FastMarkets

Gold and silver prices are little changed this morning with spot gold at $1,217.40 per oz, this as prices consolidate after recent weakness. The PGMs are firmer, up by around 0.4%. This follows a down day on Thursday, when prices dropped an average of 0.8%, ranged between 0.1% for gold prices and 1.3% for silver prices.

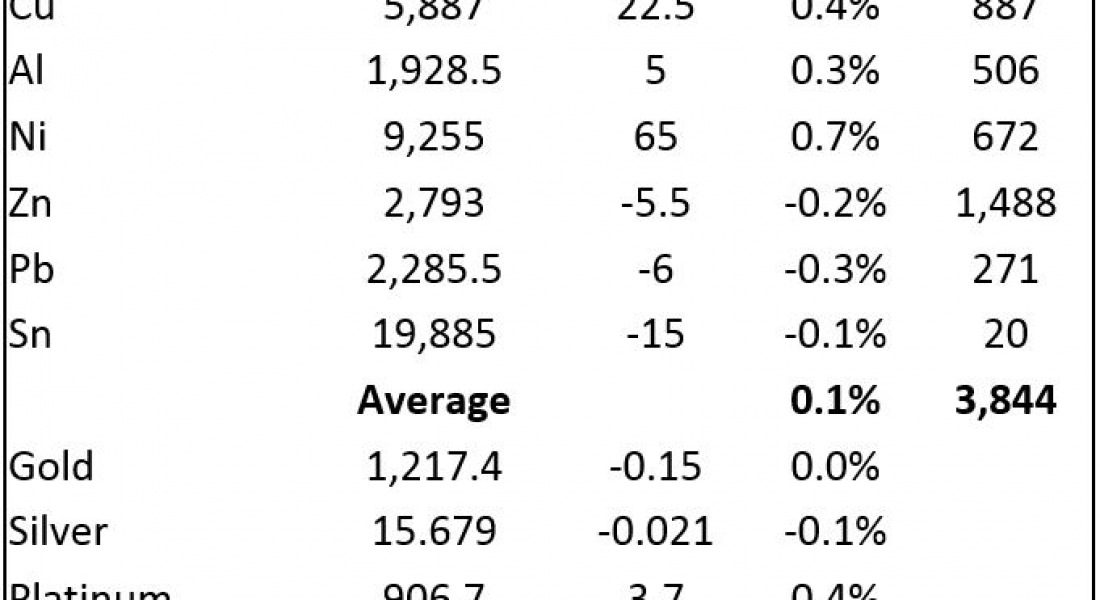

Base metals prices on the London Metal Exchange this morning are split into two camps with copper, aluminium and nickel prices up an average of 0.5% with three-month copper at $5,887 per tonne, while zinc, lead and tin prices are down an average of 0.2% – but volume has been light with 3,844 lots traded as of 06.43 BST.

This follows a generally weaker day’s performance on Thursday, the exception was aluminium that closed up 1.8% at $1,923.50 per tonne, while the rest were down an average of 0.5%.

On the Shanghai Futures Exchange (SHFE), aluminium prices are up 0.8%, while the rest are down an average of 1.1%, with lead prices down 2.1%, zinc prices off 1.8% and tin prices down 1%. Copper prices are down 0.3% at 47,170 yuan ($6,955) per tonne, spot copper prices in Changjiang are off 0.2% at 46,870-46,990 yuan per tonne and the LME/Shanghai copper arb ratio is at 8.01.

In other metals in China, September iron ore prices on the Dalian Commodity Exchange are off 1% at 483 yuan per tonne, while on the SHFE, steel rebar prices are down 1.9%, silver prices are down 1.5% and gold prices are down 0.5%.

In international markets, spot Brent crude oil prices are up 0.1% at $48.39 per barrel and the yield on the US ten-year treasuries has firmed to 2.35%, while the German ten-year bund yield is little changed at 0.52%.

Equities were firmer on Thursday with the Euro Stoxx 50 closing up 0.4% and the Dow closed up 0.1% at 21,553.09. Asia this morning is slightly higher with the Nikkei up 0.2%, the Hang Seng and CSI 300 are up less than 0.1%, the ASX 200 is up 0.3% and Kospi is up 0.2%.

The dollar index at 95.71 is consolidating in low ground, the downward trend dominates though. The euro at 1.1407 is consolidating in high ground, but it is looking quite stretched on the upside for now. Sterling is firm at 1.2957, the yen at 113.30 looks like it may be about to strengthen, while the Australian dollar at 0.7758 is on fire and at highs for the year. Resistance is seen at 0.7778 and 0.7834.

The yuan is looking stronger again at 6.7797, the real at 3.2100 is climbing, the rand and peso are stronger, while the rupee, ringgit and rupiah are fairly flat.

Data out already showed weaker than expected Japanese industrial production that fell 3.6%, down from 3.3% previously. Later there is data out on Italy’s trade balance and US data includes consumer price index, retail sales, industrial production, capacity utilisation, University of Michigan consumer sentiment, inflation expectation and business inventories.

This week’s rebound in base metals prices ran into selling on Thursday, with aluminium the only metal to show particular strength on the back of talk of further production cuts in China. This morning nickel is looking stronger, while the rest seem in consolidation mode, but as mentioned above volume is light. Although China’s trade data was strong, data for copper imports showed weakness, which may have worried the market yesterday. Overall, we remain quietly bullish for the base metals.

Gold prices are consolidating, this week’s rebound has been half-hearted, strong equities and a low level of geopolitical tension are weighing on sentiment, while a weaker dollar is providing for some support. All in all, we are not expecting much from the precious metals camp in the short term, but we expect dips to remain supported.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Gold’s rebound seems half-hearted appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News