FastMarkets

This morning, the precious metals are also firmer, up an average of 0.4% led by a 0.7% gain in spot platinum prices, silver prices are up 0.5%, gold prices are up 0.2% at $1,269.06 per oz and palladium prices are unchanged. This comes after a generally weaker day when the white precious metals closed down an average of 1.3%, while the spot gold price closed up 0.1% at $1,265.30 per oz.

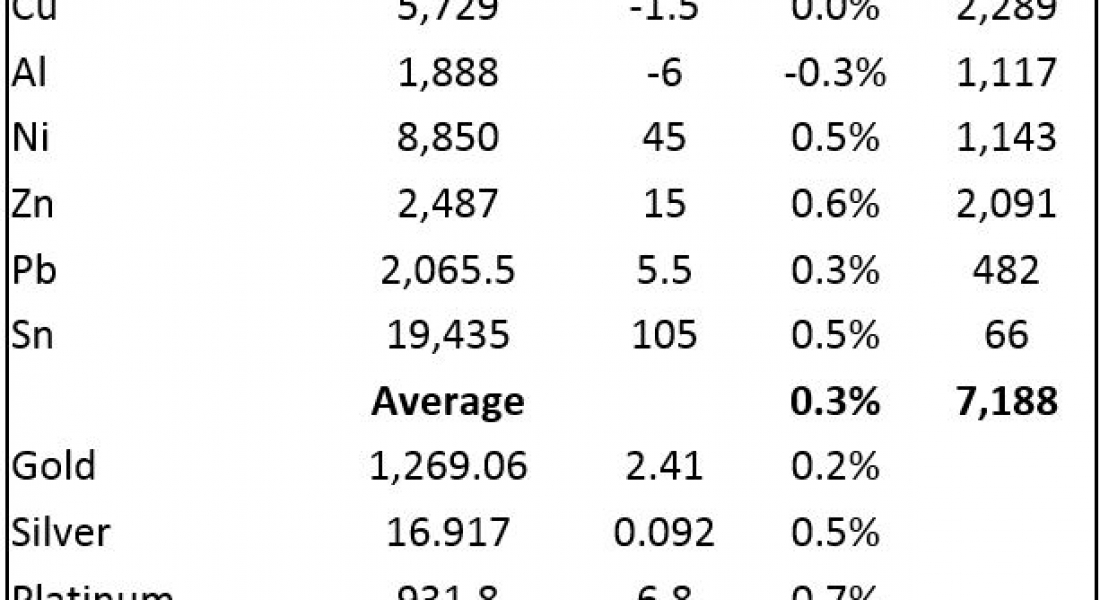

Base metals prices on the London Metal Exchange are for the most part firmer this morning, Wednesday June 14, the exceptions are aluminium that is off 0.3% and copper that is slightly weaker, while the rest are up an average of 0.5%. Volume has been above average with 7,188 lots traded as of 07:24 BST.

In Shanghai this morning, copper prices are off 0.2% at 45,970 yuan per tonne ($6,764 per tonne) on the Shanghai Futures Exchange (SHFE), while the rest are up an average of 0.5%. Spot copper prices in Changjiang are down 0.7% at 45,540-45,660 yuan per tonne and the LME/Shanghai copper arb ratio has firmed to 8.02.

In other metals in China, September iron ore prices on the Dalian Commodity Exchange are weaker again, off 0.5% at 425 yuan per tonne, while on the SHFE, steel rebar prices are up 1% while gold and silver prices are up 0.4% and 0.2%, respectively.

In international markets, spot Brent crude oil prices are up 0.2% at $48.31 per barrel and the yield on the US ten-year treasuries is 2.2%, this ahead of this evening’s US Federal Open Market Committee (FOMC) rate decision which is expected to see the Fed raise interest rates by 25 basis points to 1.25%.

Equities ended Tuesday firmer with the Euro Stoxx 50 and Dow closing up 0.4%. In Asia this morning, the Nikkei, Kospi and Hang Seng are off 0.1%, the CSI 300 is off 1.2%, the ASX200 is up 1.1%.

The dollar remains in its downward trend with the dollar index at 96.90, after its latest rebound ran out of steam at 97.50. The euro is edging higher at 1.1220, sterling is strengthening at 1.2781, the yen is flat at 110.10 and the Australian dollar is climbing at 0.7557.

The yuan at 6.7970 remains firm but flat, the rand and peso are strengthening again, while the real is weaker and the other emerging market currencies we follow are for the most part flat.

The economic agenda is busy, data out already shows Chinese industrial production was unchanged at 6.5%, fixed asset investment, year-to date, dipped to 8.6% from 8.9%, retail sales were unchanged at 8.7%, Japan’s revised industrial production was unchanged at 4% and Germany’s final CPI was unchanged at -0.2%. Later there is data on UK employment, earnings and leading indicators, EU employment change and industrial production, with US data including CPI, retail sales, business inventories, crude oil inventories and the FOMC decision, statement and economic projections – see table below for more details.

The base metals remain in a ‘glass-half-empty’ mood; copper prices seem to be the ones trying to shake off their gloom while the others continue to drift with any effort to look brighter being short-lived. Tin may have turned a corner, but we wait to see how far this current rebound travels. With data mixed-to-weak with better than expected data infrequent, it does look as though consumers are content to live hand-to-mouth and feel in no need to restock. So until the news flow brightens up, this sideways to lower direction in metals prices may continue. Based on fundamental outlook we remain mildly bullish for the medium to longer term, i.e. we are not bearish per se, but are having to wait longer than expected for an upturn.

Gold prices are holding up well as they consolidate, silver and platinum prices are giving back some of their recent gains as they consolidate, while palladium priced are pausing after their steep rise. We wait to see if the rally has further to go, or whether it will stall. We do expect gold, silver and platinum prices to be well supported into dips.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Gold prices are holding up well, palladium’s rally consolidates appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News