FastMarkets

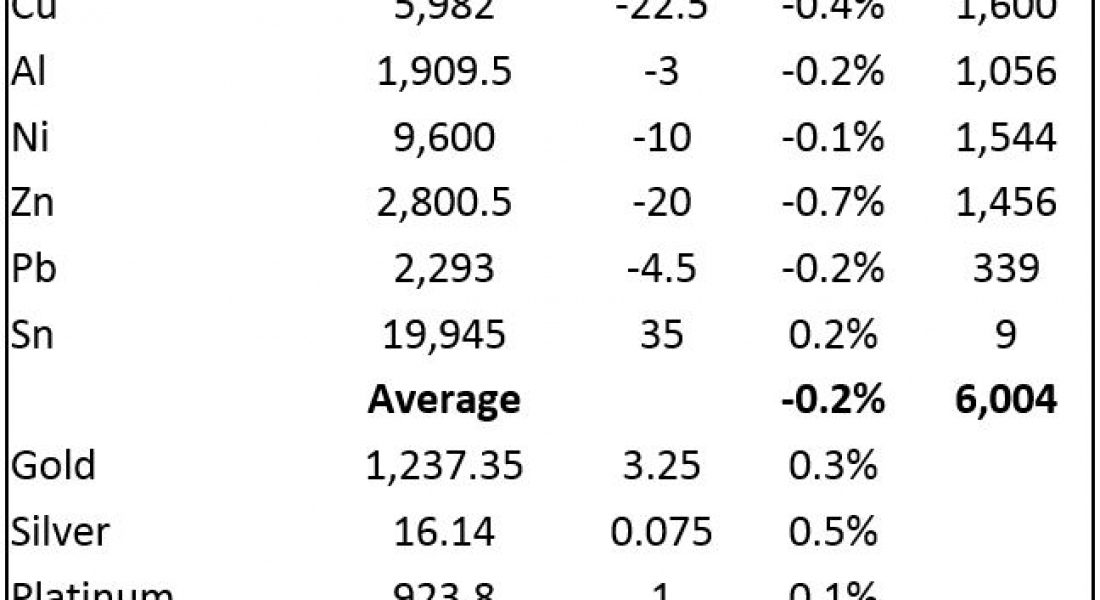

Gold and the other precious metals are firmer this morning, Tuesday July 18, with prices up an average of 0.4%, led by a 0.6% rebound in palladium prices. Silver prices are up 0.5% at $16.14 per oz, gold prices are up 0.3% at $1,237.35 per oz and platinum is the laggard with a 0.1% gain. This comes after a strong performance on Monday when the complex closed up an average of 0.8%.

Base metals prices on the London Metal Exchange have started to weaken as European trading gets underway with three-month prices off by an average of 0.2% this morning.

Zinc prices are off the most with a 0.7% decline to $2,800.5 per tonne and copper prices are off 0.4% at $5,982 per tonne. Tin prices are bucking the trend with a 0.2% increase to $19,945 per tonne. Volume has picked up in the past 30 minutes, 6,004 lots had traded as of 07:05 BST.

This comes after a mixed performance on Monday when copper, zinc and nickel closed up between 0.8% and 1.3%, while the rest were down between 0.2% and 0.9%.

On the Shanghai Futures Exchange (SHFE), the base metals prices are up an average of 0.3%, led by a 1.2% rally in nickel prices, copper prices are up 0.5% at 47,780 yuan ($7,054) per tonne, zinc and tin prices are up 0.4%, while aluminium prices are down 0.7% and lead prices are off 0.3%. Spot copper prices in Changjiang are up 0.8% at 47,690-47,790 yuan per tonne and the LME/Shanghai copper arb ratio is firmer at 7.98. There seems to be some mismatch between the SHFE and LME prices, with the LME weakening while the SHFE has held up.

In other metals in China, September iron ore prices on the Dalian Commodity Exchange are up 5.5% at 518 yuan per tonne, while on the SHFE, steel rebar prices are up 0.1%, silver prices are up 0.7% and gold prices are 0.4% firmer.

In international markets, spot Brent crude oil prices are up 0.2% at $48.44 per barrel and the yield on the US ten-year treasuries has eased to 2.30%, while the German ten-year bund yield is little changed at 0.58%.

Equities were slightly weaker on Monday with the Euro Stoxx 50 closing off 0.3% but the Dow closed little changed at 21,629.72. In Asia this morning the markets are weaker, with the Nikkei down 0.6%, the Hang Seng and CSI 300 are off 0.1%, the Kospi is little changed, while the ASX 200 is down 1.2%.

The dollar index at 94.79 continues to weaken, while the euro remains upbeat at 1.1520, as are sterling at 1.3103 and the Australian dollar at 0.7915 and the yen is firmer at 112.12. The yuan is stronger too at 6.7586.

On the economic agenda there is a host of UK inflation data plus ZEW economic sentiment in Germany and the EU, with US data including import prices, NAHB housing market index and TIC long term purchases. In addition, Bank of England governor Mark Carney is speaking.

The metals have turned weaker as Europe has opened. On Monday, there were definite signs of strength in some of the metals, notably copper, zinc and nickel, while higher price levels in the rest led to some selling, which now appears to be rolling into the other metals too. Given the continued fall in the dollar we would expect dips to be supported. Overall we remain quietly bullish for the base metals.

Gold prices have firmed up in recent days, this despite geopolitical concerns being light but the weaker dollar and a less hawkish US Federal Reserve seem to be underpinning price rises. All in all, we are not expecting much from the precious metals camp in the short term, but we expect dips to remain supported.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Gold prices firmer as dollar slides appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News