Precious metals prices are broadly unchanged, with the exception of platinum, down 0.3%, after outperforming its peers at the end of last week. This quiet start to the week follows a marked sell-off on Friday, mostly driven by a strong increase in the dollar and US real rates following the US jobs data release, which probably prompted some speculative selling across the board.

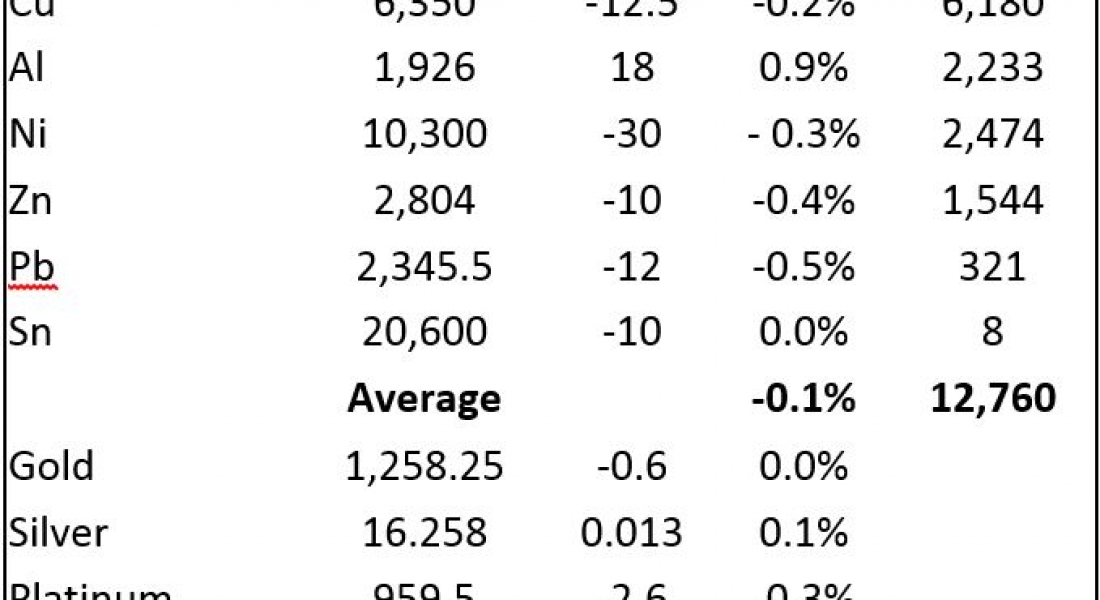

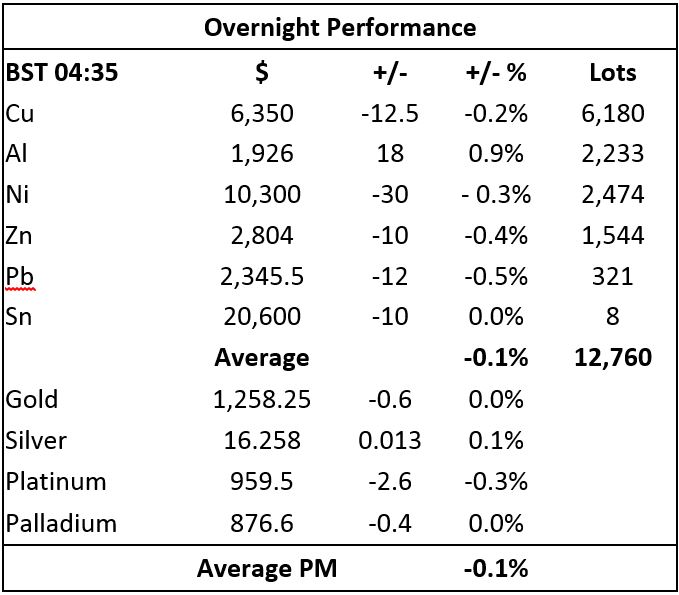

Base metals traded on the London Metal Exchange are under slight downward pressure at the start of the week in spite of some dollar weakness and solid global risk appetite. The only exception is aluminium, up about 1%, reflecting positive micro dynamics. Volume has been high, with 12,760 lots traded as of 04:35 BST.

This comes after an overall slightly weaker session on Friday, in part owing to the notable rebound in the dollar following the release of a solid US jobs report for July.

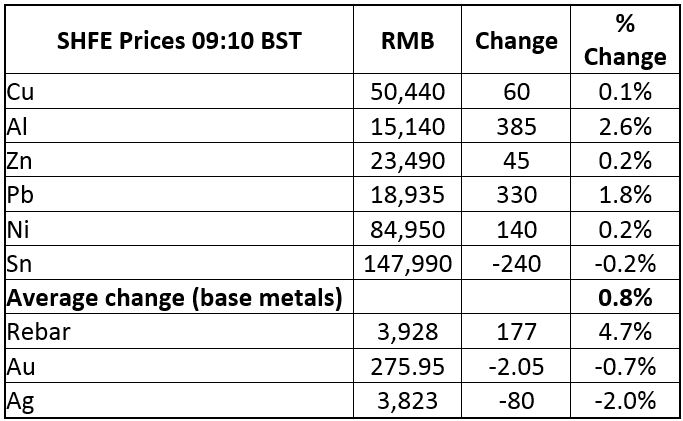

On the Shanghai Futures Exchange (SHFE) this morning, the base metals complex is on the rise. Aluminium and lead perform the best, up 2.6% and 1.8%, respectively, while tin is the only base metal in negative territory (-0.2%) as of 9:13 London Time. Spot copper prices in Changjiang are up 0.3% at 50,050-50,350 yuan per tonne and the LME/Shanghai copper arb ratio is up at 7.92 (from 7.90 on Friday).

Equities are off to a good start this week, with the Nikkei 225 (+0.61%), Hang Seng (+0.35%), and the Kospi (+0.49%) all up after a robust rally across broad-based equities on Friday, reflecting a risk-on environment in spite of continuing tensions between the USA and Russia following the recent US sanctions and Russia’s retaliations as well as continued heightened uncertainty over the North Korean crisis.

The dollar index is experiencing some weakness today, down 0.22%, after enjoying a decent appreciation of 0.76% on Friday driven by positive US macro surprises in the labour market. Whether the recent strength in the dollar following its 15-month low last week continues is far from certain considering the excessively bearish sentiment towards the currency at present.

The macroeconomic agenda is fairly light today. Investors will monitor the leading indicator index in Japan for June, the Sentix investor confidence index in Europe for August and the labour market condition index in the USA for July. In addition, US Federal Open Market Committee member Neel Kashkari is speaking.

Base metals are likely to trade sideways with a possible upward bias as investors continue to express a strong interest for reflation-oriented trades following signs that China’s economic growth momentum will remain solid in the third quarter of the year. Copper appears to be the most well placed to benefit from this risk-on environment due to its significant potential for short-covering considering its excessive gross short spec positioning on the Comex.

Precious metals may witness some buying on the dips once the market finishes digesting the strong US jobs numbers released at the end of last week. Yet, we acknowledge that the rebound in the dollar may continue a little longer after it reached oversold territory. This may therefore undermine the uptrend in the precious metals complex. We tend to favour platinum at this juncture, because sentiment seems to have shifted from very negative to very positive in recent days.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW 07/08: Some profit-taking in metals despite weaker dollar, equity gains appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News