FastMarkets

Precious metals are split this morning, Friday July 28, with platinum prices up 0.3% at $925.1 per oz, while the rest are weaker with gold prices off 0.1% at $1,257.91 per oz and silver and palladium off 0.3%. On Thursday palladium closed up 1% at $875 per oz, while the other precious metals were weaker with platinum prices off 0.6% and gold and silver prices down 0.2% and 0.3% respectively.

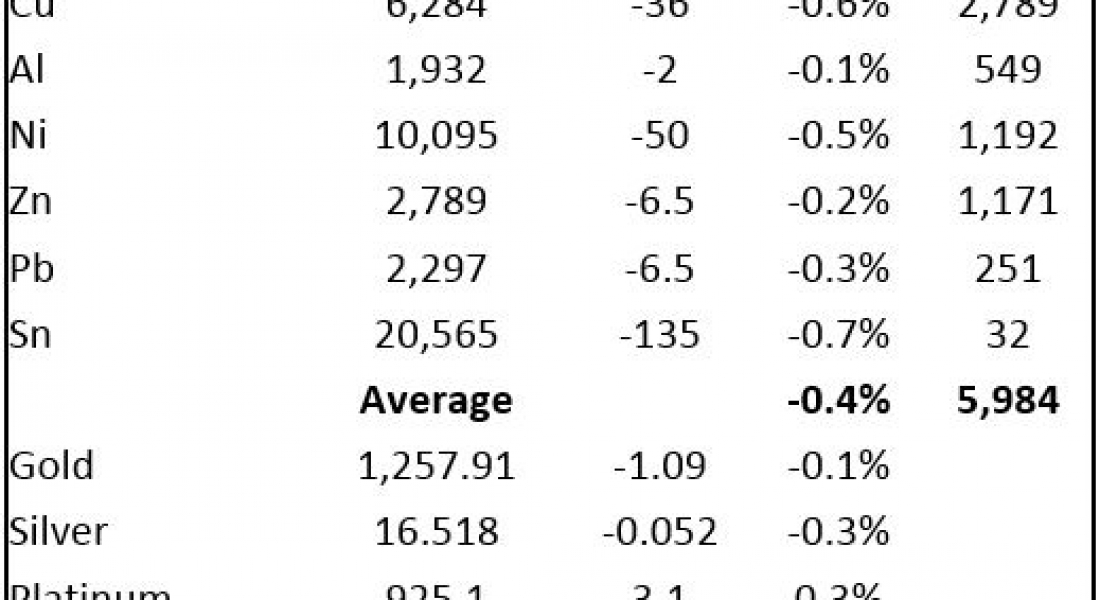

Base metals are consolidating recent gains with prices off by 0.4% on average this morning. Tin leads the decline with a 0.7% price fall to $20,565 per tonne, followed by copper prices that are off 0.6% at $6,284 per tonne and nickel prices that are down 0.5%, while the rest are off around 0.2%.

Volume has been average with 5,984 lots traded as of 06:08 BST. This comes after a mixed performance on Thursday when nickel and tin prices rallied 1.8%, while the rest consolidated – copper prices were up 0.2%, while the others were off between 0.1% and 0.2%.

On the Shanghai Futures Exchange (SHFE), the base metals are split into two camps with copper, zinc and aluminium prices weaker, with September copper off 0.7% at 49,800 yuan ($7,379) per tonne while lead, zinc and nickel prices are all up 0.3%. Spot copper prices in Changjiang are down 0.5% at 49,750-49,950 yuan per tonne and the LME/Shanghai copper arb ratio has weakened to 7.92.

In other metals in China, September iron ore prices on the Dalian Commodity Exchange are up 0.9% at 526.50 yuan per tonne and on the SHFE, steel rebar prices are off 0.3%, but gold and silver prices are up 0.2% and 0.1%, respectively.

In international markets, spot Brent crude oil prices are off 0.5% but prices remain high at $51.36 per barrel supported by falling inventories and talk of some OPEC members limiting exports. The yield on US ten-year treasuries is at 2.30% and the German ten-year bund yield is at 0.52%.

Equities were generally bullish on Thursday with the Euro Stoxx 50 closing up 0.1% and the Dow closed up 0.4% at 21796.55, having set a fresh record earlier in the day, but the S&P 500 and Nasdaq composite closed off 0.1% and 0.6%, respectively. Asian markets are mixed, the Nikkei and Hang Seng are down 0.6%, the ASX 200 is off 1.5% and the Kospi is off 1.6%, while the CSI 300 is up 0.2%. The tech sell-off in the USA seems to be rattling Asian markets this morning.

The dollar index is at 93.80, it set a fresh low for the year at 93.15 on Thursday, before better US data gave it some lift. The euro at 1.1693 is consolidating recent gains, as is the Australian dollar at 0.7971, sterling is firm at 1.3083, as is the yen at 110.97. The yuan at 6.7476 is consolidating recent strength and most of the other emerging currencies we follow are little changed, although the rupee is consolidating after yesterday’s strength.

The economic agenda is busy – a host of Japanese data already out generally looks encouraging, see table below. French GDP came in at 0.5%, later there CPI data out across parts of Europe, plus data on French consumer spending. US data includes advanced GDP, GDP price index, employment cost index and revised University of Michigan consumer sentiment and inflation expectations. In addition, US Federal Open Market Committee member Neel Kashkari is also speaking.

Copper, nickel and tin have led the price advances this week, with the others showing some gains at stages during the week but they have struggled to hold on to these gains. Profit-taking ahead of the weekend seems to be underway this morning as Asian trading rolls into European trading. Overhead tails on aluminium, lead and zinc suggests scale-up selling as prices have got back into high ground, while today’s pullbacks in copper, nickel and tin look more like profit-taking and consolidation. We would now expect volatile trading in those that have outperformed as traders adjust to the higher price levels. We have generally been quietly bullish for the metals – the danger is that prices may have run ahead of the fundamentals again.

Gold prices have done well, especially with equity markets setting fresh highs, but the weaker dollar of late has no doubt helped fuel the rally and it may be that as equities are setting fresh highs, more investors are expecting a correction so may be putting more into havens. Silver has been following gold, platinum prices have struggled to follow gold and palladium is still consolidating after the strong run in May/June. For now we expect the dollar to be the main driver in gold prices.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Gold prices consolidate but continue to hold up well appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News