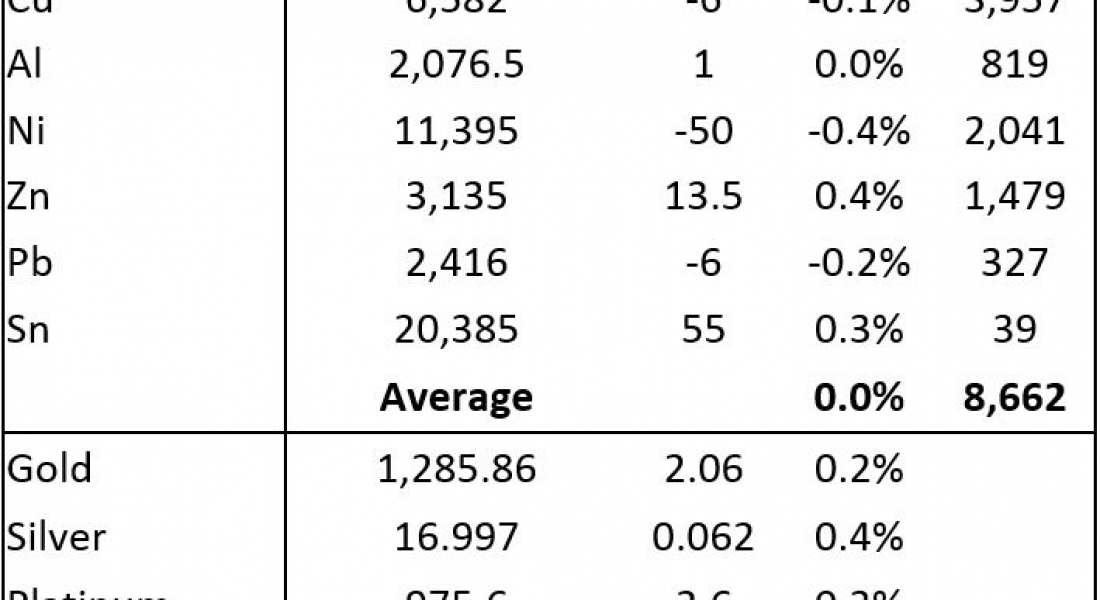

Base metals prices on the London Metal Exchange are for the most part consolidating this morning, Wednesday August 23, with three-month copper prices off by 0.1% at $6,582 per tonne, while zinc prices are up by 0.4% and nickel prices are off by 0.4%. Volume has been average with 8,662 lots traded as of 06:43 BST.

This comes after a split performance on Tuesday, when lead led the gains with a 3.2% rally, nickel prices closed up 1% and copper closed up 0.2%, while the rest were led lower by a 0.8% decline in tin prices.

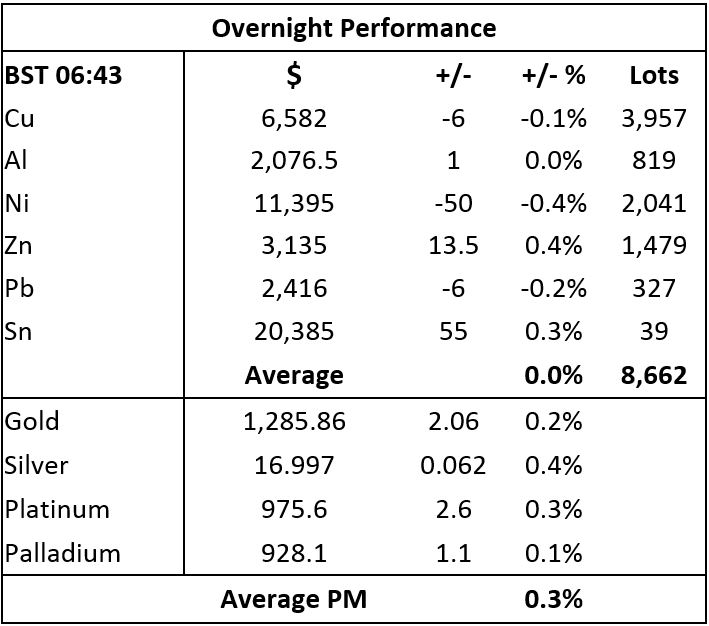

Precious metals prices are up across the board this morning by an average of 0.3%, led by a 0.4% rise in silver prices, spot gold prices are up 0.2% at $1,285.86 per oz. This follows a down day on Tuesday when the complex closed off 0.6% on average, led by a 1% fall in palladium prices.

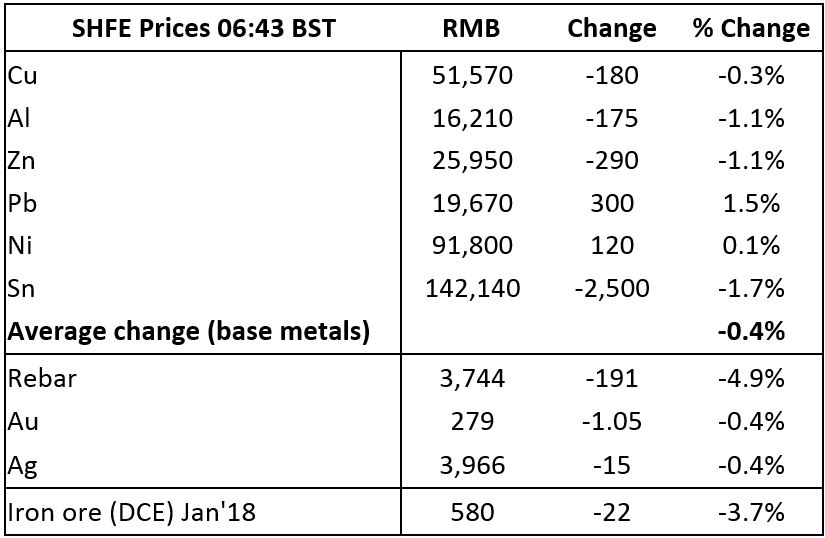

On the Shanghai Futures Exchange (SHFE) this morning, the base metals complex is for the most part weaker with prices off an average of 0.4%, led by a 1.7% drop in tin prices, aluminium and zinc prices are off 1.1% and copper prices are off 0.1% at 51,570 yuan ($7,739) per tonne. Bucking the trend are lead and nickel prices, up by 1.5% and 0.1%, respectively.

Spot copper prices in Changjiang are off 0.2% at 51,150-51,420 yuan per tonne and the LME/Shanghai copper arb ratio stands at 7.86 (unchanged from Tuesday).

Other metals in China are looking weaker, SHFE rebar prices are down 4.9% and iron ore prices on the Dalian Commodity exchange are down 3.7% at 580 yuan per tonne on the January 2018 contract, while gold and silver prices on SHFE are both down 0.4%.

In international markets, spot Brent crude oil prices are up by 0.2% at $51.71 per barrel, the yield on US ten-year treasuries is firmer at 2.21%, and the German ten-year bund yield is at 0.40%

Equities are for the most part stronger today – the Hang Seng Index (+0.9%), the Nikkei (+0.2%), the CSI 300 (0.1%) are higher, while the ASX 200 is off 0.3% and the Kospi is off 0.1%. In the USA, the Dow Jones closed up 0.9% at 21,799.89 and in Europe, the Euro Stoxx 50 closed up 0.94% at 3,455.59.

The dollar index is firmer this morning at 93.52, correspondingly the euro is weaker at 1.1758, sterling is drifting at 1.2820, the yen is at 119.43 and the Australian dollar is weaker at 0.7886.

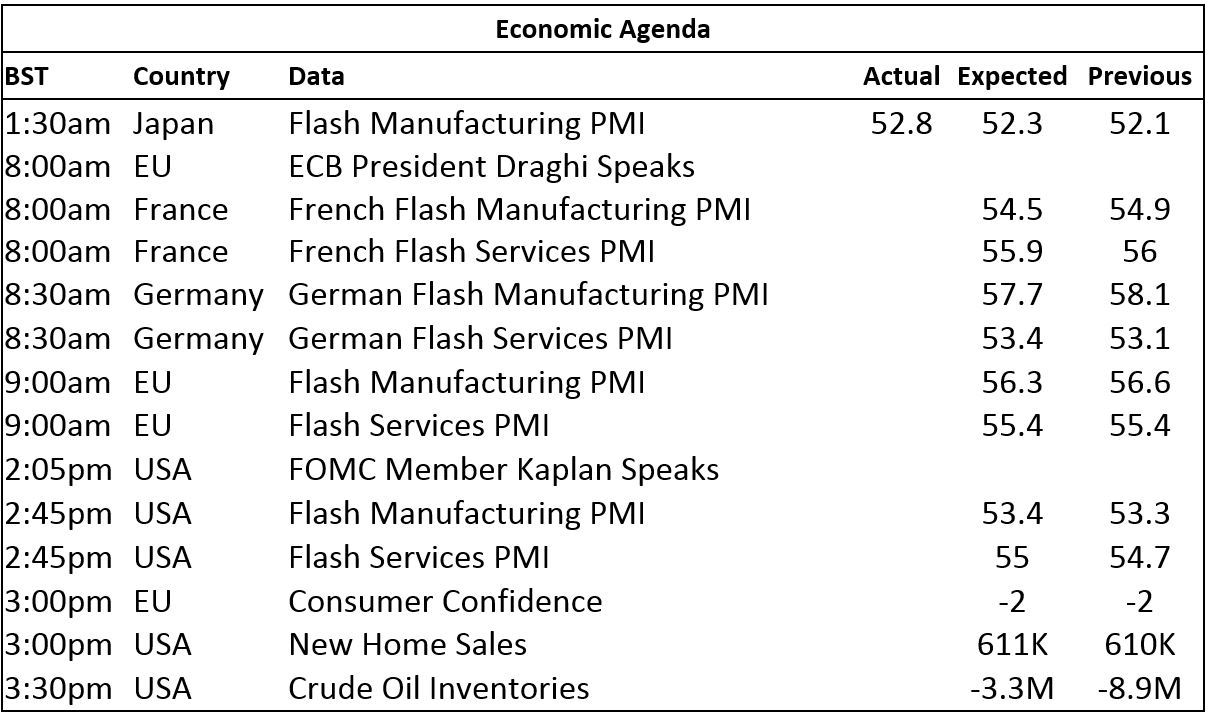

The focus on the economic data front is the flash manufacturing and services PMI with Japan’s data on manufacturing improving to 52.8 from 52.1, later there is data out on France, Germany, the EU and the USA. In addition, there is data on EU consumer confidence, US new home sales and US crude oil inventories. European Central Bank president Mario Draghi and US Federal Open Market Committee member Robert Kaplan are also speaking.

For the most part, base metals prices are consolidating after their strong gains seen in mid-August or earlier. Tin and lead are the more volatile ones, but overall the trends continue to look bullish, but up at these higher price levels the metals are likely to have to absorb more selling/pricing, so choppy trading should be expected. Key will be how well dips are supported. On balance, we remain bullish for the base metals complex.

Precious metals prices are also consolidating, gold and silver prices are holding up well for now and given the geopolitical undercurrent that is not surprising, but the platinum group metals may be more vulnerable to price corrections, especially palladium.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices pause ahead of this year’s highs appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News