FastMarkets

Precious metals prices are similarly firmer this morning, Wednesday July 12, with average gains of 0.6%, led by a 0.9% rebound in spot palladium prices to $856.50 per oz, while gold prices lag behind with a 0.2% rise to $1,219.59 per oz. This follows a day of consolidating on Tuesday when the complex closed up an average of 0.5%.

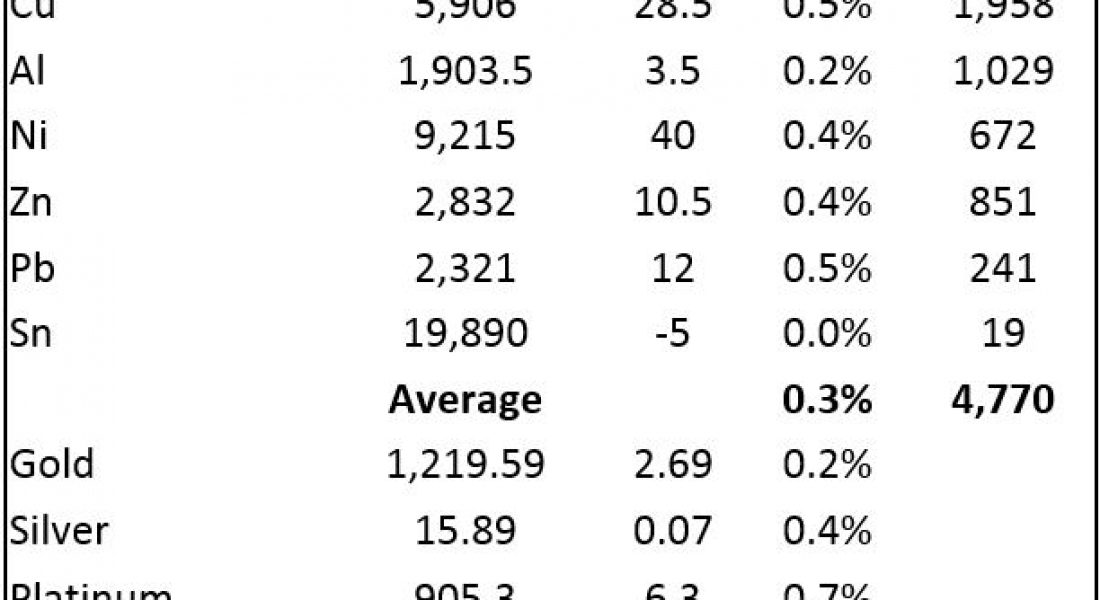

The base metals on the London Metal Exchange are firmer this morning, with prices up an average of 0.3%, led by 0.5% gains in copper ($5,906 per tonne) and lead ($2,321 per tonne).

Volume is above average for this time of day with 4,770 lots traded as of 05:16 BST.

The base metals were looking firmer yesterday morning too, and went on to close with average gains of 0.7%. Nickel and zinc were the main performers on Tuesday, closing up 1.8% and 1.7%, respectively, with copper closing up 0.7% at $5,877 per tonne.

On the Shanghai Futures Exchange (SHFE), base metals prices are up by a healthy 1.5% on average, led by a 2.7% rebound in nickel prices, with zinc prices up 2.3%. We noted yesterday in our Nickel Today report that with iron ore and steel rebar futures in China ticking higher again, demand for steel products may be on the rise too, which may well be why nickel and zinc have seen good gains today. The rest of the base metals are up between 0.9% for lead and 1.1% for aluminium, with copper prices up 1% at 47,330 yuan ($6,971) per tonne. Spot copper prices in Changjiang are up 0.9% at 47,050-47,170 yuan per tonne and the LME/Shanghai copper arb ratio has eased to 8.01.

In other metals in China, September iron ore prices on the Dalian Commodity Exchange are up 0.9% at 492.50 yuan per tonne, while on the SHFE, steel rebar prices are up 2.2%, silver prices have recovered 2% and gold prices are up 0.5%.

In international markets, spot Brent crude oil prices are up 0.1% at $48.15 per barrel and the yield on the US ten-year treasuries has eased to 2.35%, while the German ten-year bund is little changed at 0.55%.

Equities were split on Tuesday with the Euro Stoxx 50 closing down 0.4%, while the Dow closed little changed at 21,409.07. In Asia this morning, equities are broadly weaker, with the ASX 200 down 0.9%, the Nikkei is off 0.6%, the Kospi is off 0.1%, while the Hang Seng is up 0.8%.

The dollar index’s show of strength/consolidation has given way to further weakness with the index falling to 95.55, the low from June 30 was 95.47. The weaker dollar has given the euro a boost to a new high for the year at 1.1487, the Australian dollar is firmer at 0.7653, the yen is likewise firmer at 113.38, this comes after Tuesday’s low of 114.49, while sterling is weaker at 1.2853 – suggesting Brexit concerns are weighing on the currency.

Data out already showed Japan’s producer price index (PPI) steady at 2.1% and its tertiary industrial activity dropped 0.1% in May, better than the 0.5% fall expected, but down from a 1.4% rise in April – it is a volatile data series though. Later there is data out on German wholesale price index (WPI), a host of UK employment data, EU industrial production, US crude oil inventories and the Beige book. The focus, however, today is likely to be US Federal Reserve chair Janet Yellen’s testimony to the US House Financial Services Committee.

Base metals prices are on the rise again today, the spell of weakness seen last week seems to have passed. Zinc is leading the advance with prices pushing up to levels not seen since March, copper prices have gapped higher and the rest look well placed to rebound/climb. Whether consumers will feel the need to chase prices higher is another matter – we doubt they will, but there may be some short-covering to be done now the latest downside run may have run its course.

The sell-off in the precious metals prices also seems to have run their course, with underlying tails on recent days’ candlesticks suggesting dip buying interest. The dollar’s resumption of its weaker trend is also likely to be a supporting factor, as is the latest uptick in the Washington political scene over Donald Trump Jr’s dealings with the Russians ahead of last year’s US election. Given the weakness of late in the precious metals, we would not be surprised to see the rebounds travel further.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Gold prices start to rebound, weaker dollar helping appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News