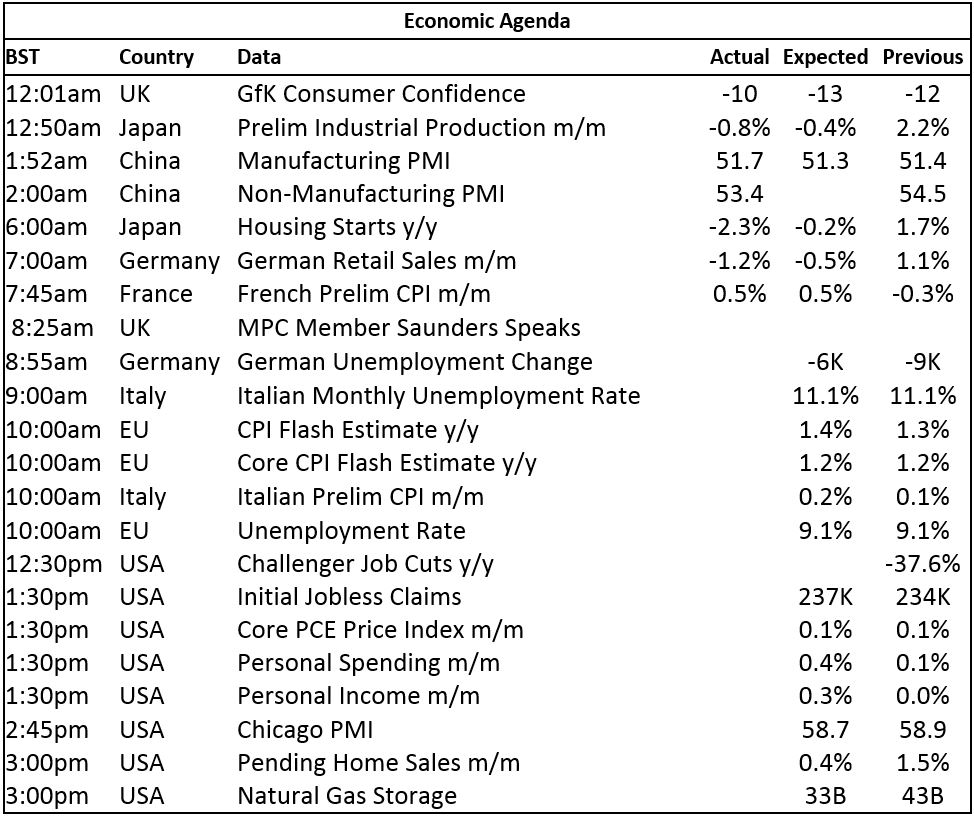

Today’s economic agenda is very busy. Japan’s July industrial production fell 0.8%, June’s was revised up to 2.2% from 1.6%, its housing starts fell 2.3%, from an increase of 1.7%, China’s non-manufacturing PMI dropped to 53.4, from 54.5, German retail sales dropped 1.2%, after a 1.1% rise and French CPI climbed 0.5%, after a 0.3% decline – so quite a mixed bag. Data still to come includes German and EU unemployment change, Italian and EU unemployment rate, EU and Italian CPI, with US data including initial jobless claims, personal income, spending and PCE prices, Chicago PMI, pending home sales and natural gas storage – see table below for more details.

Most of the base metals prices are in upward trends, with prices consolidating in high ground, lead and tin are the two that are still somewhat below their high ground. The trends show underlying strength and the fact dips have been limited and well supported, suggest robust markets, but high prices are likely to attract more selling from profit-taking and pricing, so we should expect choppy trading for a while, especially with today being the last trading day of the month. On balance, we remain bullish for the base metals complex, but would not be surprised to see some consolidation.

Gold prices seem to be pulling back to test their break out level which was around the $1,300 per oz level, the firmer dollar and good US data may be a headwind, but the main driver is still likely to be the uncertainty over North Korea and that problem is unlikely to go away any time soon. As such, we expect gold prices will remain well supported. Silver is following gold’s lead, platinum prices are consolidating but look bullish overall and palladium prices are consolidating in high ground.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Better US data supports dollar, weighs on gold prices appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News