The weak dollar and dialling back of US Federal Reserve (Fed) monetary tightening expectations has given a modest lift to the precious metals, which stand up a net 0.3% at the time of writing. Palladium is holding in firm ground having touched a fresh 17-year high above $920 per oz.

For the precious metals diverging views in the FOMC are likely to push back rate-rise expectations, which is supportive for price sentiment. The question now is how markets react as Fed hawks continue to signal the central bank will continue to tighten monetary policy. Meanwhile palladium has made an upside break above $900 and could be set for further gains following the emergence of exchange-traded fund investment demand recently.

The base metals remain in a buoyant mood, as dollar weakness has supported follow-through buying after the minutes of the July US Federal Open Market Committee (FOMC) meeting showed growing division among policy setters over the path of interest rates given the lack of inflationary pressures.

The base metals trading on the London Metal Exchange are trading in positive ground; aluminium, zinc and lead have set fresh 2017 highs overnight after the complex surged higher on Wednesday, closing with a net 3.4% gain, driven by a mix of option, momentum and stop-loss buying, which saw lead and zinc surge by over 5.5% on the back of heavy trading volumes. At the time of writing the metals were up by an average of 0.8%, while volume has been strong with 9,414 lots traded on LME Select as of 07:20 BST.

On the Shanghai Futures Exchange (SHFE) this morning, prices up by a net 2.4% at the time of writing, led by lead, nickel and zinc as they react to the surge in LME prices on Wednesday.

In other metals in China, September iron ore prices on the Dalian Commodity Exchange are up by 2.9% at 582.5 yuan per tonne while steel rebar futures on the SHFE are down by 0.7%.

Equities have seen a mixed start in Asia; the CSI 300 was up 0.2% while the Nikkei and Hang Seng were down by 0.1% and 0.2%, respectively.

In other markets, oil prices are little change so far and remain capped ahead of $50 per barrel by high output. The dollar index currently stands at 93.44, after closing down 0.4% in response to the FOMC minutes. The index set a low of 92.84 on August 3.

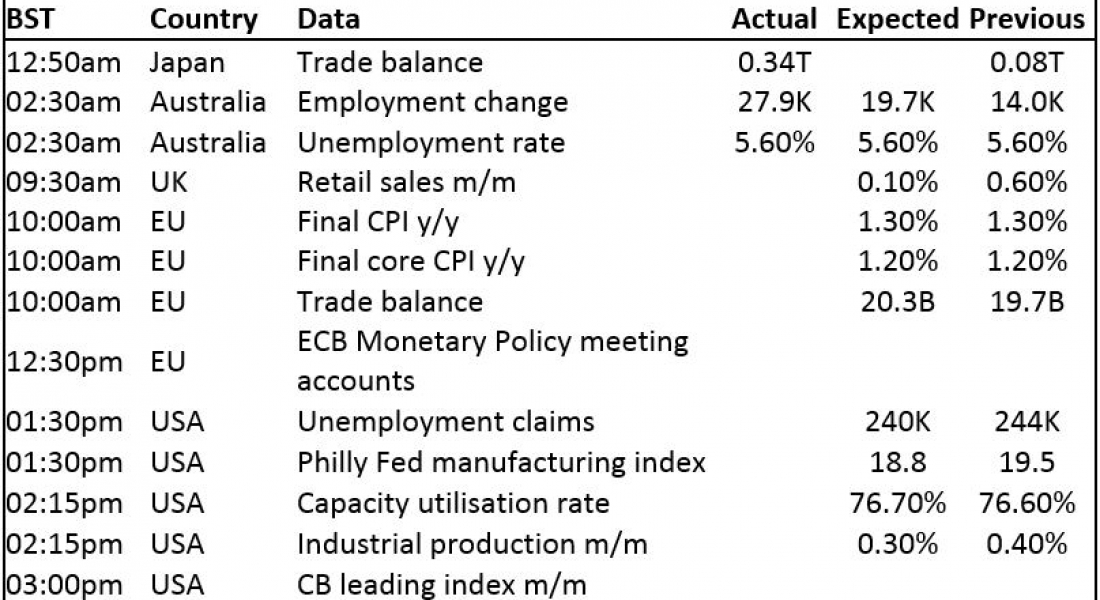

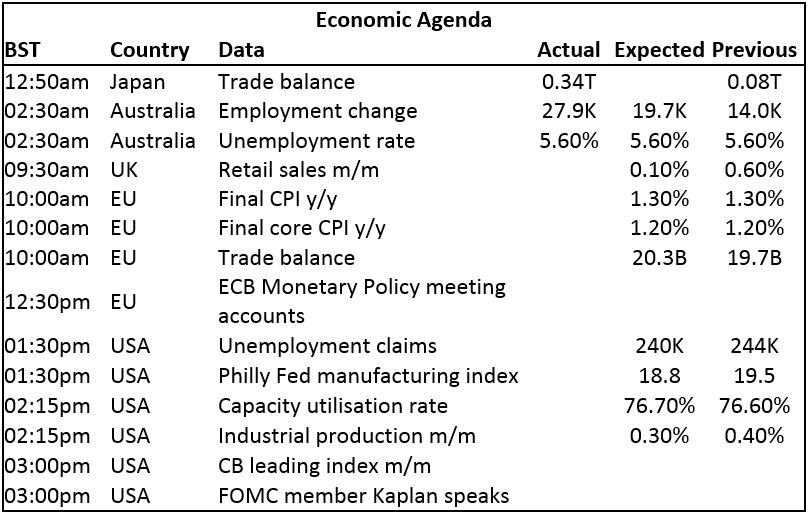

Figures overnight have shown a further pick-up in employment in Australia as the country added 27,900 jobs in July. The unemployment rate held unchanged at 5.6%. Later today, final CPI inflation readings from the Eurozone are expected to be unchanged from last week’s flash readings. From the USA, the Philly Fed manufacturing index and weekly jobless claim figures are expected to remain stable, as are industrial production and capacity utilisation.

Clearly sentiment towards the base metals is bullish, bolstered by expectations of stronger broad-based economic growth, but also as producer restraint has served to tighten the underlying fundamentals for many of the metals. For the moment the trend is to the upside however this run-up is in danger of running ahead of the fundamentals. There is also the danger stronger price will challenge producer restraint, which risks negating the bullish underlying fundamentals.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Weak dollar and Fed give modest lift to precious metals appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News